[orc]An Ex-Serviceman had to struggle for 9 long years with the civic authorities to get exemption from property tax. After repeated failures to get his due, he used the RTI act and woke up the civic authorities from their slumber.

This is the story of an ex-serviceman who had to struggle with the civic authorities for 9 long years to get his due. Mr. PP Sebastian worked in the Indian Air Force and is now settled in Hyderabad. He had to run after the local municipal authorities for 9 long years to get his property tax exemption order.

The Background Story

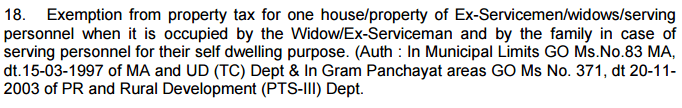

Most state governments extend a variety of welfare measures for serving personnel and ex-servicemen. The erstwhile Andhra Pradesh Government also extended similar facilities to ex-servicemen. As per the orders of the erstwhile Andhra Pradesh State government, all serving army personnel and ex-servicemen/widows are exempted from paying property tax for any one house owned by them.

Application for exemption filed in 2006

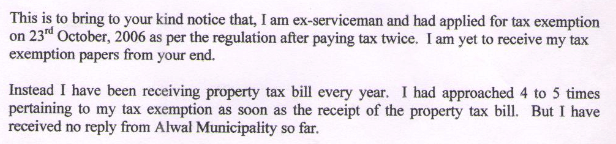

Mr. Sebastian applied for property tax exemption in October 2006 in accordance to the Government Order. He submitted his application to Alwal Municipality, duly submitting all the required certificates. Instead of granting him exemption, the civic authorities kept sending him property tax bills. Moreover, the ex-serviceman received threatening calls to clear his dues

RTI to the Rescue

Meanwhile in 2007, the Alwal Municipality was merged into the Greater Hyderabad Municipal Corporation (GHMC). After repeated trials to know the status of his earlier application, Mr. Sebastian was exhausted and was resigned to his fate.

In early 2013, Mr. Sebastian came to know of Right to Information (RTI) through an awareness workshop. As soon as he realized its power, he filed an application under RTI with the GHMC authorities to know the status of his earlier request for property tax exemption.

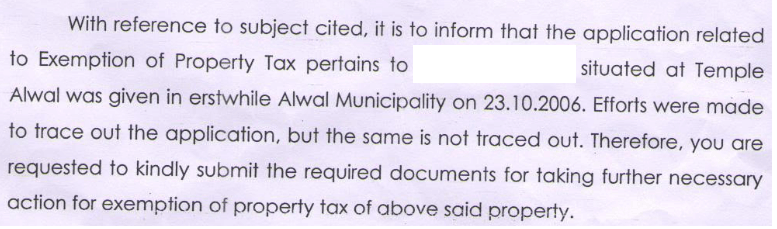

After repeated follow-ups and intervention from the State Information Commission, the GHMC finally admitted that they had lost his application that was filed in 2006. They also requested Mr. Sebastian to submit all the documents once again to initiate further action.

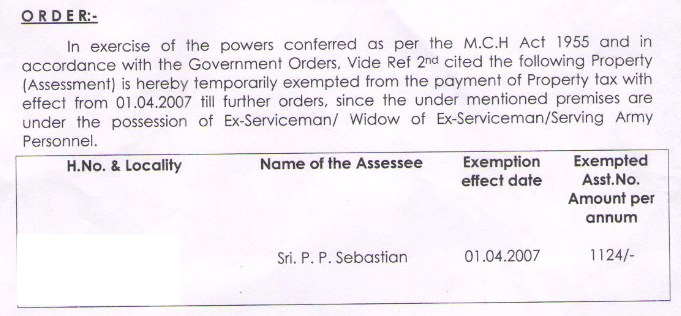

Finally, after submitting the application once again, the GHMC issued the property tax exemption order in December 2015.

‘If not for RTI, I would not have got this exemption’

‘If not for RTI, I would not have got this exemption. Thanks for my living God who guided me to that workshop’, Mr. Sebastian said. He is now a contented individual who feels that every citizen should know and use RTI.

16 Comments

is it applicable in other state also, maharashtra and gujarat??

Pingback: Power Of RTI: Ex-Serviceman Gets Property Tax Exemption After 9 Years Of Struggle | Wiki News India | News In All Indian Languages

Sir, kindly guide on property tax exemption applicability to Houses falling under Secunderabad Contonment limits for Ex-servicemen since we are under erstwhile AP G.O. I am Ex-Sgt Kundaram Anjaiah. I am paying hefty amount of Property Tax being Ex-Serviceman. I am paying Rs.5900/-. pa. on small House in Risala Bazar, Bolaram, Secunderabad.

Can any one provide us a copy of Govt. Notification for property tax exemption to ex-servicemen. DSB at Bandra not even aware and asking for a copy of said notification. please help.

Sir,

Please provide me a copy of property tax exemption. I’m ex sergeant from Indian Air force discharge 2008 after completing 20 years of service. Now I am holding flat at Saidabad, comes under GHMC for which I want to avail property tax exemption.

Mohammed Ghouse

Hyderabad

Please go through this link

http://telanganasainik.nic.in/G.O.Ms.No.83%20MA.pdf

Sir,

Please provide me a copy of property tax exemption. I’m serving personal in Indian Air force.from guntur

Sir ,

In my area now gram panchayat secretary is saying that ground floor of your house will be exempted from tax but u have to pay tax for 1st floor . In GO its mentioned that one property/house will be xempted wht to do now ?

Pls help

Sir,my father is an ex service man.this year we have got property tax.when we went to enquiry why we got property tax they are saying you have to pay this year from next year you won’t get.tax is sum of 14000 with fine we got.what should we do now

Sir, I Ex-No 15109039P Hav Dipak Kumar Paul, had sent letter from Zila Sainik Welfare Office, Cachar Silchar to SILCHAR MUNICIPAL BOARD during the year 2014 and reminder there too but No action has been taken by the Municipality for EXEMPTION OF TAXES/HOUSE /PROPERTY.

EXEMPTION OF HOUSE TAX FOR EXSERVICEMEN RESIDING UNDER THE JURISDICTIOIN OF SILCHAR MUNICIPALITY BOARD, SILCHAR , CACHAR (ASSAM)

1. Kindly refer details above on April 22 , 20`17 7:22 AM.

2. Even to day paid House Tax up to 2017-18 one year in advance, no response is given to the letters from the Ex-Servicemen .

kindly issue authority from the Govt of India, Defence Ministry direct to the all authorities to District Authority and for information at large of the ESM community via local print/electronic Media to implement on ground and the facilities can be avail by the ESM community.

rajendra parschuram sabale on 06 april 2018 13;39 sir,i ex no-4566756f nk sabale rajendra sir please kindly issued authority from the govt of india. and mee i submeet to home and water anul tax 4960/-rs sir please reply

I was retired from Indian Army on Dec 2016. I have a residential property in Pune. Kindly provide a copy of Govt authority for exemption of property tax for ex serviceman.

Sir, we are living in gajularamaram, GHMC ,HYDERABAD ,we are pay our house tax regularly but OUR area bill collector given notice to me , in that notice they demand last two years due house tax with interest . So please give a suggestion that demand notice are correct , If not correct how to fight my tax issue please give suggestion.

Shall I get the copies of these letters regarding exemption of House Tax to the Ex-servicemen? Ministry of Defense letter no. 250 A.C./P.A 31 D. 3870/D.P. and services 247/06/09 and later no. D.P.V.C.later T.R./01/30 (D) 85/600 Date 19/12/1985

Is there a form to apply for house tax exception online? If so can some please add the link. Thanks