Multiple countries around the world have phased out cheque payments as newer modes of digital payment emerged. While India has not phased out cheque payments, data indicates that the volume of cheques used for payments has decreased significantly post COVID-19. They are increasingly used for high value transactions.

Cheques, once a widely prevalent method of payment worldwide, have experienced a decline in usage in many countries due to the emergence of digital payment methods and other instruments such as debit and credit cards. Moreover, customers now prefer such convenient and faster modes of payment. Several countries have either completely phased out or significantly reduced the usage of cheques due to the same. However, their status and usage vary significantly by region and country.

For instance, the Monetary Authority of Singapore announced that all corporate cheques will be eliminated by end-2025 while individuals will still be able to use cheques for a period after 2025. This move was announced following the decline in cheque transaction volume by almost 70% from 61 million in 2016 to less than 19 million in 2022. Likewise, in Australia, cheques that once accounted for 85% of the number of non-cash payments in 1980 and almost all their value, will be phased out by 2030. According to a 2023 Australian government report, the country witnessed a 90% decrease in cheque usage over the past decade with cheques comprising only 0.2% of non-cash retail payments. Meanwhile, its neighbour, the New Zealand government made a strategic decision to end the use of cheques by the end of 2021.

Countries are phasing out cheques following steep decline in its usage

In the European Union, following the deployment of the giro system, the usage of cheques became rare. Finland ceased cheque usage in 1993, while Dutch banks stopped accepting cheques in 2001, both within the giro system. Denmark significantly reduced cheque practices by 2017, aligning with the broader trend toward electronic payment methods in the Nordic states.

According to a recent report from the Federal Reserve Bank of Atlanta that studied the use of cheques in 20 countries for the period from 2012 to 2021, the United States had the highest share of cheque volume in total volume of cashless payments with 5.1% in 2021. It was followed by France and Canada with 4.1% in 2021. The share in Mexico, India, Italy, and Argentina was between 0.9 to 1.6%. However, in 2012, the same share was as high as 44.4% in India and 17.4% in the US. In terms of the value of cheques, the share in the US dropped from 35.1% to 19.6% while in India, the same dropped from 74.6% in 2012 to 13.3% in 2021.

Reserve Bank of India’s analysis observed that cheque-based payment transactions in India declined at a CAGR of 15.4% from 2017 to 2020. Most of the countries considered in the report were close to eliminating the use of cheques, with Germany, Korea, Saudi Arabia, South Africa, and the United Kingdom most successful in reducing the usage of cheques.

Volume of CTS transaction grew by 7.7% in 2022-23

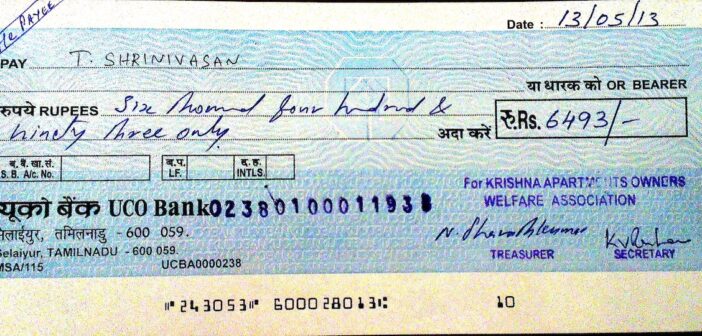

The Reserve Bank of India introduced the Cheque Truncation System (CTS) to modernize and streamline the cheque-clearing process in India. CTS makes cheque clearance faster and more efficient by replacing the physical movement of cheques, with the transfer of an electronic image of the cheque for clearing.

In contrast to the above-discussed trends, a response in the Parliament revealed that in 2021-22, the total volume of cheques through Cheque Truncation System (CTS) in India grew by 0.4%, and in 2022-23, it grew by 7.7%. In numbers, the volume of transactions involving cheques grew from 6,570.84 lakhs in 2020-21 to 7,109.27 lakhs in 2022-23. For a deeper understanding of the trends, we look at the monthly CTS transactions in the country and compare them with those of other widely used digital transaction modes. For the same, the following data has been used for analysis from Dataful:

- Year-, Month- and Zone-wise Volume and Value of Cheques Issued and Returned through CTS System

- Day-, Operator- and Location-wise Volume and Value of transactions done through CTS, NACH, NFS, UPI, IMPS and other Modes of Payment

Volume of CTS transactions dropped because of pandemic

The volume of transactions through CTS was 559.9 lakhs in October 2023. For the period from June 2020 to October 2023, the average monthly volume of transactions through CTS was 590.5 lakhs. The highest volume of transactions through this mode was recorded in March 2021 with about 806.6 lakh transactions which dropped to 366.6 lakh transactions, the lowest in this period, in May 2021. It can be observed that the volume of transactions through CTS had grown until the second wave of the COVID-19 pandemic, following which it dropped sharply. Since July 2021, the volume has stayed between 500 to 600 lakhs, except for the spikes in March 2022 and March 2023. The sudden spikes in March may be attributed to the year-end financial activities, tax-related transactions, or quarterly settlements.

Volume of transactions using debit cards have dropped by 44% in 3 years

The volume of transactions through debit cards has dropped considerably by about 44% between November 2020 and October 2023. However, the volume was still almost twice that of CTS transactions. On the other hand, the volume of transactions through credit cards, IMPS, NEFT, RTGS, and UPI has grown sharply. The volume of UPI transactions increased 8.5 times from 13,369 lakh transactions in June 2020 to 1,14,088 lakh transactions in October 2023. Among the 6 popular modes of transactions considered here, the volume of CTS transactions was higher than that of only RTGS.

CTS is being used for large transactions

Except in the cases of NEFT and RTGS, the trends in the total monthly value of transactions through each of the payment modes are more or less similar. The value of CTS transactions was about 5.84 lakh crore rupees in October 2023, up from 3.85 lakh crore rupees in June 2020. The monthly average value of transactions through CTS stood at 5.64 lakh crores rupees during this period. When this increase in the value of transactions is read with the decrease in the volume of CTS transactions, it is clear that Cheques are increasingly being used for high-value payments, such as settlements, large purchases, or transactions involving substantial sums of money. The value of transactions through CTS is much higher than that through credit cards, debit cards, and IMPS. While CTS is efficient, it might not be as immediate as RTGS or NEFT which are used typically for large transactions.

Volume of CTS transactions is highest in Western Grid

CTS centralizes cheque processing across India into three main grids located in New Delhi (North), Chennai (South), and Mumbai (West), with each grid offering processing and clearing services to all banks falling within its jurisdiction. These were introduced in 2008, 2011, and 2013, respectively. The jurisdictions of these grids are as follows:

- Chennai Grid: Andhra Pradesh, Telangana, Karnataka, Kerala, Tamil Nādu, Odisha, West Bengal, Assam, and Puducherry.

- Mumbai Grid: Maharashtra, Goa, Gujarat, Madhya Pradesh, and Chhattisgarh.

- New Delhi Grid: National Capital Region of New Delhi, Haryana, Punjab, Uttar Pradesh, Uttarakhand, Bihar, Jharkhand, Rajasthan, and Chandigarh.

The data for the southern grid has been available since April 2012, for the western grid since April 2013, and for the northern grid since December 2013.

The trend in the volume of transactions in each of these grids is similar- a slow rise until 2014, stable until 2020, and then a fall. Across these grids, the average monthly volume of transactions is the highest in the Western Grid followed by the Southern Grid.

Value of transactions is also higher in Western Grid

Unlike in the case of volume, the value of CTS transactions across grids has not declined significantly post the fall during the two waves of the pandemic. The average value of transactions was 1.67 lakh crore rupees in the northern grid, 1.81 lakh crore rupees in the southern grid, and 2.26 lakh crore rupees in the western Grid.

India should be mindful of the concerns while promoting cashless economy

As the world is shifting to digital payments, the volume of paper-based transactions is declining across jurisdictions. The majority of the benchmarked countries are close to eliminating the use of cheques. The share of cheque payments in total payment systems transactions has also reduced over the years. In India as well, while cheques remain a relevant form of payment in India, their usage in terms of volume is gradually decreasing as the country moves towards a more digital and cashless economy. As the government promotes a cashless economy, and if India plans to phase out the cheque system in the future, it should be mindful of the challenges and concerns.