The amount of gross & net NPAs has reduced in the last two years from the high recorded by the end of 2017-18. However, this reduction in the amount of NPAs is largely driven by the increased ‘write-offs’ in the last two years. Here is a detailed analysis.

Recently, the Reserve Bank of India (RBI) released the annual publication, “Statistical Tables Relating to Banks in India 2019-20”, which provides information on various activities of the scheduled commercial banks (SCBs) and rural co-operative banks in the country. One of the major data points provided in this report is the details about the non-performing assets (NPAs) of SCBs.

Over the past few years, there has been a discussion over NPAs of the SCBs and the yearly write-offs by banks. Incidents of defaulters fleeing the country or closure of companies due to loan defaults etc. have raised concerns about the growing NPAs of banks and their impact on the financial health of banks. Furthermore, the number of write-offs, especially by the public sector banks have raised concerns among the general public. Here is a look at the trends in NPAs and loan Write-offs over the years based on the information provided by RBI.

Fall in the amount of NPAs at the end of 2019-20 compared to the earlier years

As per RBI’s data, the total Gross NPAs declared by the Public Sector, Private Sector, Foreign, Small Finance & Payments banks as on 31 March 2020, amounted to Rs. 8.99 lakh crores, less than the Rs. 9.36 lakh crores as of 31 March 2019. Gross NPAs have been on a declining trend over the last two financial years compared to 2017-18, the year when gross NPAs touched the highest of Rs. 10.39 lakh crores.

Amidst concerns about rising NPAs, the government of India stated that the increase in NPAs is due to the Asset Quality Review (AQR) initiated in 2015, where-in stressed accounts were reclassified as NPAs. This transparent recognition has contributed towards an increase in the NPAs as per the government’s explanation.

Over the last two years, apart from Gross NPA, there is also a fall in the Net NPA. While Gross NPA refers to all the loans that have been defaulted by the borrowers, Net NPA refers to defaulted bad loans after the provision for the un-paid debts is accounted for. Hence Net NPA reflects the actual loss to the banks as there is no provision for them.

Apart from the fall in the total value of Net NPAs, the share of Net NPAs out of the gross NPAs has also shown a declining trend. In 2019-20, net NPAs accounted for 32% of Gross NPA, while it was 38% and 50% in the earlier years. While the decline in Net NPAs is a good sign, it ought to be noted that the increased provision to cover the NPAs could have been used for business activity if it wasn’t for the higher incidence of NPAs.

Increase in the Gross NPAs of Private Sector Banks

NPAs of Public Sector Banks constitute the major portion of the overall NPAs. The fall in the overall NPAs in the last two years compared to 2017-18 can be attributed to the lesser NPAs reported for Public sector banks. By the end of 2019-20, the Gross NPAs of Public Sector Banks were Rs. 6.78 lakh crores compared to Rs. 7.39 lakh crores by the end of the previous financial year.

On the other hand, the Gross NPAs of Private Sector Banks show a worrying trend. By the end of 2019-20, the Gross NPAs of private sector banks was Rs. 2.09 lakh crores compared to Rs. 1.83 lakh crores by the end of 2018-19. However, the increase was not as steep as observed in 2018-19, where around Rs. 54 thousand crores worth of Gross NPAs were added. Meanwhile, the NPAs of Foreign Banks have shown a consistent decline since their high by the end of 2015-16.

However, the Net NPAs of Private sector banks have decreased by the end of 2019-20 to Rs. 55.74 thousand crores compared to Rs. 67.3 thousand crores by the end of 2018-19. The proportion of Net NPAs has reduced to around 26% in the case of private banks. It was nearly 50% by the end of 2017-18.

Net NPAs of Public sector banks constitute 34% of the gross NPAs by the end of 2019-20, compared to nearly 51% two years ago, i.e.by the end of 2017-18. While the Gross NPAs of foreign banks have declined, the net NPAs do not present an optimistic picture with 20% being Net NPAs by the end of 2019-20, higher than the earlier two years – 11% (2017-18) & 16.5% (2018-19).

Increase in new NPAs added during the year

While the overall value of Gross NPAs has come down in the last two years, the same cannot be said about the new NPAs added during 2019-20. A total of Rs. 3.78 lakh crores worth of NPAs were added in 2019-20, compared to Rs. 3.08 lakh crores in 2018-19. As highlighted earlier, the highest addition of NPAs was in 2017-18 with Rs. 6.04 lakh crores.

The additions to NPAs have been higher than the previous financial year across all the bank types. The addition to NPAs during 2019-20 is higher compared to even 2017-18 in the case of private banks. With the COVID-19 induced lockdowns & economic slowdown during 2020-21, there could be an increase in the NPAs during the current year.

The challenge due to the increase in additions to NPAs during the year is compounded by the fall in reductions. The overall reduction in NPAs during 2019-20 was Rs. 1.55 lakh crores compared to Rs. 1.73 lakh crores in 2018-19.

This fall in the overall reduction of NPAs is due to the fall in the annual reduction of NPAs for Public Sector Banks. The annual reduction was the highest for public sector banks in 2018-19 with Rs. 1.27 lakh crores have reduced to Rs. 99.69 thousand crores in 2019-20. Meanwhile, the private sector banks and foreign have fared better in the reduction of NPAs during 2019-20 compared to the previous year.

Increase in the value of NPAs being written off

Banks have the provision for writing off NPAs. The RBI has laid down the rules regarding the recognition of the NPAs and the conditions for writing off these loans. The decrease in the overall NPAs at the end of 2019-20 despite an increase in the new NPAs during the year can be attributed to the increase in the loan write-offs.

As per the data provided by RBI, the total NPAs written off during 2019-20 was Rs. 2.37 lakh crores compared to Rs 2.36 lakh crores in 2018-29. The trends over the last 10 years indicate a consistent increase in the Loans being written off. The increase in the loans written off in 2019-20 is however lesser compared to the corresponding increase in previous years.

In fact, the amount of loans written off by Public Banks during 2019-20 is lesser than the previous year, in contrast to the trend in earlier years. However, both the Private Banks and the Foreign Banks have written off a greater amount in 2019-20 compared to the earlier years.

Conclusive information about recovery of Written-off loans in not available

A popular misconception is equating write-offs to waivers. In case of a waiver, the defaulter is released from the liability of paying the debt, with the loan being permanently canceled. This action is taken up by the Government. For instance, waiving off the loans taken by the farmers or other groups.

Technically, a ‘Write off’ is different. The default NPAs are ‘written off’ from the bank’s book of accounts to present a better balance sheet. However, the record of this unrecovered debt is maintained, and banks pursue the recovery of even these written-off loans. Apart from cleaning up of the balance sheet, another advantage for the bankers is that the amount which has been reserved as a provision for security against bad loans can be reduced in proportion to the reduction in NPAs. Such amount release can be used for banking purposes of providing loans etc.

The banks also have the option of selling the loans and handing over the recovery to third-party agencies. Although there is a scope of recovery of the loans, banks have not been successful in such recoveries.

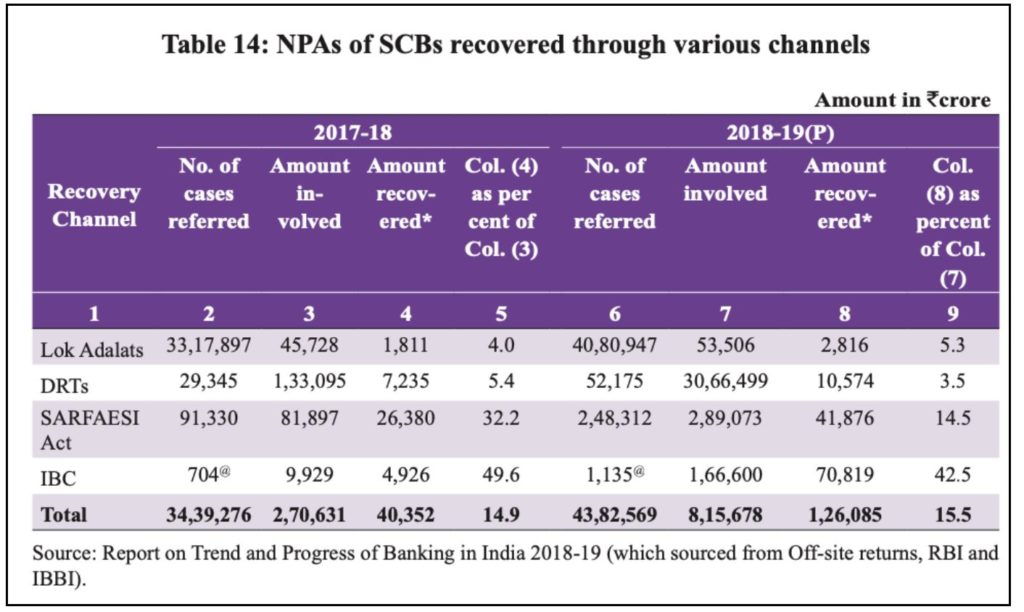

As per the information provided in the Economic Survey of India -2020, during the year 2017-18, 14.9% of the NPAs of SCBs ( Scheduled Commercial Banks) were recovered through various recovery mechanisms. The Insolvency & Bankruptcy Code (IBC) has been the most successful compared to the earlier recovery regimes. For the year 2018-19, the recovery rate is provisioned at 15.5%.

However, there is no information on the extent of the recoveries among the loans written off. If the recovery rates of overall NPAs is an indication, the recovery for written off loans could be much lower. With the NPAs being written off the books and provision for bad loans being diverted to other purposes, there is no incentive to recover the written-off loans. There is an urgent need for the RBI to release data on the recovery of these written-off NPAs.

Featured Image: Amount of NPAs