In an earlier story, we looked at MSP procurement numbers across different states and the related trends. Data further indicates that the average market prices for rice & wheat have fluctuated during the procurement season and are not necessarily more than MSP. But is increased MSP procurement a solution?

In the earlier story, we explored the numbers relating to MSP (Minimum Support Price) for various food grains over the years, the procurement of these food grains and the trends across states.

From the data, it is evident that, the procurement of food grains at MSP, especially of Rice and Wheat is highly skewed and most of the procurement by the government is done in only a few states.

In this story, we further explore the uneven procurement of the food grains in the country, the sale of farm produce by the farmers beyond the markets set up by AMPCs (Agricultural Produce Market Committee) and FCI’s sale of food grains etc.

Punjab & Haryana have the highest targets & achievement for Wheat procurement

The individual data of the states indicates that the procurement targets set for each of the states vary widely ultimately resulting in the varying amounts of government procurement. We spoke an official from the FCI regarding the rationale of such widely varying targets among the states and were given to understand that, prior to every marketing season (i.e. Kharif & Rabi), respective states send their proposals to the centre, with information on expected production for the year and the procurement of food grains that they can manage for the central pool.

Based on these proposals, the central government announces the procurement target for the upcoming marketing season along with the procurement targets for each of the states. This is the case for the procurement of both Rice as well as Wheat.

The data of the last three years indicates the trends to be uneven in the case of Uttar Pradesh and Madhya Pradesh. After a shortfall compared to the expected target in 2017-18, Madhya Pradesh has exceeded the target of 67 lakh tones for 2018-19 by procuring 73.13 lakh tons. However, after the target was increased to 75 lakh tons in 2019-20, the procurement is only 67.25 tons as on date.

Similarly, the targets for Uttar Pradesh was set higher at 50 Lakh tons for 2019-20 based on the earlier procurement performance but fell short of the target.

Rajasthan not only has lower procurement targets but also these targets are not often met. The shortfall in targeted procurement of these states is compensated with additional procurement from Punjab and Haryana. As per the available data, Punjab and Haryana tend to have the highest procurement targets for Wheat, and in each of the last three years, the actual procurement has exceeded these targets.

Procurement target for rice is met over Kharif & Rabi Seasons for a few states

Analysis of the data for procurement of Rice from various states indicates that the each of the states have managed to procure the amounts set as targets for 2019-20. However, there are differences in the targets itself in terms of procurement quantity, with Andhra Pradesh, Telangana and Punjab accounting a large share of the procurement targets.

Unlike in the case of Wheat, the procurement of Rice happens over Rabi and Kharif seasons. In a few of the states, the procurement targets are met over both the Kharif & Rabi seasons. As is the case highlighted earlier, the target for procurement is based on the proposals sent by the respective states prior to the beginning of the marketing season.

As highlighted in the earlier story, the procurement in different states is not in proportion to the production in those states. The process and the data indicate that few states have opted to set a higher target of procurement, while few others have set a lower target. This could either be due to the inability of the states to mobilize resources for procurement, or the presence of better sales alternatives for the farmers, then the MSP procurement by the government.

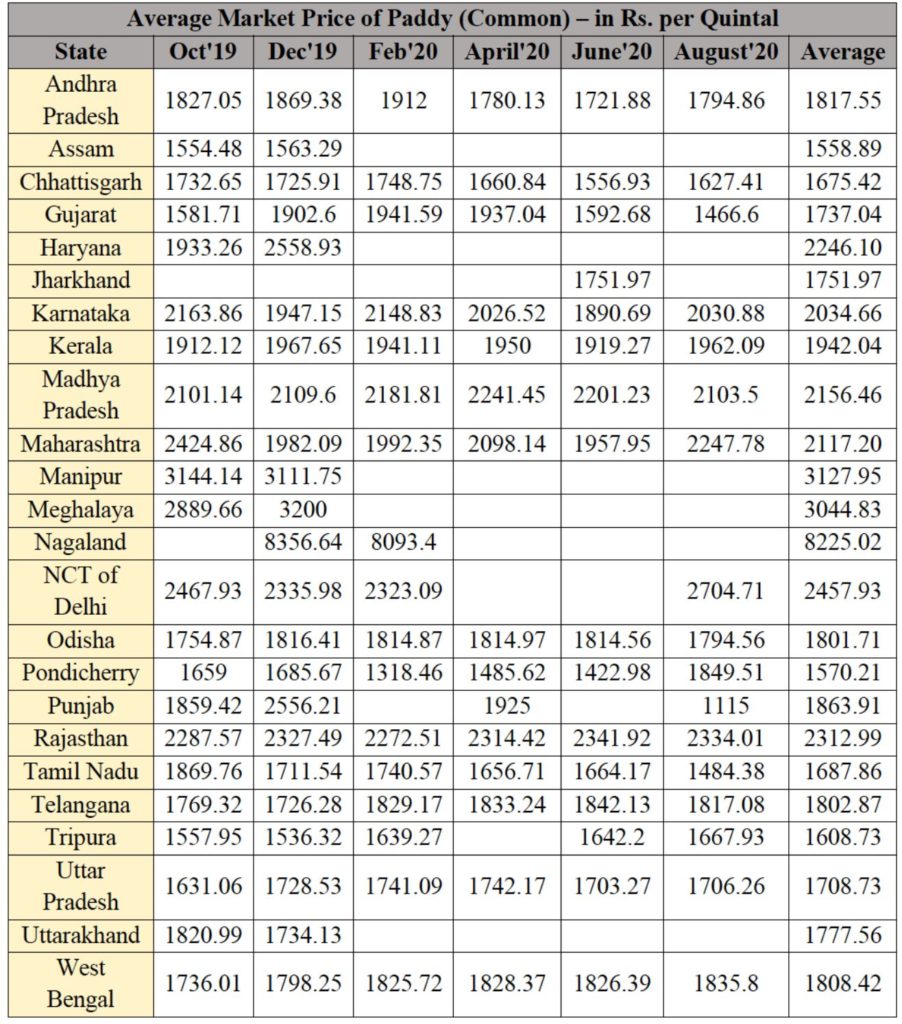

Market Prices of Paddy & Wheat are fluctuating and lower than MSP at different times in different states

The MSP for Paddy was set at Rs.1815 per quintal for 2019-20 and Rs.1868 for 2020-21. As per the data available from the different markets across the country, the price for Paddy varies across the states and fluctuated at different points of time.

Andhra Pradesh, Telangana and Punjab which are among the states with highest MSP procurement by the government, also have market prices near about the declared MSP during different times in the period between October’19 and August’20.

In the earlier story, we had observed that Uttar Pradesh and West Bengal, although being the highest producers of rice have very low procurement by the government. However, the market prices over the year indicate that they are not higher than the MSP. This could mean that the higher price in open market is not necessarily the reason for lower procurement by the government. This is truer in case of Uttar Pradesh.

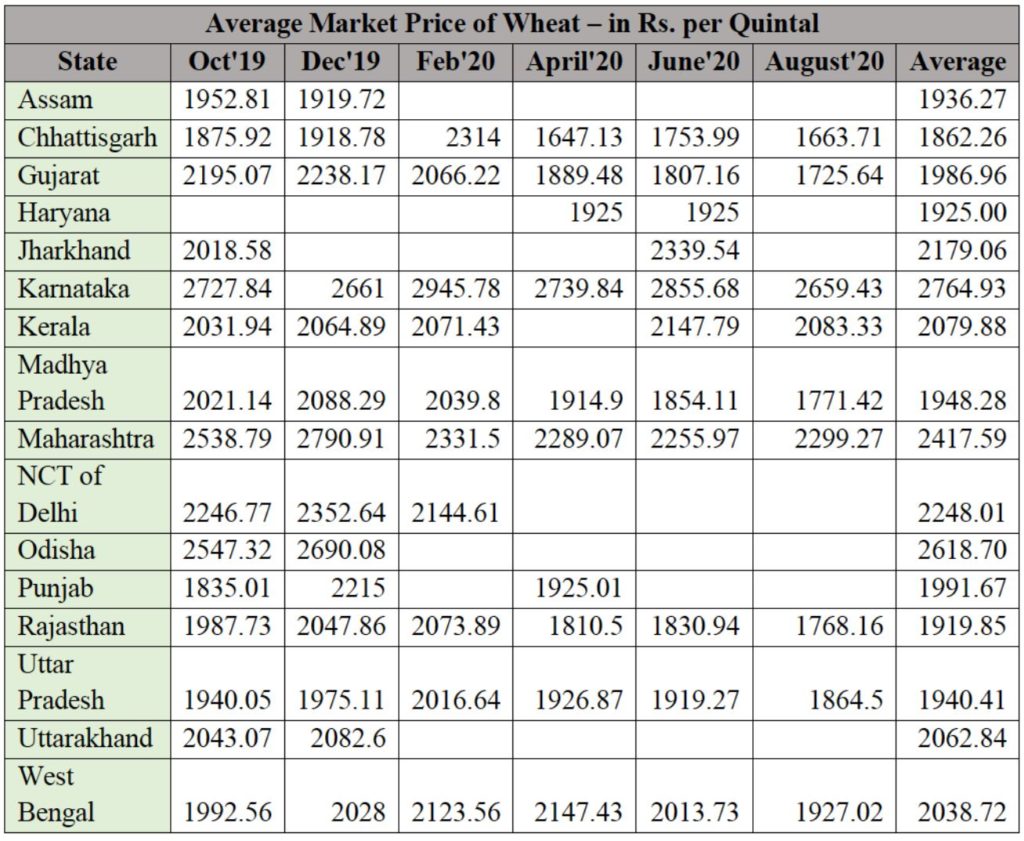

The same holds good even in the case of Wheat. The MSP declared for 2020-21 is Rs.1925 per quintal. Uttar Pradesh, Bihar and Rajasthan are among the states which have a higher production of wheat but comparably lower procurement by the government.

April’20-August’20 is period when most of the wheat procurement for Rabi marketing season happens. During this period, the market price in UP markets decreased from Rs. 1927 in April’20 to around Rs. 1864.5 per quintal by August’20.

While, market price data for Bihar isn’t available, the available market prices are much lower than MSP in Rajasthan during the Rabi marketing season. The same trends can be observed in few of the other states like Chhattisgarh, Gujarat and Madhya Pradesh. The prices were either very close to or higher than MSP around April’20 and have subsequently fallen by the end of season.

Another trend that can be observed from the data is slightly higher market prices during the non-marketing season. This is understandable as the availability of stocks is low during the non-marketing season.

As the market price data indicates, there are fluctuations in the market prices where the farmer may get a higher price than MSP at certain times but also runs the risk of lower prices at other times. Hence MSP assumes significance because it provides the farmers with a minimum guarantee for their produce.

The lower targets and procurement from some of the states indicate that there are other factors at play rather than a better price than MSP in the open market. As seen in the case of wheat, few of the states are not even able to procure to the extent of their targets.

Problem of lower market prices compounded due to OMSS

In an earlier explainer, we discussed the role of FCI in procuring food grains and making stocks available towards the food security & other related schemes of the government. In another analysis, we had observed that the quantum of food stocks procured by FCI are beyond the requirement and that the buffer stocks currently available are more than enough to meet even the increased demand because of COVID-19 relief measures.

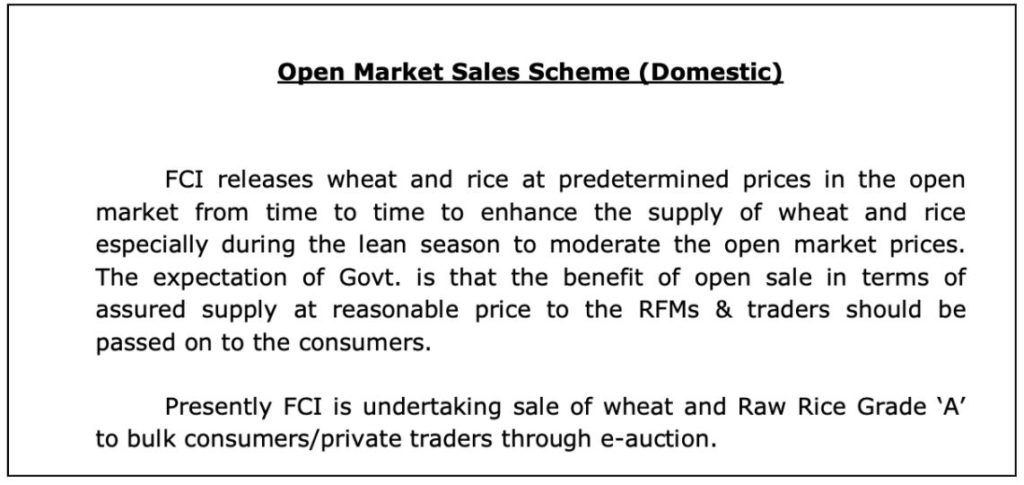

In an effort to off load the existing stock, FCI has introduced OMSS (Open Market Sales Scheme). As per this scheme, FCI takes up the sale of Wheat and Rice in open market at pre-determined prices. The sale happens in bulk quantities through e-auction.

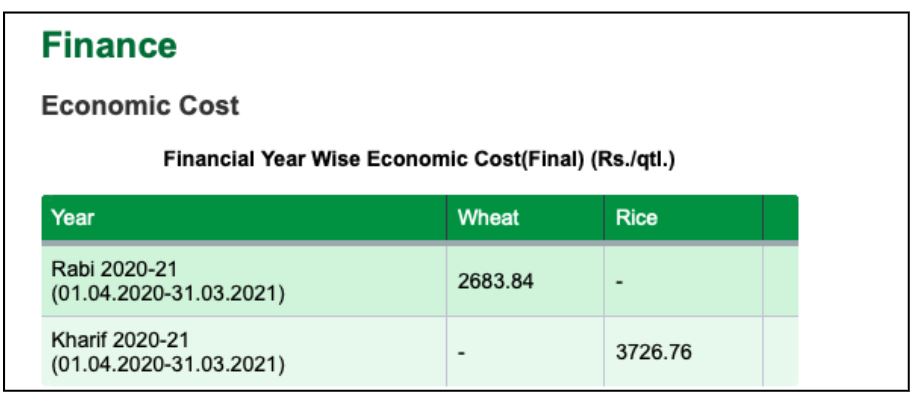

Apart from reducing the overheads because of buffer stocks, the key purpose of OMSS is to regulate the market prices by ensuring supply of rice and wheat. However, the challenge with OMSS are the losses that FCI makes on sale through OMSS. Apart from the cost of procurement which involves MSP and other charges, there are other costs that FCI incurs including storage costs, distribution costs etc.

As per the information available on the FCI website, the economic cost incurred by FCI for the current season in case of Wheat is Rs. 2,683.84 per quintal and for rice it is Rs. 3,726.76 per quintal.

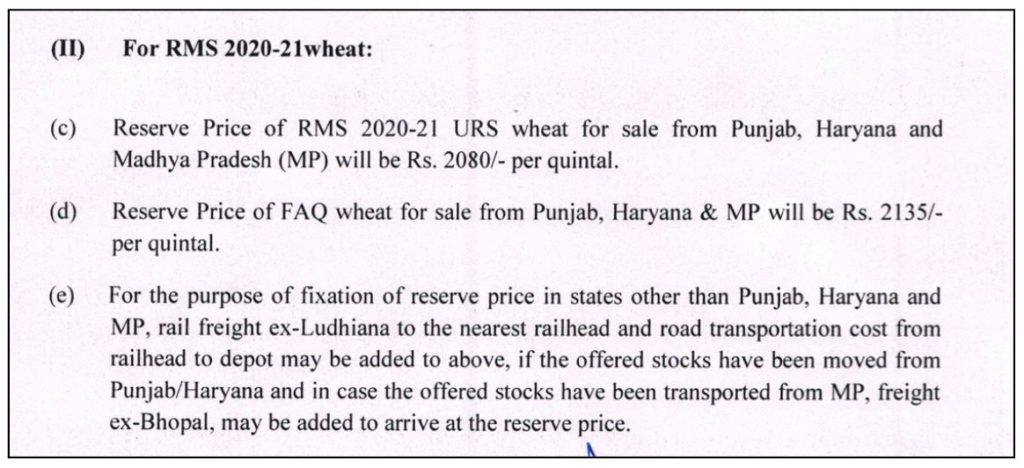

The pre-determined fixed price for Rice to be sold through OMSS for 2020-21 is Rs. 2250 per quintal, whereas for Wheat it is Rs. 2080 in Punjab, Haryana & Madhya Pradesh. Transportation costs and other costs for logistics would be added to this price.

This sale price through OMSS is much lower than the cost incurred by FCI to procure and store the stock, implying that FCI is selling the produce at a loss through OMSS. The produce entering in the market at a lower price during non-marketing season could impact the market prices, when the farmers might be expecting to fetch a higher price. Farmers selling their produce during the non-marketing season incur higher costs for stocking the produce over an extended period.

While MSP provides price security to farmers, the coverage is limited

The market price data for rice & wheat has shown price fluctuation over the years. In such a scenario, MSP does provide price security to the farmer against the vagaries of prices and ensures they get a guaranteed return on their produce.

Among other things, accessibility of the APMC procurement centres, cost of logistics and storage incurred by farmers especially small farmers could be the reason for farmers to sell their produce to local traders at a lower price outside the government approved markets.

However, MSP procurement has its own set of issues. The extent of farmers availing the benefits is limited to a few states. The lower market prices indicate that the lower procurement in few of the states is more to do is the lack of infrastructure and support to sell the produce at MSP rather than a better open market price. Higher MSP procurement by the government also distorts the market because FCI is forced to sell the excess stocks through OMSS at lower prices. Further, higher MSP procurement for certain crops also forces farmers to choose some select crops like Rice & Wheat rather than diversifying the production.

While the apprehension of farmers in states like Punjab and Haryana regarding the new farm bills is valid, it has to be noted that MSP and the current role of APMCs and FCI already have their own set of challenges not brought upon by the new bills. MSP procurement is also not spread evenly across the country for it to affect farmers across the country.

At the same time, the supposed advantage of farmers because of the flexibility to sell as per their choice might not be realistically possible for many small & marginal farmers unless they are organized. The available data also does not support the notion of better open market prices.

The need of the hour it so ensure basic income security for the farmers, especially the small & marginal farmers. The government should ensure that the farmers are in a strong position to negotiate a better deal for their produce, either through government procurement or through sale in the open markets.

Featured Image: Increased MSP Procurement by the government