[orc]As consumers, we are all paying GST on various goods and services in our daily lives. By becoming aware about key aspects of GST, we can better appreciate the role of GST in nation-building; can educate our friends and relatives; can raise voice confidently against any malpractices; can be a whistle-blower on GST frauds etc. So, let’s learn some basics to be ‘GST-wise’!

By now, everyone knows that the Good and Services Tax (GST) is the tax on consumption/supply of Goods and Services. From 1 st July, 2017, GST replaced several indirect taxes at Central and State levels, mainly, the Sales Tax (State VAT), Central Excise Duty and Service Tax. With some exceptions specified in law, GST applies on all ‘supplies’ of goods and services.

Why CGST & SGST?

India being a federal country and GST being a concurrent levy by both Centre and the States, the GST revenue has to be distributed among Central Government and concerned State Government. It is for this accounting purpose that the GST rate is split and shown in two equal components, viz., Central GST (CGST) & State GST (SGST). On every supply within a state, both CGST & SGST are levied simultaneously. Where the supply is between two states, Integrated GST (IGST) is levied. IGST rate = CGST rate + SGST rate.

The GST rates are uniform throughout the country. Most goods fall under the 18% tax slab (9% CGST + 9% SGST). Only 50 items are currently under 28% slab. From 15th November 2017, rates on several goods were reduced . For easy searching of GST rates on various goods and services, one can download ‘ GST Rate Finder’ app from Google Play Store.

Registration

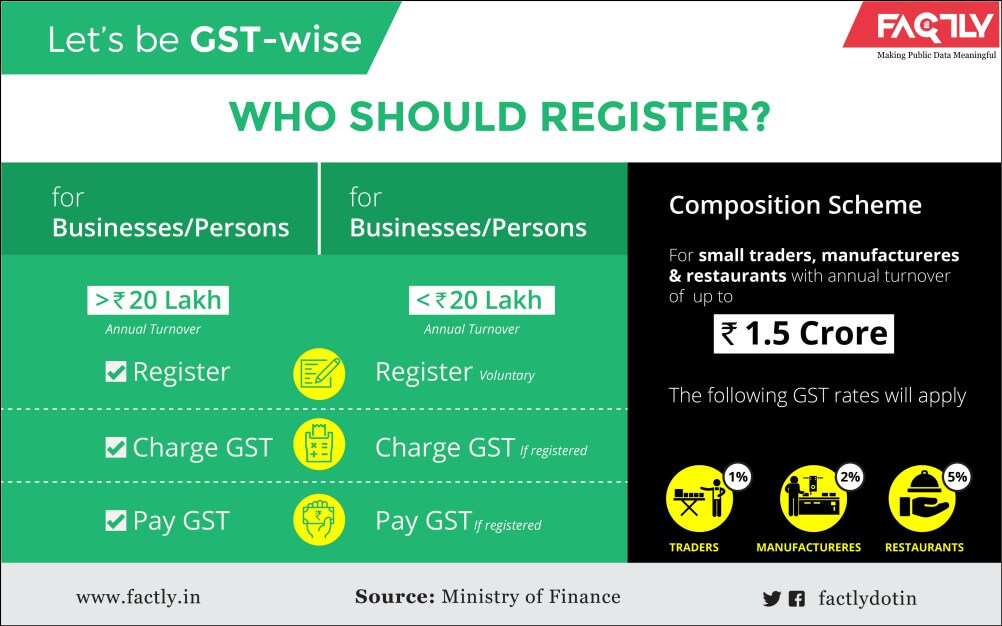

Persons/businesses dealing in taxable supplies with aggregate turnover of more than Rs. 20 lakhs in a financial year are compulsorily required to take registration and charge/pay GST. (In case of 11 ‘special category’ States, this threshold is Rs. 10 lakhs) Persons with aggregate turnover < Rs. 20 lakhs may also take registration voluntarily. But, once taken, they have to comply with all requirements stipulated for GST registrants, i.e., collect and pay GST, file returns etc. Once obtained, the GST registration certificate shall be displayed at a prominent location in the business premises and on the name board exhibited at the entry of business place. Penalty for non-display is up to Rs. 25,000/-.

Small manufacturers, traders and food supply businesses (restaurants) having aggregate turnover less than a prescribed threshold (increased to Rs. 1.5 Crore) can opt for ‘Composition Levy’ under GST. Such ‘composition suppliers’ are not supposed to collect/pay CGST & SGST at prescribed rates. Instead, they are given the simpler option to pay a lumpsum ‘amount’ as a percentage of their turnover. That’s why the bills issued by composition suppliers don’t contain CGST & SGST components. However, they have to mention the words “Composition taxable person, not eligible to collect GST on supplies” on the top of every bill and also display the same on notice/signboard prominently at the place of business. Penalty for such non-mention/non-display is up to Rs. 25,000/-.

GST Bill/Invoice

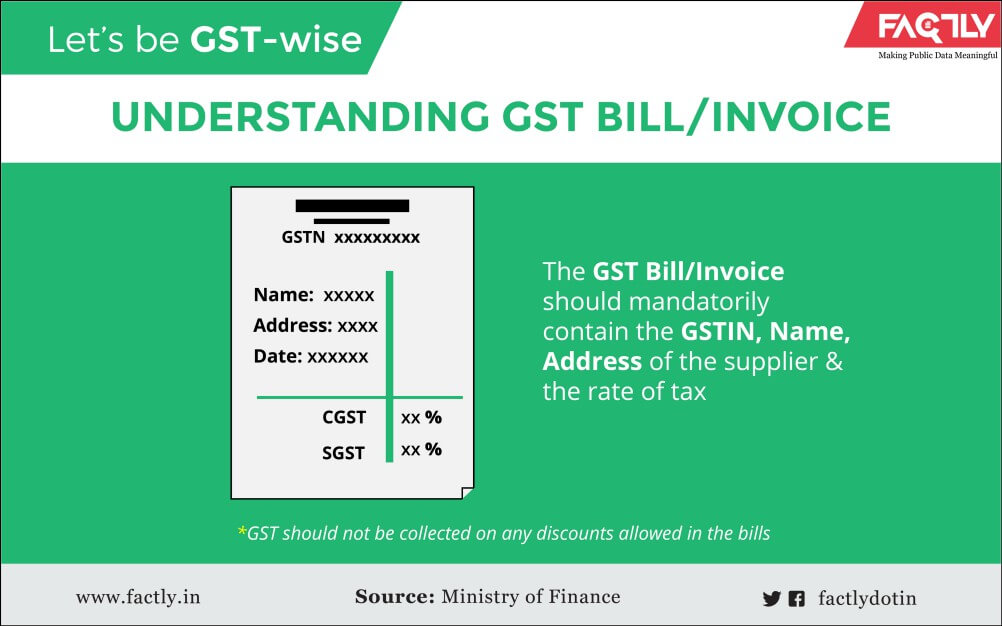

As a vigilant consumer, insist on bill for every purchase. GST law provides that the supplier may not issue invoice (i) if the value of goods/service is < Rs. 200/- and (ii) if the recipient is not a GST-registered person (e.g., a consumer) and (iii) if the recipient does not require invoice. However, a consolidated tax invoice shall be issued for all such supplies at the close of each day.

Some businesses are not giving bill or not showing GST separately in the bill on the pretext that their computer system is not working or software is still not ready. Note that the Bill/invoice under GST need not be computer-generated. It can be hand-written on paper also but shall contain the mandatory particulars like GSTIN, name and address of the supplier, date of issue, rates of Tax etc.

Any person/business not registered under GST is prohibited from collecting GST. If GST is charged, check whether GSTIN (PAN-based GST Identification Number) is indicated clearly in the bill. You can enter the GSTIN and verify business details at www.gst.gov.in > Search Taxpayer > Search by GSTIN/UIN. Also check whether CGST & SGST rates and amounts are indicated separately. GST shall not be collected on any discounts allowed in the bills. However, GST is payable on any other additional amounts collected/shown separately in bill, e.g., in the name of ‘service charges’, ‘handling charges’, ‘packing charges’, ‘processing charges’ etc.

GST shall not be collected on any discounts allowed in the bills. However, GST is payable on any other additional amounts collected/shown separately in bill, e.g., in the name of ‘service charges’, ‘handling charges’, ‘packing charges’, ‘processing charges’ etc.

No GST on MRP

MRP (Maximum Retail Price) is affixed on most of the packaged products. MRP is inclusive of all taxes including GST. So, it is a malpractice to charge GST, again on MRP. Complaints in this regard can be filed with concerned Asst. Controllers of Legal Metrology who are part of State government.

Generally, there will be single MRP for any packaged product. However, in view of change in GST rates, Department of Consumer Affairs has permitted for declaring revised MRP until 31st March, 2018.

For any queries or guidance on consumer protection issues, one can visit: http://www.consumerhelpline.gov.in or call National Consumer Helpline, Toll Free: 1800-11-4000 or send SMS to +918130009809.

‘Service Charge’ in restaurants

From 15th November 2017, all stand-alone restaurants, whether AC or non-AC, restaurants in hotels with room tariff of less than Rs. 7500 per unit per day and food parcels/takeaways attract only 5% GST (2.5% CGST + 2.5% SGST).

Apart from food tariff and taxes, some restaurants are charging extra amount in the name of “Service charge”. Some claim that this amount will be distributed equitably among all the restaurant staff (not only waiters but the cooks, cleaning staff etc.). So, this is not any government tax but a kind of “compulsory tip” charged by restaurants from customers. However, if a restaurant collects ‘service charge’, GST is payable on that amount also.

‘Anti-Profiteering’ in GST

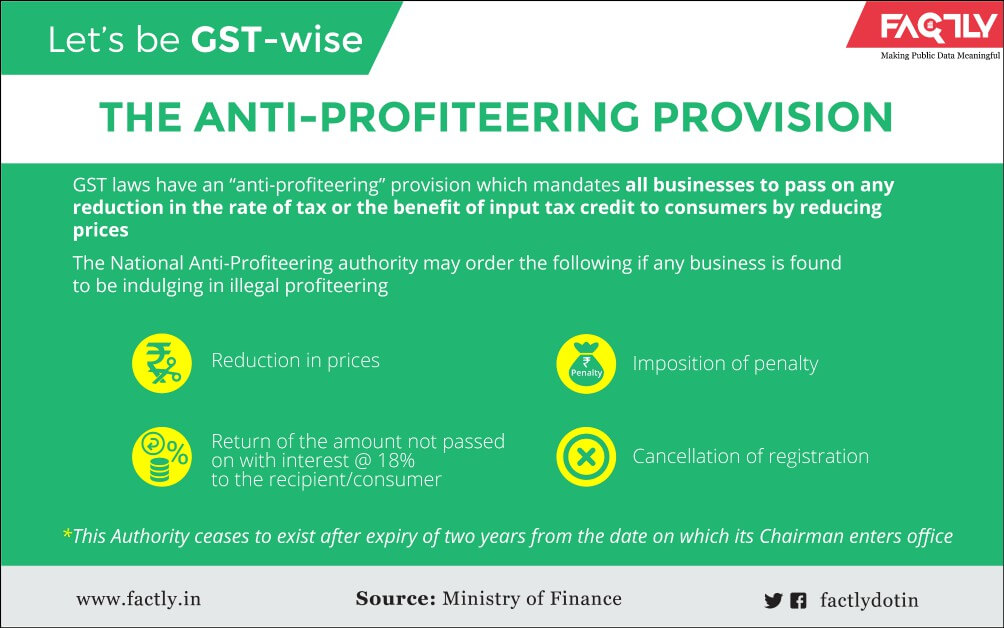

It has been the experience of many countries that when GST was introduced, there had been a marked increase in inflation and prices of the commodities. This happened in spite of the availability of tax credit right from the production stage to the final consumption stage, which should have actually reduced the final prices. To tackle this, the GST laws have an “anti-profiteering” provision which mandates that all businesses must pass on any reduction in the rate of tax or the benefit of input tax credit to consumers, by way of proportionate reduction in prices.

If this is not done and if any business indulges in illegal profiteering, the consumer’s interest is protected by the National Anti-Profiteering Authority which may order for: (a) reduction in prices; (b) return of the amount not passed on with interest @ 18% to the recipient/consumer; (c) imposition of penalty; and (d) cancellation of registration of the supplier. This Authority ceases to exist after expiry of two years from the date on which its Chairman enters upon his office, unless the GST Council recommends otherwise.

Affected consumers may file an application before the State Screening Committees, if the profiteering is of local nature or before the Standing Committee on Anti-profiteering, if the profiteering has all-India character. Contact details of State Screening Committees are available on the CBEC portal. National-level Standing Committee on Anti-profiteering is located at Second Floor, Bhai Vir Singh Sahitya Sadan, Bhai Vir Singh Marg, Gole Market, New Delhi – 110001. Tel No.: 011-2371537, Fax No.: 011-23741542, e-mail: anti-profiteering@gov.in Prescribed application form for filing complaint against anti-profiteering is also available on the CBEC portal.

Administration of GST

Both the Central Government (Central Board of Excise & Customs, to be rechristened soon as Central Board of Indirect Taxes (CBIT)) and State Governments (Commercial Tax Departments) have role in the administration of GST. However, there will be no dual control on taxpayers. Each business registered under GST is assigned either to Centre or respective State. In many States, already this assignment of taxpayers among Centre/State is complete and the lists are displayed on websites of CBEC zonal offices and State Commercial Tax Departments. Further, the assignment of taxpayers will be switched between the Centre and States at regular intervals as decided by GST Council. In view of this, before reporting violations of GST law or to give specific information about GST evasion etc., it is advisable to check which taxpayer is administered by which authority and accordingly address the complaint.

Author is a member of Indian Revenue Service (IRS) and has keen interest in Consumer and Media Laws (ravikiranedara123@gmail.com). This write-up in simple language is meant for consumer awareness only and shall not be used for legal interpretation purposes.

1 Comment

Pingback: Be a ‘GST-wise’ Consumer! – Tune IN'23