With ever increasing digital transactions, the number of cases of fraud involving ATMs, cards, online banking have increased in the last few years. However, the total amount involved in such fraud cases has decreased.

The most common banking services have been made simple, accessible and convenient thanks to Automated Teller Machines or ATMs, debit & credit cards which are ubiquitous now. At the same time, a substantial number of fraud cases are reported every year despite RBI issuing guidelines from time to time to prevent such fraud. Remember banks urging customers to change their debit and credit cards to EMV cards in 2018?

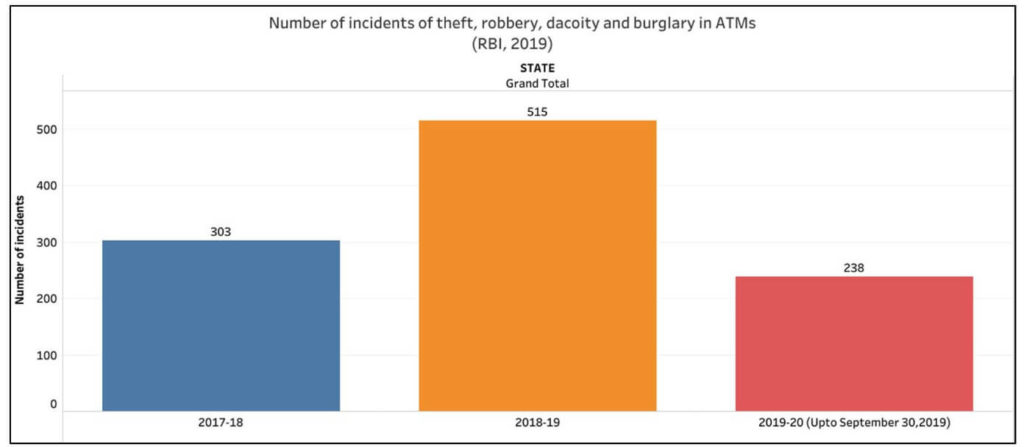

In 2018-19, cases of Robbery & Theft at ATMs increase by 70%

Sections 392 to 398 of the Indian Penal Code define theft, robbery, burglary and dacoity differently. RBI has been maintaining data of incidents in ATMs under these heads only since the fiscal year 2017-18.

It was reported that incidents pertaining to theft, dacoity, burglary and robbery in ATMs in the last two financial years have gone up from 303 cases in 2017-18 to 515 in 2018-19, an increase of 70%. The amount involved in these incidents was Rs.11.2 crores in 2017-18 and Rs. 25.5 crores in 2018-19.

Haryana accounted for the maximum number of such incidents with 9.6% of the total in 2017-18. In the subsequent year, Maharashtra accounted for 13% of the cases reported, the largest for any state. However, in terms of the amount stolen, Rs. 3.74 crores (14.6% of the total) was reported to be stolen in 2018-19 from Karnataka, the highest for any state.

In the current fiscal (2019-20), as on 30 September 2019, 238 such cases had already been reported in the first six months.

In April 2019, RBI issued a circular to banks recommending a few additional measures to enhance security at ATMs. These include increased surveillance and grouting of ATM to solid structures such as walls and pillars.

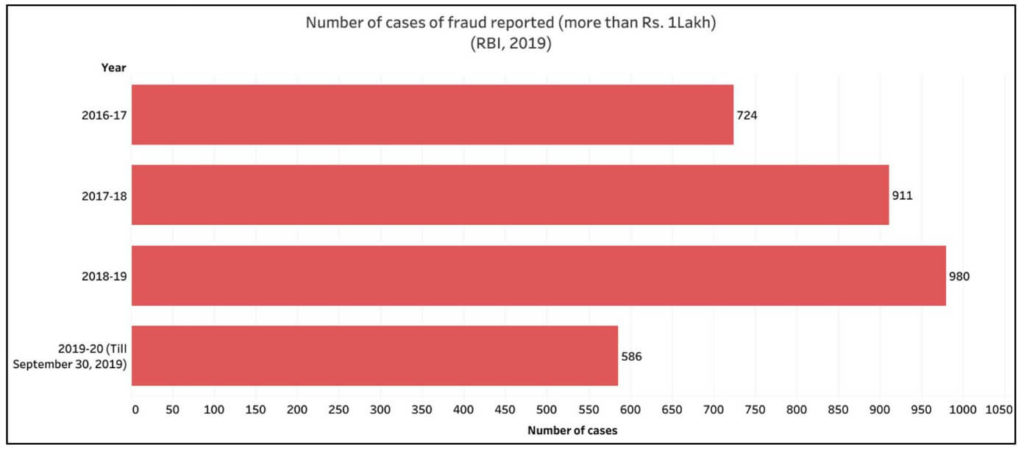

Cases of fraud involving ATM cards and online banking have also risen

Meanwhile, data on cases of fraud with respect to ATM cards and online banking worth at least one lakh rupees each have also increased in the last three years.

In 2016-17, a total of 724 cases involving ATM cards and online banking frauds (of more than a lakh rupees) were reported. This rose to 911 cases in 2017-18 and further to 980 cases in 2018-19. In spite of the increase in the number of cases by 7.5%, people lost Rs. 65.26 crores in 2017-18 and only Rs. 21.36 crores in 2018-19, showing a decline in the amount involved.

In the first six months of the current financial year of 2019-20, 586 cases are already reported.

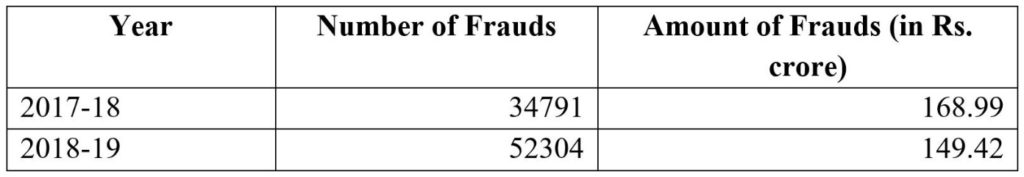

Number of fraud cases increased by 50%, while the total amount decreases

Irrespective of the amount involved & the type of case, a total of 34,791 fraud cases involving Rs. 168.99 crores and 52,304 cases involving Rs.149.42 crores in 2017-18 and 2018-19 respectively, were reported according to RB (card related & online banking). It is observed that the amount involved has reduced despite the increased number of cases by almost 50%.

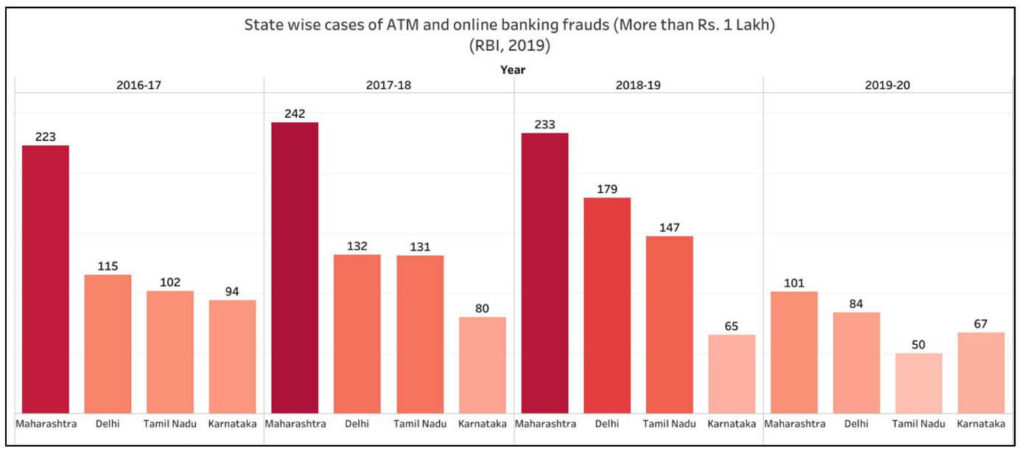

The same four states account for the greatest number of cases of fraud

In every year for the last three years, Maharashtra has reported the highest number of cases related to fraud involving ATM cards and online banking. Throughout these years, Delhi, Tamil Nadu and Karnataka continue to report large number of cases along with Maharashtra. Data for 2019-20 is available only up to 30 September 2019.

Most number of fraud cases reported in SBI in 2019-20

In 2019-20, almost one-third of the cases were reported in State Bank of India. ICICI Bank accounted for more than 11% of the cases. HDFC and Kotak Mahindra were also hit significantly by bank frauds in the current as well as previous financial years.

RBI keeps issuing instructions to prevent such frauds

RBI, in 2015, directed banks to report the cases of fraud to law enforcement agencies and take appropriate actions to recover the money lost in fraud. In unauthorised transactions due contributory fraud, negligence or third party breach, RBI notified that customers will have zero liability if they notify the bank within three working days. Banks should also take immediate action to ensure safety in ATMs and provide customer channels such as toll free numbers, SMS, e-mail and more, which function throughout the day for customers to report cases of unauthorised transactions. In December 2018, RBI mandated that debit and credit cards had to be converted to EMV cards with PIN for safety reasons.

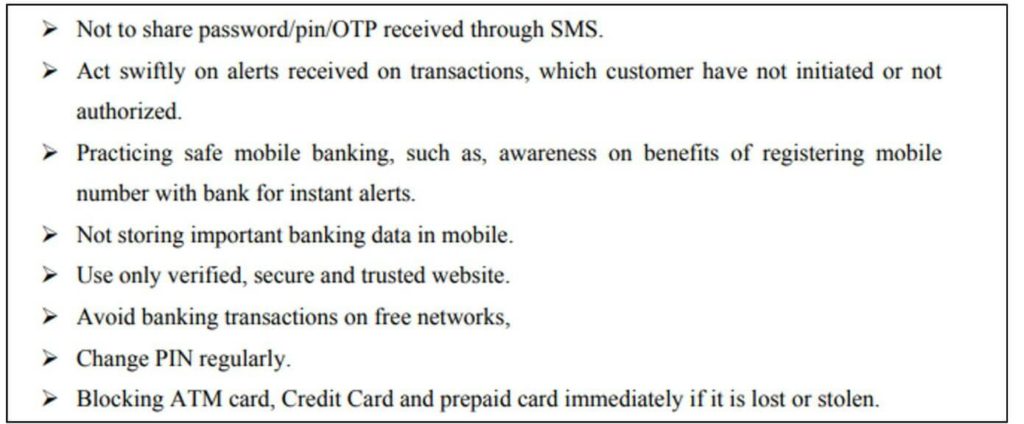

In addition to these measures, RBI also conducts awareness campaigns under ‘RBI Kehta hai’ to spread awareness on safe digital banking.

A few important tips include the following.

What should one do in case of a fraudulent transaction using debit card/ credit card/ online banking?

As soon as a person gets to know that some suspicious transaction has taken place in their account, they must notify the bank immediately. The bank must resolve the complaint within 90 days. For more details, one can give a missed call on 14440 to complain.

Featured Image: Bank Frauds in India