[orc]Punjab National Bank has just reported that it detected fraudulent transactions worth $ 1.77 billion. Government data on bank frauds indicates that more than 12000 such cases were reported between 2014-15 and 2016-17.

One of the major Public Sector Banks, the Punjab National Bank (PNB) has said in a regulatory filing that it has detected fraudulent & unauthorized transactions worth $ 1.77 billion. The statement also said that the matter has been referred to the law enforcement agencies. Data shared by the government indicates that there have been a total of 12,778 bank fraud cases in the 3 years between 2014-15 and 2016-17.

Fraud Classification in Banks

The Reserve Bank of India (RBI) has issued detailed directions about classification & reporting of fraud by all the Scheduled Commercial Banks (SCBs). As per these directions, frauds in banks have been classified into the following categories.

- Misappropriation and criminal breach of trust.

- Fraudulent encashment through forged instruments, manipulation of books of account or through fictitious accounts and conversion of property.

- Unauthorised credit facilities extended for reward or for illegal gratification.

- Cash shortages.

- Cheating and forgery.

- Fraudulent transactions involving foreign exchange

- Any other type of fraud not coming under the specific heads as above.

Banks have to report frauds electronically in a specific format to the Central Fraud Registry (CFR). CFR is a web-based and searchable database available to banks.

Guidelines for reporting Fraud

The RBI has also laid down the following guidelines for reporting incidents of fraud. Banks are directed to not only focus on recovery of the amount involved, but also ensure the guilty are punished.

| Category of bank | Amount involved in the fraud | Agency to whom complaint should be lodged | Remarks |

|---|---|---|---|

| Private Sector/ Foreign Banks | ₹ 10000 and above | State Police | If committed by staff |

| ₹ 0.1 million and above | State Police | If committed by outsiders on their own and/or with the connivance of bank staff/officers. | |

| ₹ 10 million and above | In addition to State Police, SFIO, Ministry of Corporate Affairs | Details of the fraud are to be reported to SFIO in FMR Format | |

| Public Sector Banks | ₹ 10,000 and above but below ₹ 0.1 million | State Police | If committed by staff |

| ₹ 0.1 million and above but below ₹ 30 million | To the State CID/Economic Offences Wing of the State concerned | To be lodged by the Regional Head of the bank concerned | |

| ₹ 30 million and above and up to ₹ 250 million | CBI | To be lodged with Anti-Corruption Branch of CBI (where staff involvement is prima facie evident) | |

| Economic Offences Wing of CBI (where staff involvement is prima facie not evident) | |||

| More than ₹ 250 million and up to ₹ 500 million | CBI | To be lodged with Banking Security and Fraud Cell (BSFC) of CBI (irrespective of the involvement of a public servant) | |

| More than ₹ 500 million | CBI | To be lodged with the Joint Director (Policy) CBI, HQ New Delhi |

More than 12000 cases of Fraud in 3 years

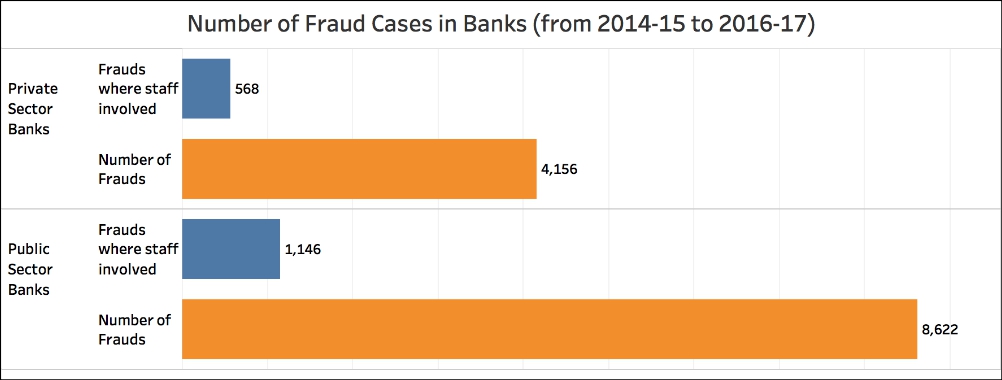

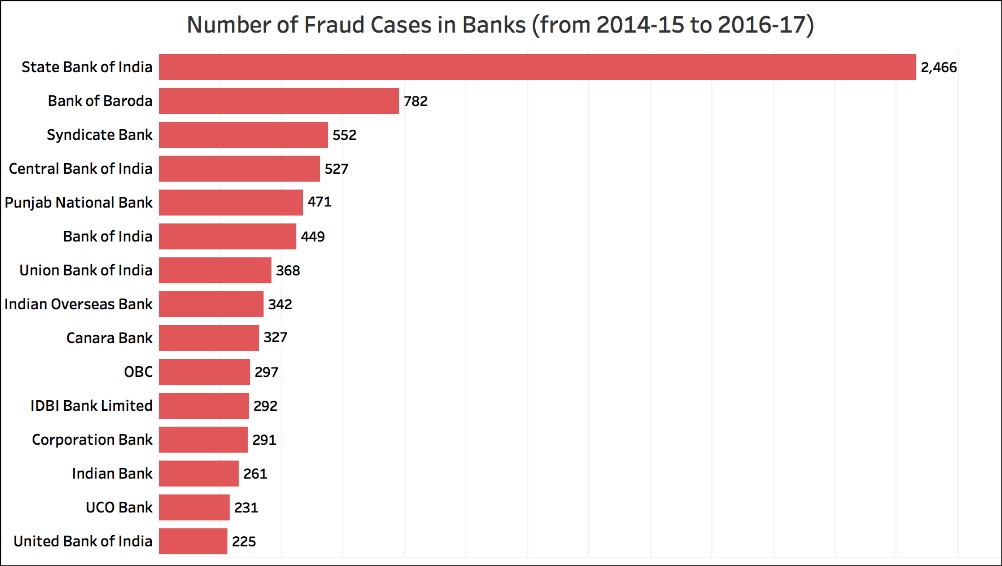

As per data shared by the government in the Lok Sabha, a total of 12,778 cases of fraud were reported in all scheduled commercial banks in the 3 years between 2014-15 and 2016-17. The Public Sector banks reported 8622 cases while the Private banks reported 4156 cases. The involvement of staff was reported in more than 13% of the fraud cases. In the 3 year period between 2014-15 and 2016-17, most cases of fraud were reported in the country’s largest bank, the State Bank of India. Four (4) Public Sector banks reported more than 500 cases each during this period while 15 banks reported more than 200 fraud cases each. Only Punjab & Sind Bank reported less than 100 fraud cases during this period.

In the 3 year period between 2014-15 and 2016-17, most cases of fraud were reported in the country’s largest bank, the State Bank of India. Four (4) Public Sector banks reported more than 500 cases each during this period while 15 banks reported more than 200 fraud cases each. Only Punjab & Sind Bank reported less than 100 fraud cases during this period. The government has also informed the Lok Sabha that action was taken against 5200 employees of the Public Sector banks for their involvement in fraud between January 2015 and March 2017.

The government has also informed the Lok Sabha that action was taken against 5200 employees of the Public Sector banks for their involvement in fraud between January 2015 and March 2017.

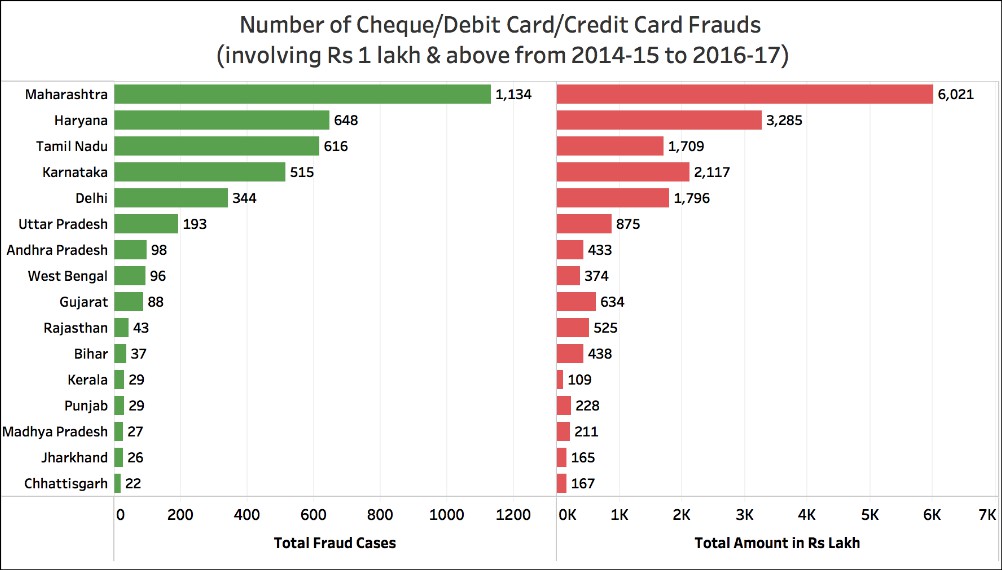

More than 4000 cases of Cheque/Debit Card/Credit Card Frauds

In response to another question in the Lok Sabha, the government informed that more than 4000 cases of Cheque/Debit Card/Credit Card related fraud cases, each involving an amount of Rs One lakh and above have been reported by the banks between 2014-15 and 2016-17. The total amount involved in such frauds was close to Rs 200 crore. Among the states, the most such cases were reported in Maharashtra (1134), the only state to report more than 1000 cases during this period. Haryana, Tamil Nadu & Karnataka are the only other states to have reported more than 500 such cases each.

4 Comments

My father also affected by this iob bank dms branch chennai but bank people are forcing us to pay the depths they say it is not bank problem how do I go and work In the bank foreign exchange with out their permission they gave foreign remittances with out adjusting the packing credit and they say that your packing credit is. Not adjusted so your bank account is non performance account and my father was a special export award winner for 2013

Government support only bank people’s not the people who support the bank and give business for the bank this also like corporate game

Government is involved in the fraud, that is why the guilty is given higher promotions, even though the enquiry is pending against them.Government should not finance the losses made by Banks with tax payers money.Bank employees are enjoying heavy perks even though their performance is not good.we absolutely lost confidence on government.

Why the government banks not maintained the seperate credit team & collection team.

Bank managers are doing the commission business.