[orc]Expect heavy rush & chaos at the Bank Branches today. Go prepared and follow the rules specified by the RBI.

All Banks will reopen today for normal banking operations. Since this is going to be the first working day after the withdrawal of Rs 500 and Rs 1000 notes, expect heavy rush and long queues in banks. As Factly reported earlier, the government has issued detailed rules on both exchange and deposit of old notes. Here is a brief of what to expect at the Banks today. Banks will also remain open both on Saturday & Sunday (12th & 13th November, 2016) to facilitate the exchange & deposits of the withdrawan notes.

Detailed Guidelines issued to Banks

RBI has issued detailed guidelines to be followed by Banks for the task of both exchange & deposit of old notes by the common public. RBI has also directed banks to accord highest priority to this work till 30th December, 2016, the last date to deposit/exchange the old notes. Banks were also asked to submit a statement by midday of 09th November showing the details of the specified Bank Notes held by it at the close of business as on 8th November 2016.

All ATMs and cash dispensing machines will have to be re-configured to disburse bank notes of Rs 100/- and Rs 50/- denominations prior to reactivation of the machines on 11th November, 2016. The ATMs & cash dispensing machines will remain closed on 10th November also. The new Rs 500 and Rs 2000 notes will be issued over the counters from 10th November 2016.

Information material for educating the public regarding withdrawal limits and also the salient features of the new series of bank notes (Rs 500 and Rs 2000) are required to be printed by banks in adequate quantity and distributed to the public in banking halls and ATM kiosks.

Banks have also been directed to identify the staff for managing the exchange counters and brief them properly about the scheme and the procedure to be followed. A copy of the FAQs provided should be supplied to the staff manning the exchange counters.

Banks have also been directed to provide adequate number of note counting machines, UV Lamps, note sorting machines etc. at the exchange counters to take care of the work load and timely detection of counterfeit notes. The banking hall, public areas and counters should be under CCTV surveillance and recording should be preserved.

What will happen on November 10th, 2016?

Bank branches will commence normal operations on November 10, 2016. Banks have to accord top priority to provide facility for exchanging / accepting deposits of Specified Bank Notes and open additional counters to meet the public demand and keep the counters open for extended hours, if necessary. Maximum staff should be deployed for this purpose. If necessary banks may consider hiring retired employees for a temporary period to take care of additional work load.

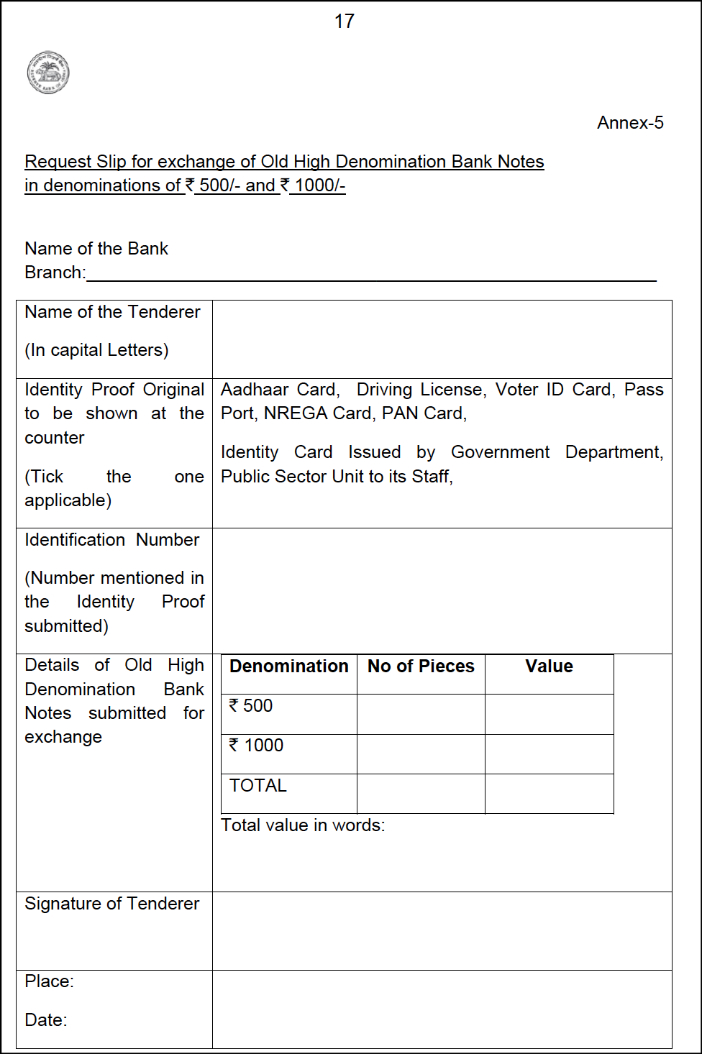

Any person wishing to exchange the old notes has to fill the receipt in the following format as specified by the RBI.

As reported earlier, the exchange of old notes will be limited to an amount of Rs 4,000/- per person till 24th November 2016. With respect to the deposits, there will no limit on the amount as long as relevant KYC norms are satisfied. For those accounts where the KYC norms are not complete, the maximum deposit amount will be limited to Rs 50,000/-. The normal process for deposits will continue.

Business Correspondents (BCs) will also be allowed to exchange Specified Bank Notes upto ₹ 4000/- per person as in the case of bank branches, against valid identity proof and requisition slip.

Each bank branch has been directed to report at the close of business on each day starting from November 10, 2016 till the closure of the scheme on December 30, 2016 by email or Fax to their Controlling Office a statement showing the details of Specified Bank Notes exchanged by it and the respective Controlling Offices will aggregate these details and report to the Department of Currency Management, RBI by email on a daily basis.

Featured Image: New 2000 Rs Notes

1 Comment

‘the exchange of old notes will be limited to an amount of Rs 4,000/- per person’

If the person has 10 bank accounts then it will become 40k. I think it is the time to link all the bank accounts to unique number like PF department did.