CLICK HERE for an updated version of this article with latest numbers.

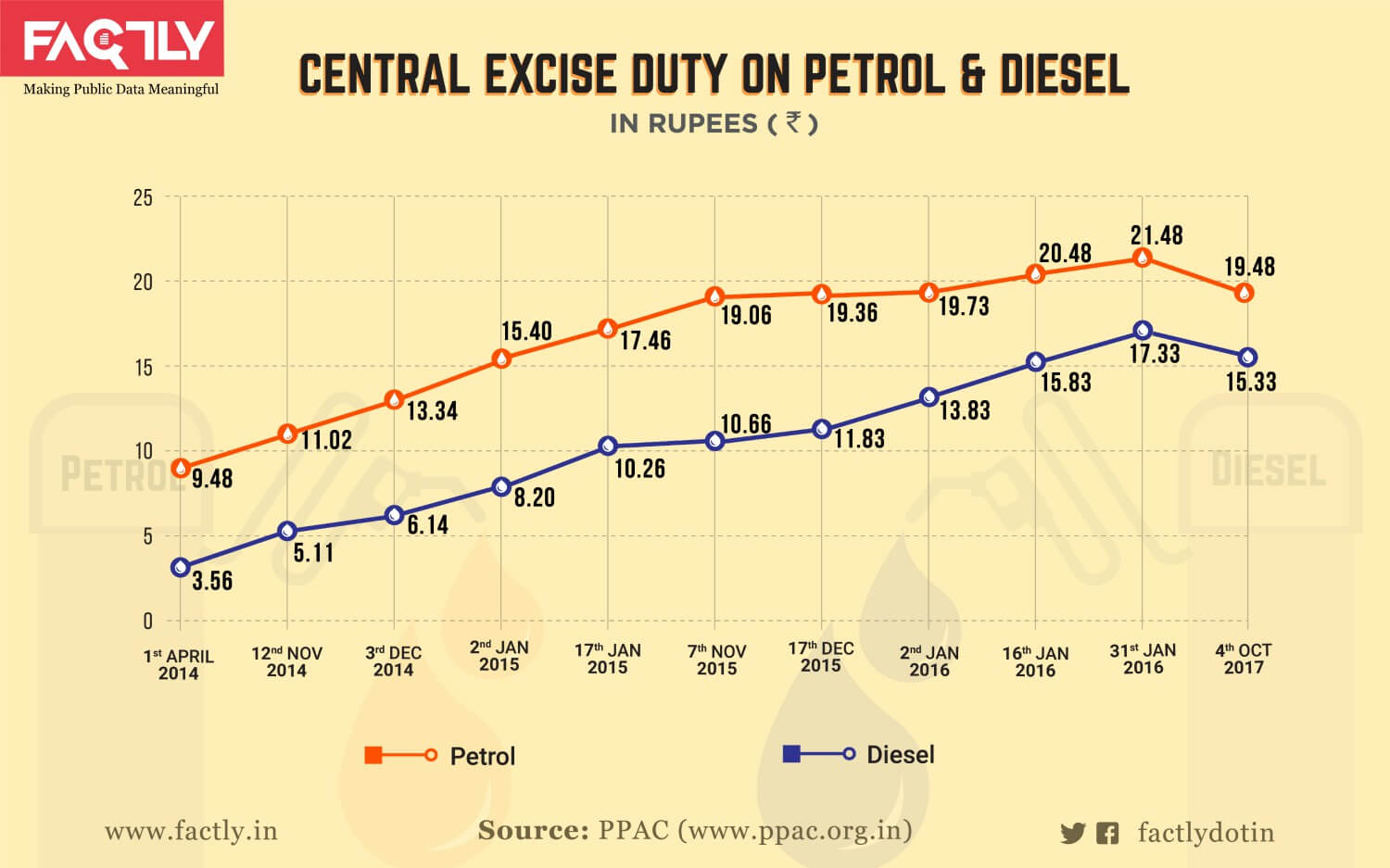

1. The Central Excise Duty on Petrol increased from Rs 9.48 per liter to a high of Rs 21.48 per liter. In October 2017, the excise duty on Petrol was reduced by Rs 2 per liter, the first such reduction by the BJP government. On the other hand, the duty on Diesel increased by more than 4 times from Rs 3.56 per liter to a high Rs 17.33 per liter. Like Petrol, the duty was reduced by Rs 2 per liter in October 2017 to Rs 15.33 per liter.

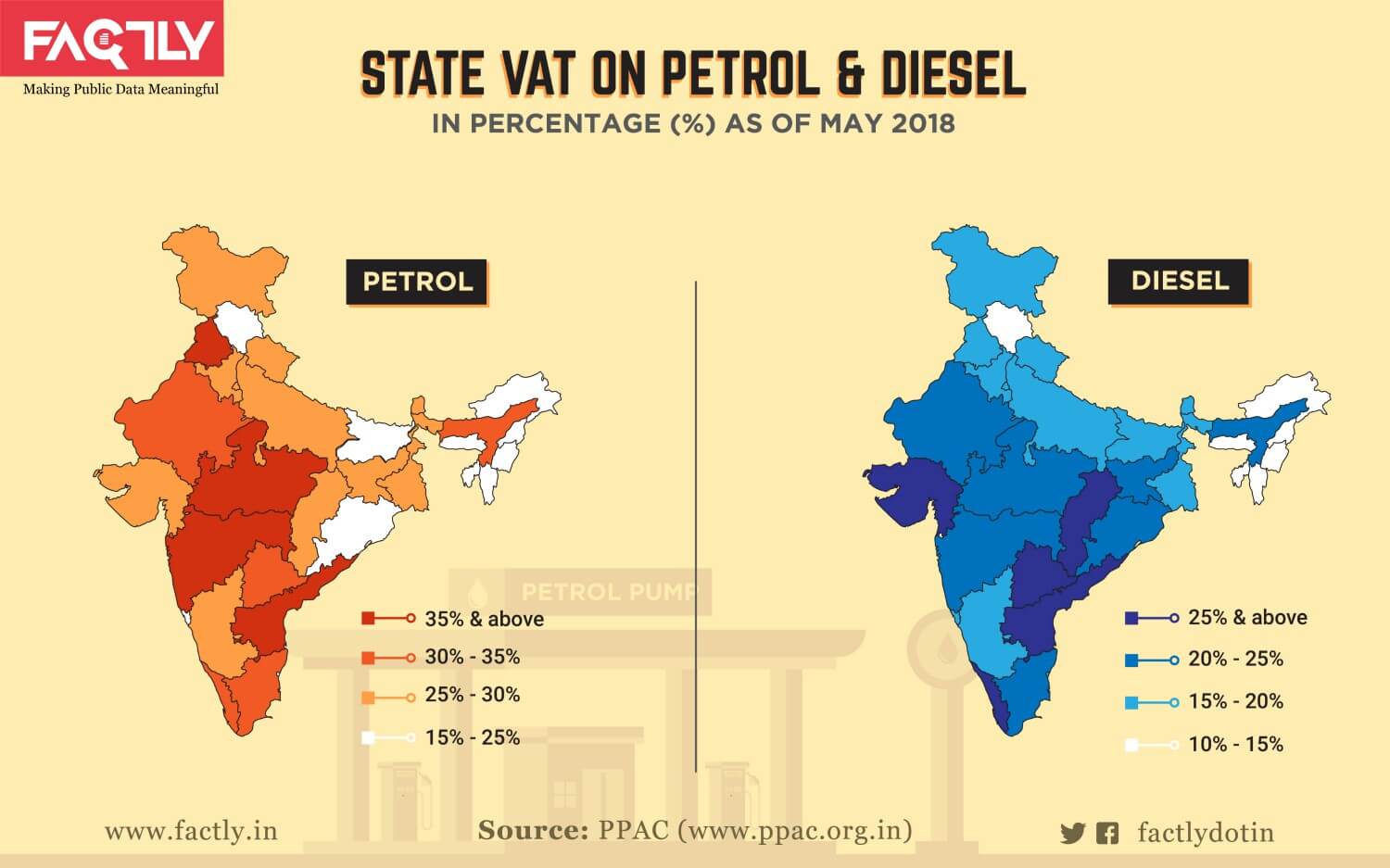

2. The State VAT on petrol is at least 25% in 20 states with the highest in Mumbai at 39.78%. The State VAT on diesel is more than 20% in 12 states and highest of 28.47% in Andhra Pradesh.

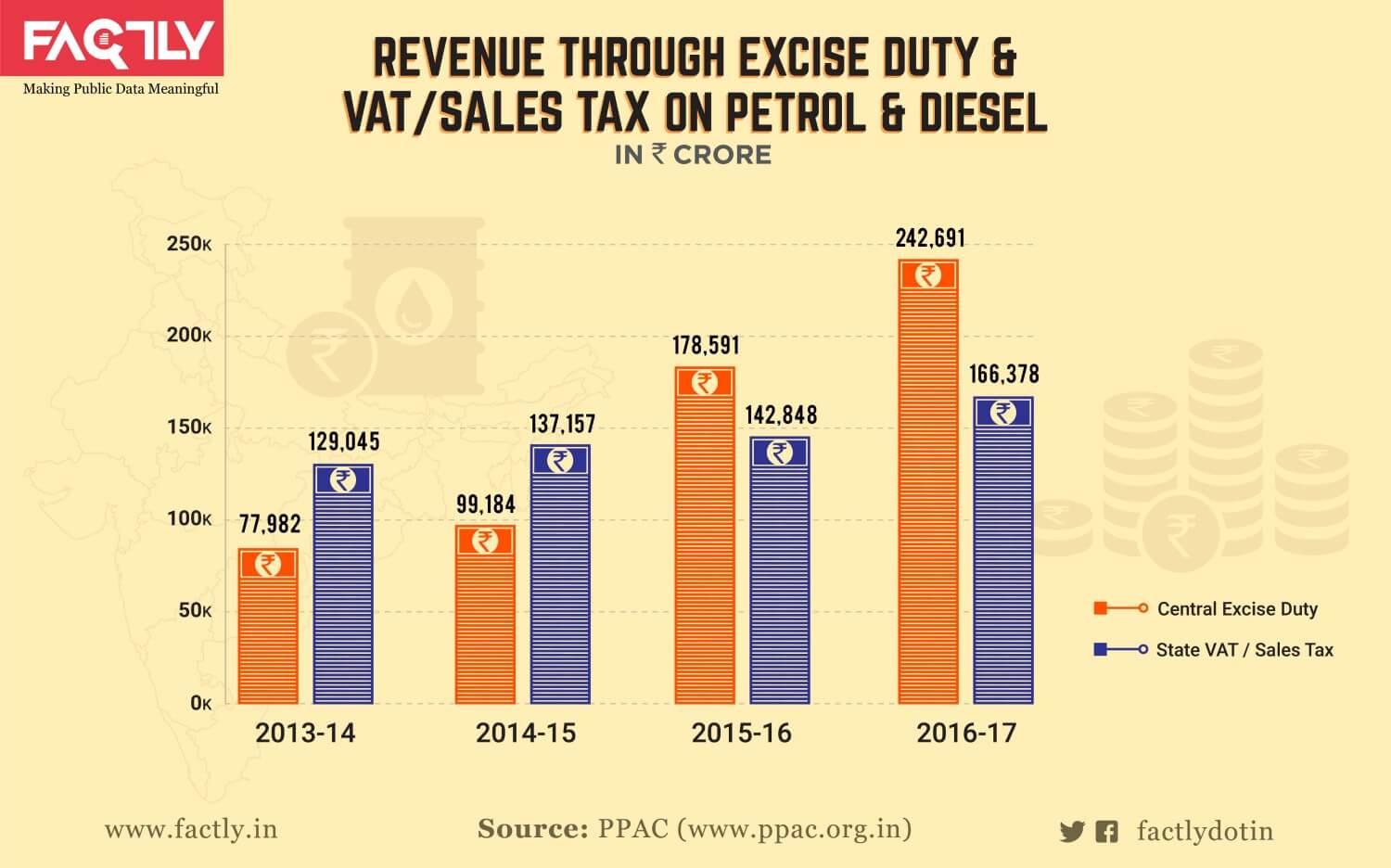

3. The central government revenue through excise duty on petrol & diesel more than tripled between 2013-14 and 2016-17. During the same period, the state government revenue through VAT increased marginally.

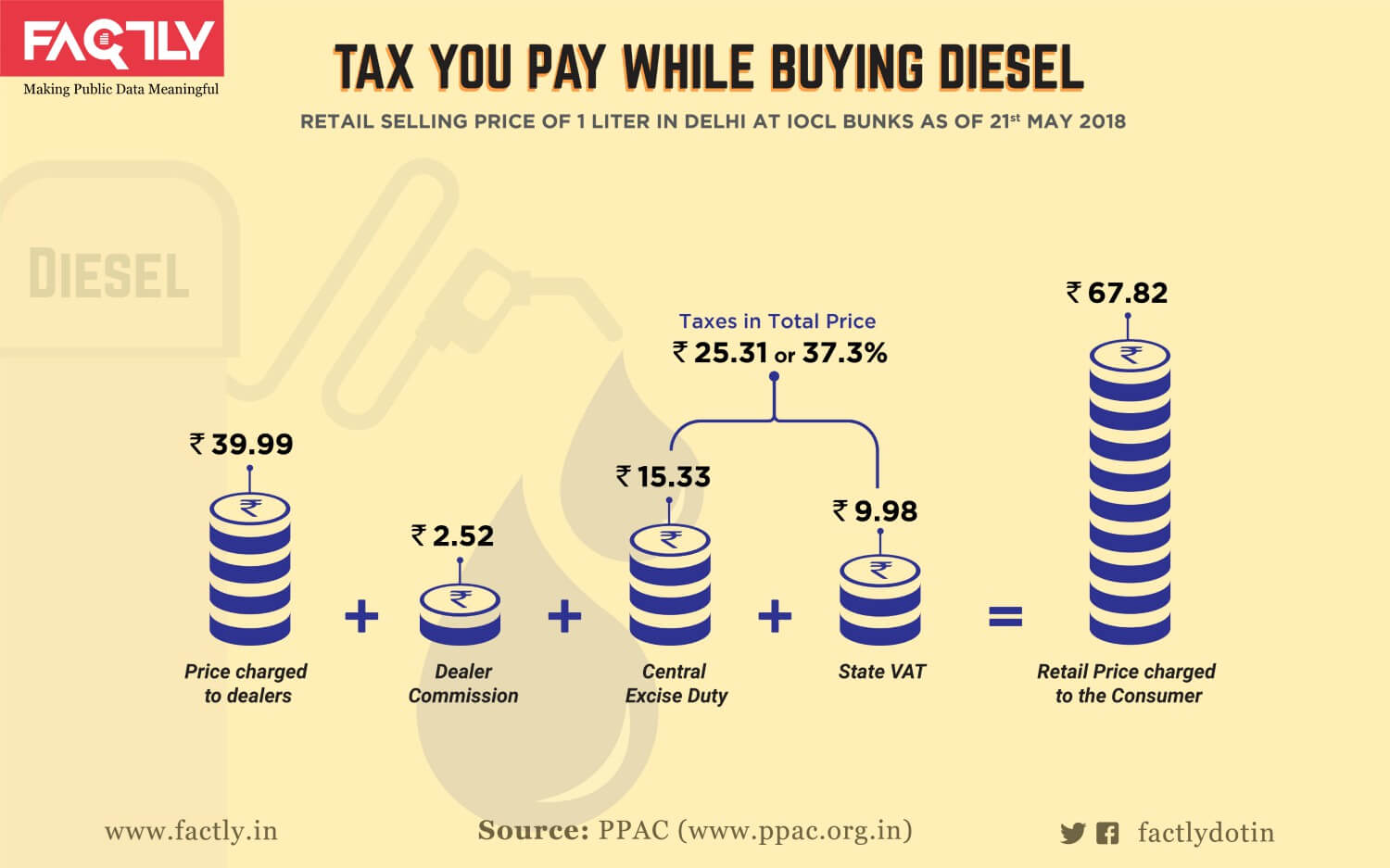

4. In the retail selling price of diesel (in Delhi at IOCL as of 21st May 2018), 37.3% is taxes. In other words, for every Rs 100 you pay for diesel, Rs 37.3 goes to the government in the form the taxes in Delhi. This is will more or less in different states based on the State VAT & other factors.

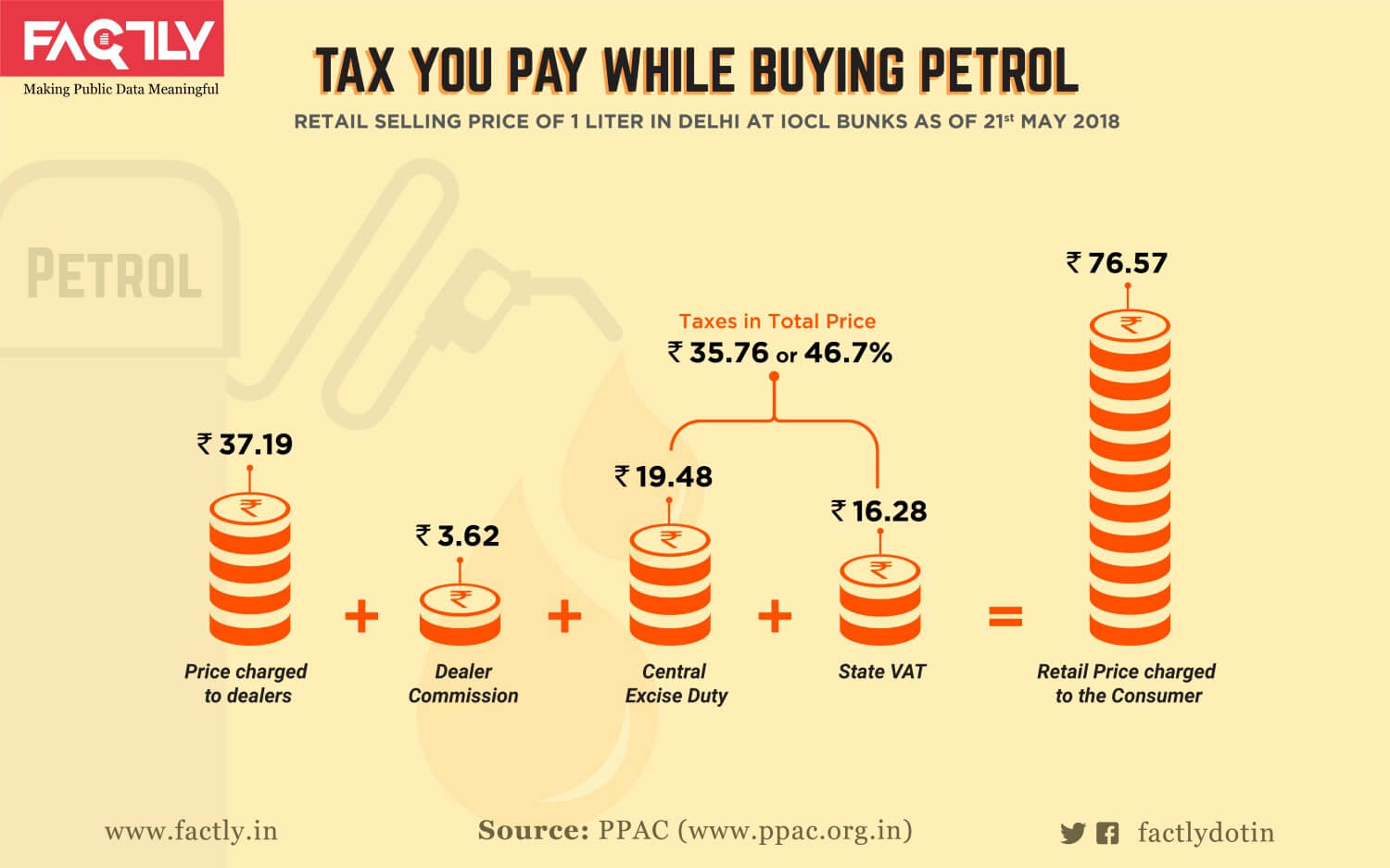

5. In the retail selling price of petrol (in Delhi at IOCL as of 21st May 2018), 46.7% is taxes. In other words, for every Rs 100 you pay for petrol, Rs 46.7 goes to the government in the form the taxes in Delhi. This is will more or less in different states based on the State VAT & other factors.

14 Comments

This is the simple funda of the Govt : loot the people who can be looted to fill the kofers and then redirect this money to populist schemes. Populist schemes are not bad per se, however routing this money to the contractors and suppliers via these populist schemes is the actual GAME. How would otherwise these big parties manager their cadres ? Think about it …

Pingback: Here’s An Insight Of Why Petrol Prices Are Frequently Fluctuating And How Crude Oil Is Imported To Our Country! - Officialtollywood

Also mention that 42% Central excise duty is given to state govts again. Cess part is not given, but excise duty part is given.

You have provided an nice article, Thank you very much for this one. And i hope this will be useful for many people.. and i am waiting for your next post keep on updating these kinds of knowledgeable things…

Fantastic article. i am so impressed. I suppose you have a awesome knowledge specially even as dealings with such subjects. thanks on your e-book; wild fashion. Many thank you sharing your article.

The first chart provides a distorted view of how the prices have changed given that the time intervals are not uniform. It makes it look like the slope of the increase is always greater, if not equal, than it should be.

Fist of its kind…very useful data….I think people of India should know more about such facts …. And we are anticipating more such reports nd analysis for other givt department as Well ….nice work

Update the details..for 2018 present situation

Government Just Say They Care For The People, But Don’t Mean It. When Congress Was In Power, They Said The People Must Bear It. Now It is The Same With Present Government.

Words Are Easy To Say, When Have No Meaning.

Pingback: Here's What Centre & State Govts Can Do To Cut Fuel Prices, According to Experts!

Can we have a similar article in petrol price trends for 2003-2013? That would help people understand the trends.

Also, the prices can be compared with crude oil prices in international market.

I really appreciate the kind of topics you post here.

Pingback: పెట్రోల్ ధరలో ఉండే వివిధ పన్నులు గురించి వివరిస్తూ ఉన్న పోస్టులోని వివరాలు తప్పు – My blog

Your article is very meaningful, the content is quite interesting and impressive, I hope in the near future you will have many good and meaningful articles to bring to readers.

https://aixonne.com/l/iPhoneCase.html