A post is being widely shared on social media claiming that central government imposes tax on school books. Let us fact-check the claim made in the post.

Claim: Central government imposes tax on school books.

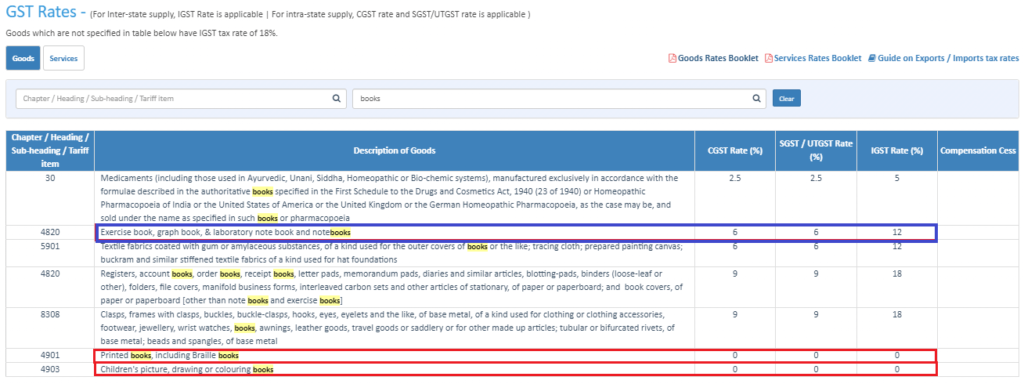

Fact: While there is no exact mention of GST on school books or school textbooks, GST on ‘Printed books, including Braille books’; and on ‘Children’s picture, drawing or colouring books’ is zero, whereas the GST on ‘Exercise book, graph book, & laboratory note book and notebooks’ is 12%. The Authority of Advance Ruling (AAR) held that 12% of GST is applicable to printing and supply of textbooks to government departments which are registered under Goods and Services Tax (GST) Acts, 2017.

While there is no exact mention of Goods and Services Tax (GST) on schoolbooks or school textbooks, GST on ‘Printed books, including Braille books’ (tariff item 4901); and on ‘Children’s picture, drawing or colouring books’ (tariff item 4903) is zero.

Whereas the GST on ‘Exercise book, graph book, & laboratory notebook and notebooks’ (tariff item 4820) is 12%.

In general, books are exempted under GST, but the inputs such as printing, binding, and royalties to authors attract tax at 12% (rates vary according to rates of corresponding goods). Also, no input tax credit is available to publishers which many feared could lead to increased prices.

According to this article, “the Authority of Advance Ruling (AAR) held that 12% of Goods and Service Tax (GST) is applicable to printing and supply of textbooks to government departments which are registered under Goods and Services Tax (GST) Acts, 2017.” However, the GST is exempted if the departments are not registered under the GST Act.

In 2020, when the same claim was viral on social media, PIB Fact Check through its Twitter account had affirmed that this claim was fake. It even said, “There is no tax on school textbooks.”

To sum it up, while there is no tax on printed school books, there is tax on its printing and supply.

Update (11 JULY 2022):

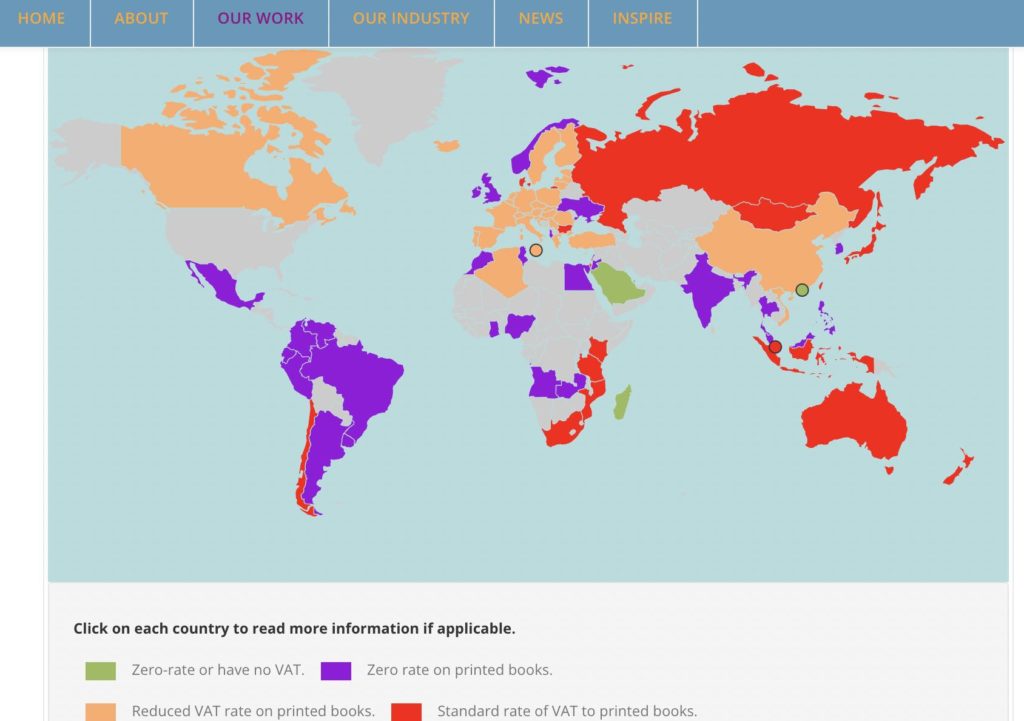

It is also being falsely shared on social media that India is the first and the last country to impose such a tax on school books. It has been already debunked above that there is no GST on printed books in India (only inputs such as printing, binding, and royalties to authors attract tax). While there is no GST on printed books in India, many other countries impose taxes on printed books. More details regarding those countries can be found on the website of ‘International Publishers Association’.