Tobacco plays a significant role in India, not just in people’s lives, but in the country’s economy too. India is the second-largest producer of tobacco in the world, after China. Tobacco not only supports millions of livelihoods but also brings in significant tax revenue to the government. However, the health impacts of Tobacco consumption cannot be ignored.

Every year, tobacco kills over 8 million people across the world. Most of them are people who use tobacco directly, but shockingly, around 1.3 million die simply from being exposed to second-hand smoke. The World Health Organization (WHO) estimates that in 2020, about 22.3% of the global population used tobacco, with usage far more common among men (36.7%) than women (7.8%).

In India, tobacco use remains widespread, though the numbers are slowly improving. According to the Global Adult Tobacco Survey (GATS) 2016–17, about 28.6% of adults in India used tobacco, a decline from 34.6% in the 2009–10 survey. This drop is encouraging, but the rural-urban divide is stark, with rural areas showing significantly higher usage. Among teenagers, the shift is more promising. The Global Youth Tobacco Survey (GYTS 2019) found that tobacco use among school-going children aged 13–15 fell from 14.6% in 2010 to 8.4% in 2019 — a significant 42% decline.

As India pushes towards its health goals under the Sustainable Development Goals (SDG 3), tackling tobacco is not just a policy issue — it’s a public health priority. In this story, we take a closer look at India’s tobacco landscape, its users, the taxes meant to curb its spread, and where we stand today.

India and Tobacco

Tobacco plays a significant role in India, not just in people’s lives, but in the country’s economy too. India is the second-largest producer of tobacco in the world, after China. Around 4.5 lakh hectares of land are used to grow it, making up 10% of the world’s total tobacco-growing area. It’s an important crop that supports the livelihoods of nearly 4.6 crore people across farming, processing, and trade.

In 2023–24, tobacco brought in over ₹12,000 crore in foreign exchange for India. States like Gujarat, Andhra Pradesh, Uttar Pradesh, Karnataka, West Bengal, Telangana, and Bihar are major hubs for tobacco production. India also exports huge quantities of tobacco, ranking 2nd in the world by quantity. In 2023-24, the country earned a record $1.45 billion from tobacco exports, growing 19% over the previous year.

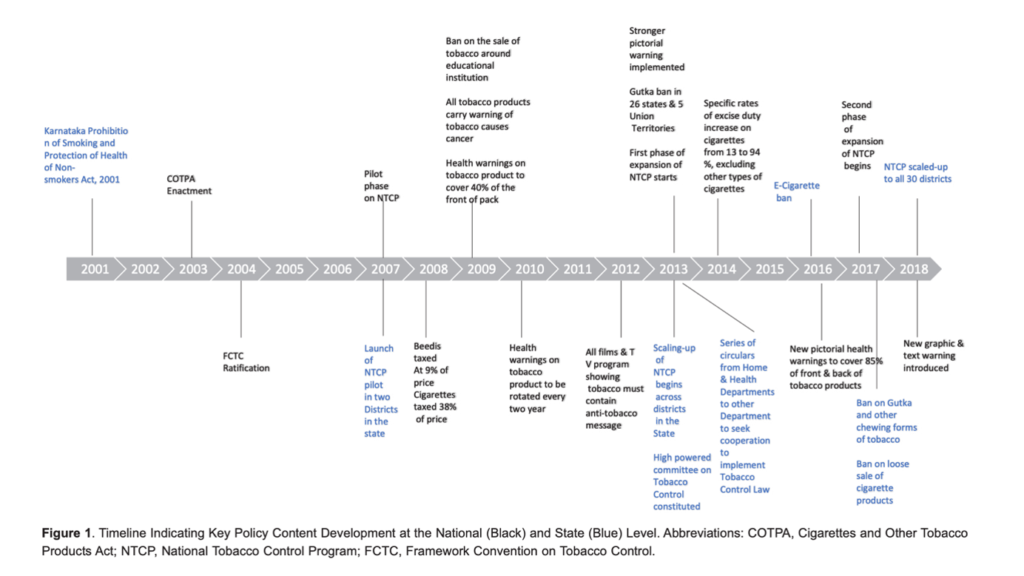

India has taken several important steps over the years to control tobacco use. In 2004, the country ratified the Framework Convention on Tobacco Control (FCTC), a major global treaty aimed at reducing tobacco consumption. Even earlier, in 2003, India had passed the Cigarettes and Other Tobacco Products Act (COTPA), which regulates the trade, production, supply, and advertising of tobacco products. Building on this, the National Tobacco Control Program (NTCP) was launched in 2007–08 as a pilot project, and later expanded during the 11th and 12th Five-Year Plans. In 2016, India further strengthened its efforts by banning e-cigarettes, making it illegal to sell, manufacture, distribute, or advertise Electronic Nicotine Delivery Systems (ENDS). The timeline below captures the major milestones in India’s journey towards stronger tobacco control.

While tobacco supports many lives through jobs and income, it also harms millions through addiction and disease. This makes India’s connection with tobacco both important and deeply complicated.

Nearly 18.6 Lakh enterprises engaged in Manufacturing of Tobacco Products in 2023-24

Over the years, the landscape of small, unincorporated enterprises in India’s non-agricultural sector has seen significant shifts, and the role of tobacco manufacturing within it tells an important story.

In 2010–11, the 67th Round of National Sample Survey (NSS) estimated 5.77 crore such enterprises across the country, excluding construction. About 30% were engaged in manufacturing, 36% in trade, and 34% in services. Among the 1.72 crore manufacturing establishments, a notable 13% were involved in making tobacco products. Nearly 9% of the workers in these manufacturing units were employed in tobacco-related businesses, with a higher concentration in rural areas (13%) compared to urban centres (4%).

Fast forward to 2015–16, the 73rd round of the NSS estimated 6.34 crore non-agricultural enterprises. The distribution remained similar, but within manufacturing, the share of tobacco-related enterprises had grown to 16.7%.

According to the Annual Survey of Unincorporated Sector Enterprises (ASUSE) survey for 2021–22, the number of unincorporated establishments stood at 5.97 crore. Of these, 28.9% were manufacturing units, 37.7% were involved in trade, and 33.4% were in other services. Among manufacturing units, 14.3% were producing tobacco products. Importantly, women made up 20.6% of the workforce in these tobacco manufacturing establishments — a significant share.

The next year, the 2022–23 ASUSE survey estimated around 6.5 crore unincorporated enterprises, with a slight decline in the manufacturing sector’s share (27.41%). Among these, 11.7% of manufacturing units were engaged in tobacco production.

By 2023–24, according to the latest ASUSE findings, the “Other Services” sector had become the largest chunk of the unincorporated non-agricultural enterprises (41.48%), followed by trade (31.07%) and manufacturing (27.45%). Within manufacturing, about 18.63 lakh establishments — roughly 10% — were involved in tobacco production. In rural areas, tobacco manufacturing was the second-largest activity among manufacturing establishments, accounting for 11.4%.

Women continue to play a crucial role in this sector — female workers made up 15% of the workforce in rural tobacco manufacturing units and 8.5% in urban areas, ranking second and third among all manufacturing activities, respectively, in 2023-24.

Overall, the data paints a clear picture- while tobacco manufacturing continues to provide employment, especially to rural women, its share among the country’s small manufacturing units has seen a slow but steady decline over the years.

Approximately 1.9 Lakh Crore collected from Excise Duties from Tobacco & Tobacco Products

Tobacco products in India are among the most heavily taxed items, reflecting both their health impact and revenue potential. These products—like cigarettes, chewing tobacco, gutkha, and beedis—are subject to a mix of taxes, including the Goods and Services Tax (GST), Compensation Cess, Basic Excise Duty, and the National Calamity Contingent Duty (NCCD).

At the core is the Goods and Services Tax (GST), where tobacco products fall under the highest slab of 28%. But that’s just the beginning. Many of these products also attract a Compensation Cess, Basic Excise Duty, and a National Calamity Contingent Duty (NCCD).

The Compensation Cess varies widely, ranging from 5% to as high as 290% in some cases, and can also be charged at fixed rates. For example, certain types of cigarettes and cigars are taxed between ₹2,076 and ₹4,170 per thousand units. In 2023, based on recommendations from the GST Council, the method of collecting this cess shifted from a percentage-based system to fixed amounts based on the retail sale price. This change helps ensure the tax is collected right at the manufacturing level, making it harder to evade.

The Union Budget 2023–24 also increased the NCCD on cigarettes by around 16%. This duty is meant to fund emergency needs like disaster relief and is applied either as a fixed rate or a percentage, ranging from ₹1 to ₹850 per thousand units or 25% to 60% of the product’s value.

Between 2008–09 and 2022–23, the government collected nearly ₹1.9 lakh crore in excise duties from tobacco and tobacco products. Year after year, the revenue steadily increased, reaching a peak in 2016–17 with collections hitting ₹21,719 crore. However, things changed after the rollout of the Goods and Services Tax (GST) in 2017. With GST replacing many indirect taxes, including central excise on several products, the excise duty collections from tobacco saw a noticeable dip in the years that followed.

Taxes on Tobacco & its products make up 2.2% of India’s Gross Tax Revenue in 2023–24

Like taxes from other sources, the revenue collected from tobacco and tobacco products contributes to the Government of India’s overall Gross Tax Revenue (GTR). This pool of money helps fund a wide range of public schemes and programmes. The taxes collected from tobacco, including GST, Compensation Cess, Basic Excise Duty, National Calamity Contingent Duty (NCCD), and customs duties, covering products listed under Tariff Headings 2401, 2402, 2403, and also Pan Masala, accounted for 2.2% of Gross Tax Revenue in 2023-24. Back in 2016–17, this share was lower at 1.27%, and it peaked at 2.75% in 2019–20. Since then, there’s been a slight dip, but tobacco remains a steady contributor to the national tax pool.

60% of amount allocated under NTCP between 2015-16 & 2022-23 remain unspent

The NTCP operates through a three-tier system with a National Tobacco Control Cell (NTCC) at the central level, State Tobacco Control Cells (STCCs) at the state level, and District Tobacco Control Cells (DTCCs) at the district level. Since the 12th Five-Year Plan, the work of STCCs and DTCCs has been integrated into the Flexi-pool for Non-Communicable Diseases (NCDs) under the National Health Mission (NHM), allowing states to receive funds more flexibly, while still focusing on specific activities approved under the programme.

Between 2015-16 and 2022-23, only 38% of the funds approved under the National Tobacco Control Programme (NTCP) were actually spent. Of the ₹764 crore approved across India, just ₹291 crore was utilised. Among 37 States and Union Territories, only 9 managed to spend more than half their approved amounts, with Haryana and Andhra Pradesh leading at 76%. In contrast, states like Punjab, Bihar, Telangana and Madhya Pradesh spent less than 10% of what was approved.

Finding the Balance: The Road ahead for Tobacco control in India

Tobacco is not just a crop or a product in India — it is part of many people’s jobs and livelihoods. This makes the fight against tobacco much harder. But studies from around the world, and from India itself, show something important: cutting down tobacco use brings larger benefits — for people’s health, for the economy, and for the country’s future.

India has already made steady progress. Over the years, strong laws and bold steps have helped reduce tobacco use. But the journey is not over. Since tobacco touches many areas — health, farming, trade — everyone must work together to push for real change.

The way forward is clear: we need to strengthen surveillance, develop a smart, unified tobacco taxation strategy that ensures higher taxes genuinely translate into higher prices across all products, and make tobacco products truly unaffordable to curb usage. The revenue collected must be earmarked for funding health and development projects, giving the nation a healthier future in return.

Equally important is supporting farmers by promoting mixed cropping—an alternative to mono-crop tobacco farming, which can offer them better and more sustainable incomes. Amplifying tobacco control messaging through every channel possible—television, social media, mobile caller tunes, and even interactive voice response systems (IVRS)—to constantly remind people of the true cost of tobacco use is equally important.