[orc]There has been a close to 20% annual increase in Air passenger traffic over the last few years. Close to 75% of the government owned airports still incur losses. But at the same time, the overall profitability has improved.

There have been demands from various states to establish Airports in smaller cities, to encourage investments, tourism & improve connectivity. While the demands are fair, viability is always an issue. Currently, the airports in India are either government owned/managed by the Airports Authority of India (AAI) or managed by a Public-Private entity (PPP). The AAI currently manages 125 airports, which include 18 International Airports, 07 Customs Airports, 78 Domestic Airports and 26 Civil Enclaves at Defense airfields. Some of the bigger Airports like the ones in Delhi, Mumbai & Hyderabad are PPP projects and are not managed by AAI.

Airports Authority of India (AAI)

Airports Authority of India (AAI) was constituted by an Act of Parliament and came into being in 1995 by merging erstwhile National Airports Authority and International Airports Authority of India. The merger brought into existence a single Organization entrusted with the responsibility of creating, upgrading, maintaining and managing civil aviation infrastructure both on the ground and air space in the country.

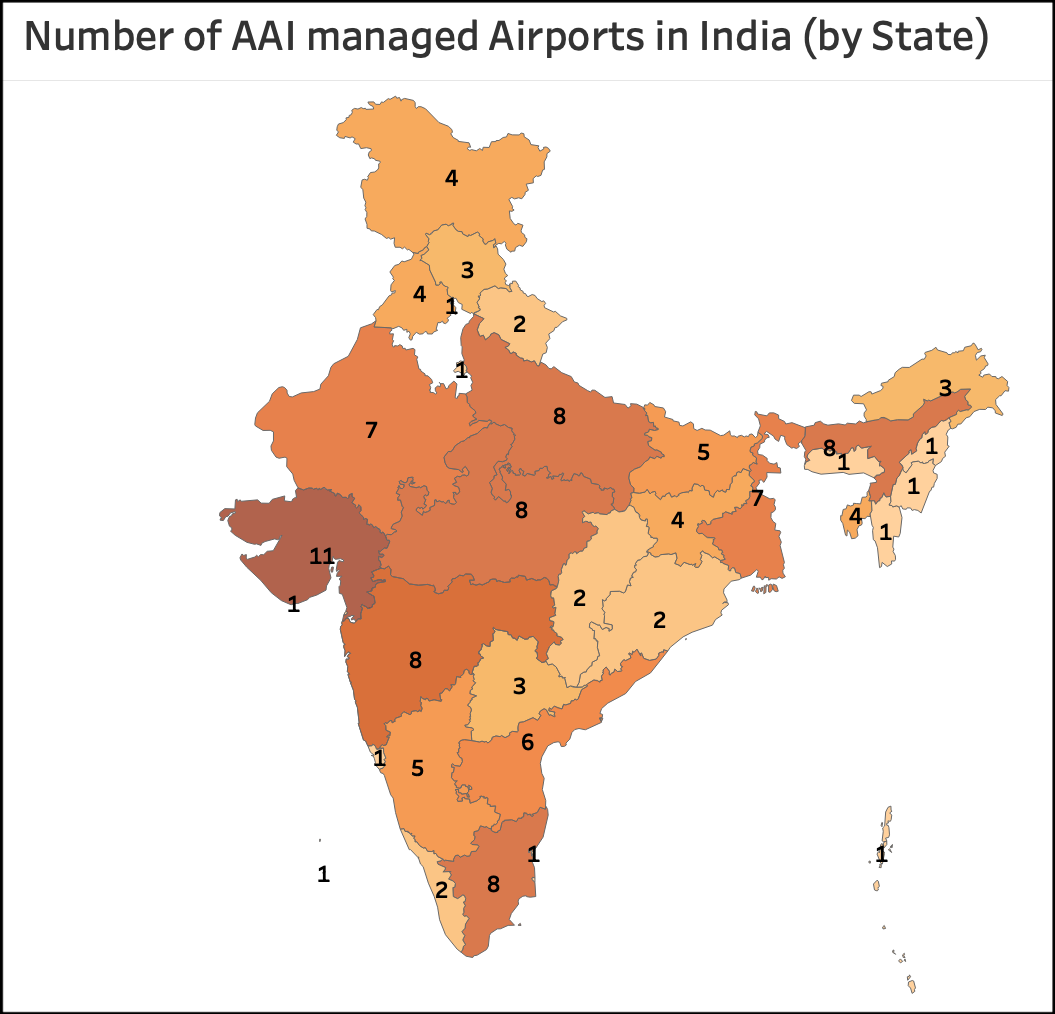

Gujarat (11) has the highest number of AAI managed airports followed by Maharashtra (8), Tamil Nadu (8), Uttar Pradesh (8), Madhya Pradesh (8), Assam (8), West Bengal (7) and Rajasthan (7).

Only 15 are Profit Making Airports

About 100 of the airports managed by AAI are currently operational. The domestic passenger traffic has seen a close to 20% annual increase over the last few years. From about 70 million domestic passengers in 2014-15, the passenger traffic has crossed 110 million in 2017-18.

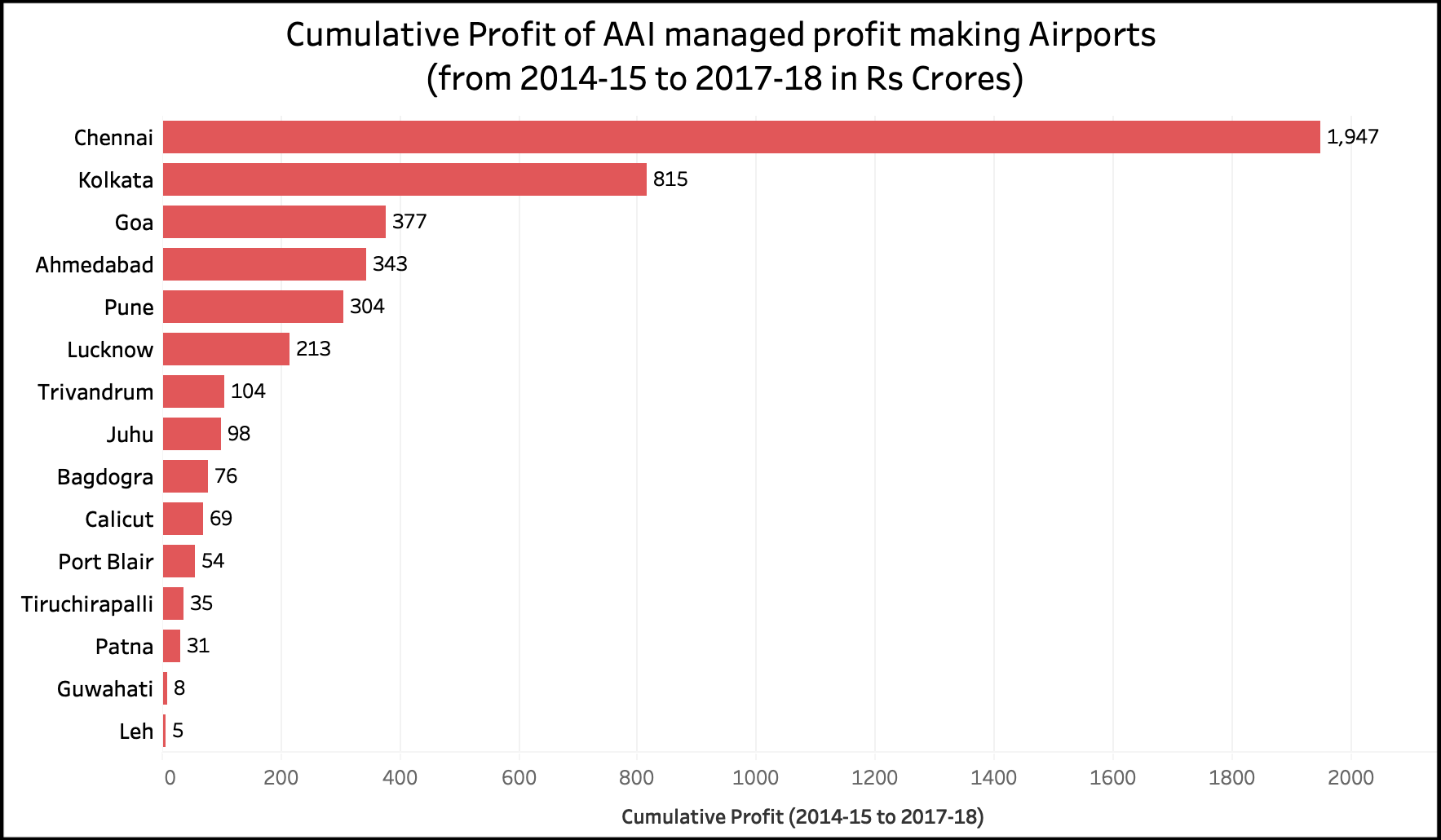

Of these airports, only 15 of them have made cumulative profits in the 4-year period between 2014-15 & 2017-18 as per data shared by AAI in response to an application under RTI. This number (15 airports) is substantially higher than number of the profit making airports during the previous four years.

During the four year period between 2014-15 & 2017-18, Chennai airport made the most profits with 1947 crores followed by the Kolkata airport with 815 crores in profit. In addition to these two airports, only five other airports (Goa, Ahmedabad, Pune, Lucknow & Trivandrum) made a cumulative profit of more than 100 crores. The profits of Goa, Ahmedabad, Pune, Lucknow airports increased substantially over the last four years.

75% of the Airports still make Losses

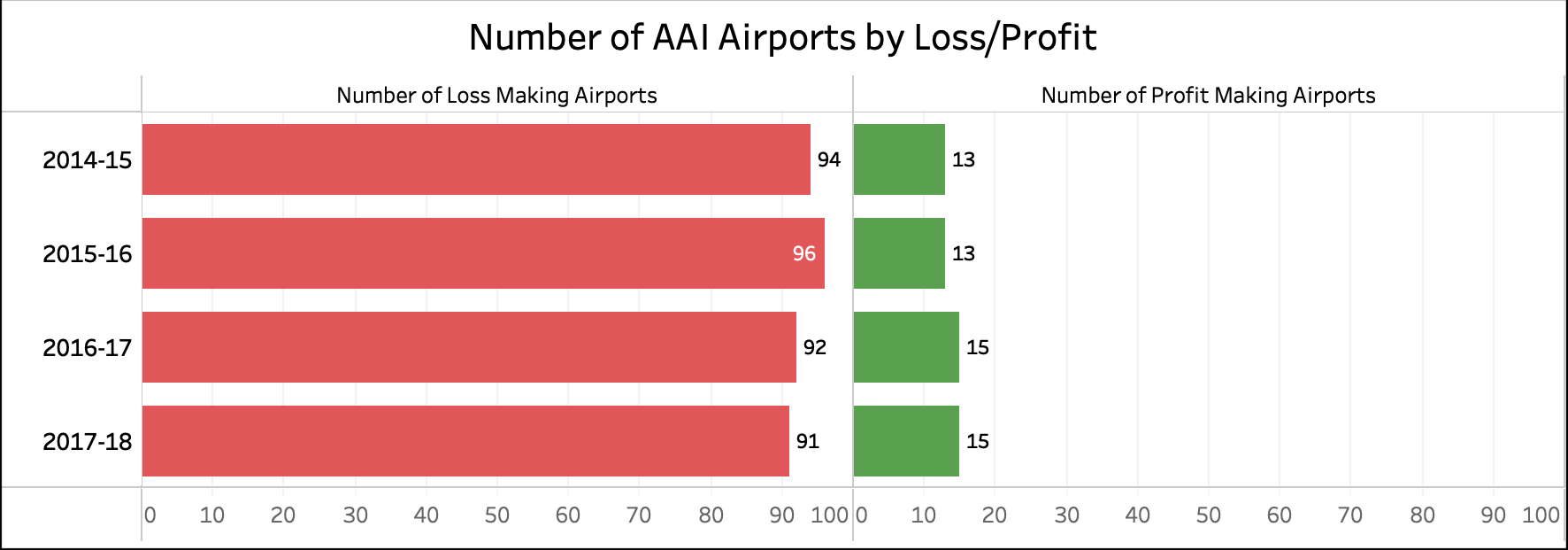

Out of all the airports managed by AAI, only 13 of them made profits in both 2014-15 & 2015-16. This number increased to 15 in 2016-17 and even in 2017-18, the number of profit making airports remained at 15. On the other hand, the number of loss making airports was 94 in 2014-15 which increased to 96 in 2015-16. This has now decreased to 91 in 2017-18.

As far as the loss making airports are concerned, Delhi’s Safdurjung airport reported a cumulative loss of 245 crores between 2014-15 & 2017-18, the highest for any AAI managed airport in the country. This airport is primarily used by VVIPs. Among the airports used for civilian operations, the Bhopal airport reported a loss of 225 crores in these four years. A total of 15 airports reported a cumulative loss of more than 100 crores between 2014-15 & 2017-18. Further analysis of data in terms of growth in passenger traffic at specific airports and the relevant growth in profit/loss is required to understand the specific reasons for such profit or loss.

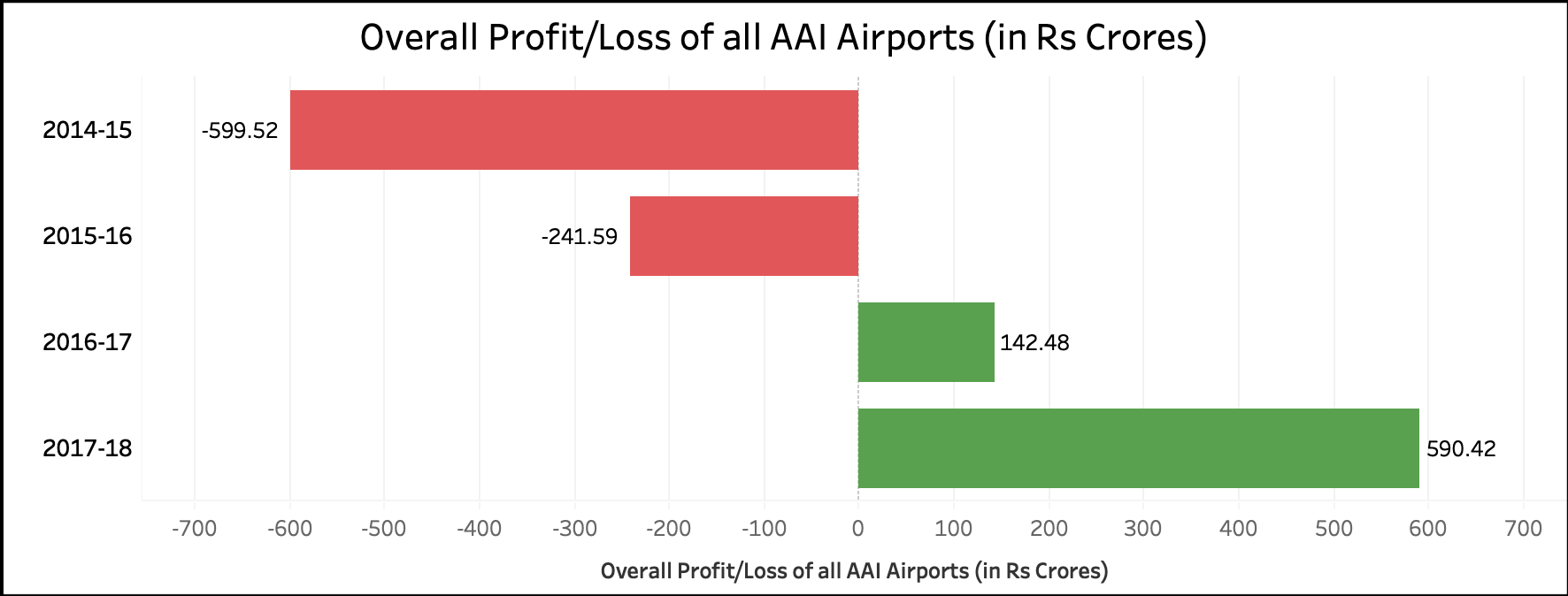

The overall profit at all AAI managed airports has increased in the last four years. From a total loss of 599.5 crores in 2014-15, it has now grown to a total profit of over 590 crores in 2017-18, a growth of about 200%. This is primarily on account of the substantial increase in profits at the 15 profit making airports.

What does the Government say?

The government on various occasions has cited the following reasons for these losses.

- Low air traffic movements resulting in lesser aeronautical revenue

- Low non aeronautical revenue potential

- Basic operating expenditure on account of regulatory/IATA and security requirements.

When asked about the steps being taken to make these airports viable, the government says it is trying to develop cargo activities, enhance non-aeronautical revenue through revision of rates and award of contracts through master concessions, allowing operation of flying schools at non-operational airports, encouraging Maintenance, Repair & Overhauling (MRO) activities, revision of base rates etc.

UDAN is one such scheme aimed at increasing air traffic movement at these airports. Only time will tell if these efforts are paying off. Between 2014-15 & 2017-18, the overall profit/loss scenario has improved in 46 airports while it has deteriorated in 61 other airports.

Feature Image Source: Tshrinivasan (Own work) [CC BY-SA 3.0], via Wikimedia Commons