Input Tax Credit (ITC) is an important feature of the Goods & Services Tax regime in India. However, there have also been several cases of ITC fraud detected in the last few years. Between 2018-19 and 2020-21, a total of Rs. 37.48 thousand crores of fake ITC claims were detected by the government amounting to 1.06% of the total GST collection in these three years. In 2020-21, this percentage went up to 1.51%.

The Goods & Services Tax (GST) came into effect from 01 July 2017, with the aim of implementing a simplified, self-regulating, and non-intrusive Indirect tax compliance regime. GST in principle allowed a unified tax system in lieu of the multiple Central & State taxes. It is a comprehensive multi-stage tax system applied to the sale of goods & services. One of the main aims of this taxation system is to curb the cascading effect of indirect taxes on the sale of goods & services. This facilitates a seamless flow of input credit across the supply chain i.e., Manufacture to Consumption. Thus, Input Tax Credit (ITC) is an important feature of GST.

What is Input Tax Credit?

Input tax credit (ITC) refers to the tax that a businessperson pays on the purchase of inputs, which can be used to reduce the Tax liability at the point of sale i.e., Businesses can claim credit to the extent of GST paid on the purchases made to further the business interests. Since GST is an integrated Tax system, where every purchase by a business matches with a sale by another business, the flow of credit would be a seamless option.

For Example:

Mr. A purchases goods worth Rs. 20,000 and pays Rs. 3,600 as GST (18%). He sells the goods at Rs. 24,000, with GST payable being Rs. 4,320 (18%).

| Outward GST payable | Rs. 4,320 |

| Less: GST paid on Purchases | Rs. 3,600 |

| Net GST payable | Rs. 720 |

He can claim the Rs. 3,600, he paid as GST on purchases as Input Tax credit (ITC) and will be liable to pay a net tax of only Rs. 720.

Below are the mandatory requirements for claiming ITC under GST:

- Must be registered under GST law

- A tax invoice by the registered supplier showing tax amount

- The Goods or services must be received

- The suppliers should have filed returns and paid such tax to the government

- In case of instalments, ITC can be claimed on receipt of last instalment

- Should be claimed within the prescribed time limits.

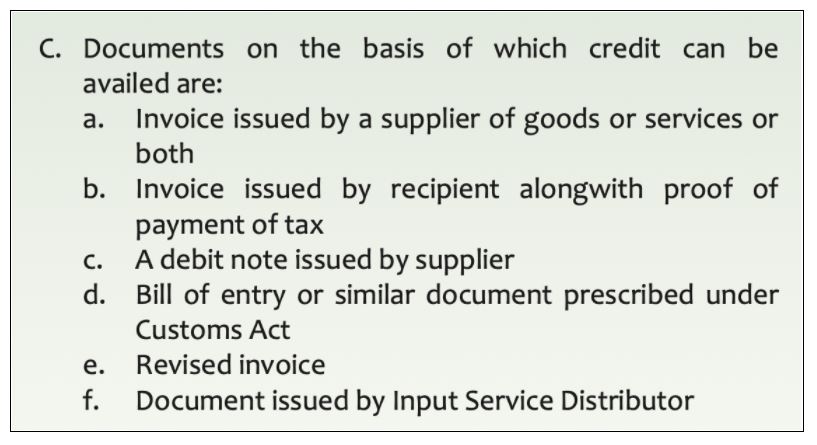

The list of documents required for claiming ITC are given in the following image.

The amount involved in ITC Fraud increased in 2020-21

The provision of ITC in the GST system provides the option for businesses to apply for claims to the extent of input taxes that they have paid. However, there are several instances of fake claims for ITC. The Directorate-General for GST Intelligence (DGGI) is an intelligence agency under the Ministry of Finance, which investigates tax evasion under GST. DGGI investigates ITC claims, identifies any frauds, and books cases against such frauds.

Responding to a question in Rajya Sabha in August 2021, the Ministry of Finance furnished the details of cases of ITC fraud booked by the DGGI. In 2020-21, a total of 1976 cases of ITC fraud were booked by DGGI, with amounts involved to the tune of Rs.17,731 crores. The GST collection during 2020-21 was Rs. 11.72 lakh crores. In other words, the volume of ITC fraud amounts to around 1.51% of the total GST collection in 2020-21.

In comparison, the volume of ITC fraud in 2019-20 was Rs. 7.9 thousand crores and a total of 1027 cases booked by DGGI. This was around 0.65% of the total GST collection of Rs. 12.11 lakh crores in 2019-20.

In 2018-19, a total of 1620 cases were booked with the total value of the fake claims being Rs. 11.81 thousand crores. This was 1.01% of the total GST collection of Rs. 11.67 lakh crores in 2018-19.

In the current financial year 2021-22, 227 cases amounting to Rs. 2.21 thousand crores were identified as fraud by the end of the first quarter, June 2021.

West Bengal, Chhattisgarh & Haryana are among the states with a higher incidence of ITC Fraud

Overall, Maharashtra accounted for the highest volume of ITC fraud with over Rs. 10.78 thousand crores in 597 cases over the three years i.e., 2018-19 to 2020-21. However, this represents about 2.06 % of the total GST collection from the State during this period. The highest incidence of ITC fraud in Maharashtra was in the year 2020-21.

- Among all the states, West Bengal has the highest proportion of ITC fraud compared to the GST revenue of the state. During the three-year period, the total value of the IT fraud in West Bengal is around Rs. 2.29 thousand crores, which accounts for more than 5% of the GST collection in the state, through 249 cases of ITC fraud.

- In terms of the number of cases, Gujarat accounted for the most ITC fraud cases with 903, followed by Delhi & Maharashtra. In the case of Delhi, most of the cases were in the year 2018-19.

- Chhattisgarh, Delhi, and Haryana are the other states which have accounted for a higher proportion of ITC fraud compared to the GST collected in those states.

- On the other hand, Karnataka, Tamil Nadu & Gujarat are among the states with a lower proportion of fraud under ITC compared to their high GST collection.

Only about 11% of the value identified as Fraud in 2019-20 & 2020-21 recovered to date

In the same Rajya Sabha answer, the Ministry of Finance also provided the value of the amount recovered out of the amount identified as ITC fraud.

During 2019-20 & 2020-21, a total of Rs. 2.82 thousand crores were recovered. In 2019-20, the amount recovered was Rs. 1.3 thousand crores accounting for around 17% of the total fraud for that year. In 2020-21, although the volume of the amount recovered increased to Rs. 1.48 thousand crores, it makes up only 8.4% of the fraud in the year.

Overall, 321 arrests were made during 2019-20 and 2020-21, with 95 in the earlier year and 226 in the latter year.

Government lists initiatives to reduce ITC fraud

In the same response in Rajya Sabha, the government listed various steps initiated to counter the frauds under ITC. With the recovery rate being very low, it is imperative that initiatives are taken to mitigate the incidence of fraud itself.

One of the efforts in this direction as stated by the government is the creation of the Directorate of Analytics & Risk management (DGRAM) which utilizes technology to identify potential cases of fraud and assist the investigative authorities. Aadhar based authentication is made mandatory for new applications to eliminate the fakes. Further, the government stated that mandatory regulations are in place for the submission of authentic proofs.

Featured Image: Input Tax Credit