In the eighth edition of the ‘Government Data Roundup’, we cover the Basic Road Statistics of India, India Innovation Index 2021, Digital Banks – A Proposal for Licensing & Regulatory Regime for India, Discussion Paper on Climate Risk and Sustainable Finance, among others.

Factly’s eighth edition of the Fortnightly Government Data Roundup covers the second half of the month of July 2022. Reports were released by NITI Aayog, the Ministry of Road Transport and Highways (MoRTH), and the Reserve Bank of India (RBI).

Publications Division of MIB released 3 books about Former Presidents of India and Flooring of Rashtrapati Bhavan

On 24 July 2022, the Union Minister of Information and Broadcasting Anurag Thakur released three books published by the Directorate of Publications Division. The three books are, Moods, Moments, and Memories – Former Presidents of India (1950-2017), A Visual History, First Citizen – Pictorial Record of President Ram Nath Kovind’s Term, and Interpreting Geometries – Flooring of Rashtrapati Bhavan. The first book contains a pictorial history including rare photographs of Presidents’ lives of all the Presidents of India from Dr. Rajendra Prasad to Pranab Mukherjee. The second book is dedicated to India’s former President Ram Nath Kovind. It also contains rare photographs from his village and his school days and traces his journey to become India’s 14th President. The third book is a pictorial volume that contains the historic & one-of-a-kind flooring of Rashtrapati Bhavan shown with its unique, repetitive motifs and designs & use of rare stones. These books can be purchased online.

Apart from this, important reports were also released by NITI Aayog, Ministry of Road Transport and Highways (MoRTH).

India Innovation Index – 2021

| Report name | India Innovation Index 2021 (3rd Edition) |

| Sector | Science and Technology |

| Agency responsible | NITI Aayog |

| Frequency of release | Annual |

| Source Link | India Innovation Index 2021 |

Brief about the report

The third edition of the India Innovation Index was released by NITI Aayog on 21 July 2022. The report is prepared by NITI Aayog and the Institute for Competitiveness. The Index is a comprehensive tool for the evaluation and development of the country’s innovation ecosystem. It ranks the states and the union territories on their innovation performance to build healthy competition amongst them. The first and second editions of the Index were launched in October 2019 and January 2021 respectively. The 2021 report is set against the backdrop of the second wave of the COVID-19 pandemic in India.

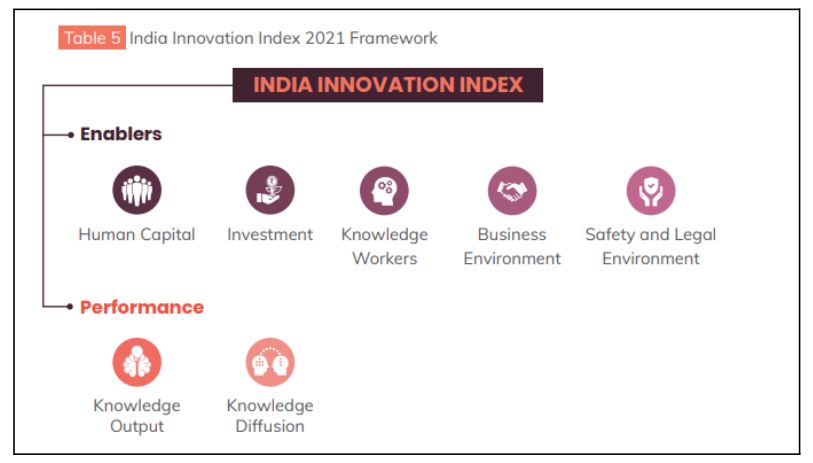

The scope of innovation analysis has been highlighted in this report by drawing on the framework of the Global Innovation Index. The number of indicators considered for the index in the 2021 report has increased to 66 from 36 in the 2020 report. The indicators are distributed across 16 sub-pillars, which, in turn, form seven key pillars. Five ‘Enabler’ pillars measure the inputs, and two ‘Performance’ pillars measure the output.

Key Highlights

- India’s overall index score was 14.56.

- Chandigarh was the best performer with a score of 27.88 and topped the overall rankings. This was followed by Delhi with a score of 27. Ladakh was at the bottom with a score of 5.91.

- States are categorized into Major States, Union Territories & City States, and Hill & Northeast states.

- Among the 9 UTs and City States, the average innovation score is 15.74. Chandigarh topped the list.

- Karnataka topped the Major States category with a score of 18.05 followed by Telangana (17.66) and Haryana (16.35) while Bihar, Odisha, and Chhattisgarh were at the bottom with score less than 12.

- Manipur (19.37) topped the ‘Hill & Northeast states’ category followed by Uttarakhand (17.67) and Meghalaya (16) while Nagaland (11) was the lowest scorer in the category.

- The report noted that the overall spending on Research & Development (R&D) has been relatively low across the country. India’s overall share of GERD as a percentage of GDP is only 0.7% and should touch a minimum of 2%. The report also notes that the role of private sector in R&D in India is not evident and should pick up pace.

Significance

The report examines innovation capacities and ecosystems in the country at state level and highlights the recent factors and catalysts that promoted the crisis-driven innovation in India during the pandemic. The 2021 report comes with a special section containing detailed analysis of the drivers of innovation, by evaluating the improvement in the indicators. That is, states can compare the change in their ranking and factors that influenced it against the India Innovation Index 2020. The findings and recommendations of the report also supposed to help the states identify and work on the challenges so as to improve their overall innovation ecosystem.

Digital Banks – A Proposal for Licensing & Regulatory Regime for India

| Report name | Digital Banks – A Proposal for Licensing & Regulatory Regime for India |

| Sector | Finance |

| Agency responsible | NITI Aayog |

| Frequency of release | – |

| Source Link | Digital Banks – A Proposal for Licensing & Regulatory Regime for India |

Brief about the report

The report which has been prepared by NITI Aayog based on inter-ministerial consultations, makes a case, and offers a template and roadmap for a Digital bank licensing and regulatory framework in India. It focuses on avoiding any regulatory or policy arbitrage and offers a level playing field to incumbents as well as competitors. Last year, NITI Aayog had released a discussion paper on the subject for wider stakeholder consultations. Comments received from 24 organizations were examined and have been addressed in the final report.

Key Highlights

- A digital bank would be a bank as defined in the Banking Regulation Act, 1949. Just like the services offered by regular banks, digital banks can issue deposits, provide loans, and offer the full suite of services that the Act enables it to. It shall have its own balance sheet and legal existence. However, it would be different from the 75 Digital Banking Units (DBUs) announced by Finance Minister in Union Budget 2022-23.

- The report recommends a carefully calibrated approach, using the following steps- Issuance of a restricted digital bank license, enlistment of the licensee in a regulatory sandbox framework enacted by the RBI, and issuance of a ‘full-scale’ digital bank license.

- The report also maps prevalent business models in this domain and highlights the challenges presented by the ‘partnership model’ of neo-banking—which has emerged in India due to a regulatory vacuum and in the absence of a digital bank license.

Significance

In the past few years, there has been a significant shift in using internet and technology in the banking sector. Financial inclusion has improved with the advent of UPI, DBT, etc. However, the success on the payments front has not yet reached the credit needs of its micro, small and medium businesses. The current credit gap and the business and policy constraints reveal a need for leveraging technology effectively to cater to these needs and bring the under-served groups further within the formal financial fold.

Basic Road Statistics of India 2018-19

| Report name | Basic Road Statistics of India 2018-19 |

| Sector | Road Transport |

| Agency responsible | Ministry of Road Transport & Highways |

| Frequency of release | Annual |

| Source Link | Basic Road Statistics of India 2018-19 |

Brief about the report

The Basic Road Statistics of India is an annual publication on the road sector by the Transport Research Wing of MoRTH. The latest volume of the report provides information on various facets of road statistics in India during 2018-19. It covers information relating to road length, surfaced road length, major initiatives of MoRTH, etc. The data presented in the report is sourced from various departments of States/Union Territories like State Public Work Departments, Municipalities, Panchayat, Railway, Forest, etc.

Key Findings

- India had a network of over 63.32 lakh km of roads as on 31 March 2019, which is the second largest in the world. Total roads constructed has increased from 62.16 lakh km in 2018 marking a growth of 1.9%.

- National Highways constituted 2.09% of total road network in the country. The total length of National Highways as on 31 March 2019 was at 1.325 lakh km. Maharashtra had the largest network of National Highways with 17,757 km (13.4%) followed by Uttar Pradesh with 11,737 km (8.9%) and Rajasthan with 10,342 km (7.8%) as on 31 March 2019.

- State Highways constituted 2.8% of total road network in the country and the total length of State Highways as on 31 March 2019 was almost 1.8 lakh km. Maharashtra had the largest State Highways network in the country with 32,005 km (17.83%) followed by Karnataka with 19,473 km (10.85%). With Gujarat, Rajasthan, and Andhra Pradesh, the five States accounted for 53.9% of the total State Highways network in the country.

- Rural Roads constituted 71.4% of the total road network with 45.22 lakh km on 31 March 2019. Again, Maharashtra accounted for the largest network of Rural Roads with 4,26,327 km (11.7%) followed by Assam, Bihar, Uttar Pradesh, and Madhya Pradesh. These five States accounted for 42.4 % of the total Rural Roads in the country.

Significance

The report is a source of important road statistics of India which is required to project a strategic and sustained expansion, and maintenance of the road network to ensure that different parts of the country are inter-connected. This is essential for supply of goods and services, access to education & healthcare, and improve the standard of living.

Discussion Paper on Climate Risk and Sustainable Finance

| Report name | Discussion Paper on Climate Risk and Sustainable Finance |

| Sector | Finance |

| Agency responsible | RBI |

| Frequency of release | – |

| Source Link | Discussion Paper on Climate Risk and Sustainable Finance |

Brief about the paper

The paper released by the RBI intends to help regulated entities deal with the consequences of climate change. It aims to prepare a strategy based on the global best practices on mitigating the adverse impacts of climate change, learnings from participation in standard-setting bodies and other international fora.

Key Highlights

- RBI has suggested financial institutions to set up a voluntary funding target to increase green funding.

- Financial institutions may also consider converting their branches to green branches by eliminating the use of paper, introduce e-receipts at ATMs, switching to renewable energy resources, etc.

- Financial institutions may integrate climate risk as part of their due diligence process. It includes assigning a climate-risk rating for customers having material exposure. High-risk ratings should be periodically monitored.

Significance

The paper comes at a time when there is a global emphasis on climate change adaptation and mitigation. The Bank has called for comments on the Discussion Paper from regulated entities and other stakeholders by 30 September 2022.

Parliamentary Answers

In addition to the reports released by departments and ministries, the parliament session is something that one should look out for important data. The parliament Q&A session and the standing committee reports are important repositories of government data. Numerous reports prepared by different parliamentary standing committees are laid and presented during the parliament sessions. Factly’s weekly parliament review lists out the important reports presented. During the Q&A session, questions concerning all the ministries are raised in both Lok Sabha and Rajya Sabha. All sectors ranging from health to environment, communication to earth sciences, etc. are covered. Questions about, funding, and status of schemes & policies, situation prevailing in the country, measures taken by the government, etc., are all addressed in the questions & answers.

For instance, a question on heatwave situation in India and another on the impact of heatwaves on agri-produce was raised in the ongoing session of the Parliament. Likewise, question on PM Gati Shakti Scheme was raised which concerns the railway infrastructure in the country. Another question on measures taken to promote ethnic foods of Northeastern States was asked in the Rajya Sabha.

Some of these questions are made easier to access through press releases by PIB. To know how to engage with parliament proceedings, watch this video by Factly.