NITI Aayog’s recent report, “From Borrowers to Builders – Women’s Role in India’s Financial Growth Story,” offers a comprehensive, data-driven analysis of the evolving role of women in India’s economy. In 2024, women opened around 37 lakh new loan accounts for business purposes, 4.3 crore loans for personal finance needs and around 4 crore gold loans.

Women are increasingly reshaping India’s economy, making significant strides in diverse sectors, from agriculture to technology. Whether leading rural Self-Help Groups (SHGs) or driving innovation in urban startups, women are taking on roles as creators, entrepreneurs, and decision-makers. However, despite their growing presence and contributions, their economic impact remains limited. Women make up nearly half of India’s population, yet their contribution to the GDP is only 18%.

NITI Aayog’s recent report, “From Borrowers to Builders – Women’s Role in India’s Financial Growth Story,” offers a comprehensive, data-driven analysis of the evolving role of women in India’s economy. Published in collaboration with TransUnion CIBIL, the Women Entrepreneurship Platform (WEP) of NITI Aayog, and MicroSave Consulting (MSC), it explores how women are increasingly shifting from borrowers to builders, with a focus on emerging trends in credit participation, financial behaviour, and self-monitoring. The report showcases the progress women are making in the financial sector, identifying key areas where their impact is growing. The report provides critical insights into how empowering women financially can unlock new opportunities for economic growth and social transformation in India. The report also highlights the systemic barriers women continue to face.

Women’s economic participation has increased over the years

Over the past seven years, India’s Female Labour Force Participation Rate (FLFPR) has steadily risen from 23.3% in 2017-18 to 41.7% in 2023-24, driven largely by the increased economic participation of rural women. The report highlights that the National Rural Livelihood Mission has empowered 9 million women through Self Help Groups (SHGs), improving their livelihoods by providing access to formal banking services.

The growth of women entrepreneurs is also evident, with over 40% of MSMEs registered under UDYAM being women-owned as of January 2025. In 2023-24, loans totalling Rs. 2.22 lakh crores were disbursed to 4.24 crore women entrepreneurs under the Pradhan Mantri Mudra Yojana (PMMY), which provides micro-financing to small businesses. Additionally, the PM SVANidhi Yojana, aimed at supporting street vendors, provided Rs, 5,939.7 crores in working capital loans to 30.6 lakh women street vendors as of December 2024.

Around 37 lakh new loan accounts were opened by Women in 2024 for business purpose

With respect to credit participation of women, in 2024, women opened around 37 lakh new loan accounts for business purposes, including business loans, commercial vehicle loans, and loans against property, with total disbursements amounting to Rs. 1.9 lakh crores. While the number of business-related loan accounts has grown 4.6 times since 2019, these loans still make up only 3% of the total loans taken by women borrowers.

On the other hand, credit for personal finance needs—such as personal loans, consumer durable loans, home loans, and vehicle loans—remains the largest portion of loans for women. In 2024, women took out about 4.3 crore such loans, worth Rs. 4.8 lakh crore, which accounted for 42% of all loans availed by women.

Gold loans have also become increasingly popular among women borrowers. Around 4 crore gold loans, totalling Rs. 4.7 lakh crores made up 38% of all loans taken by women in 2024. This marks 5 times increase in the number of gold loans since 2019.

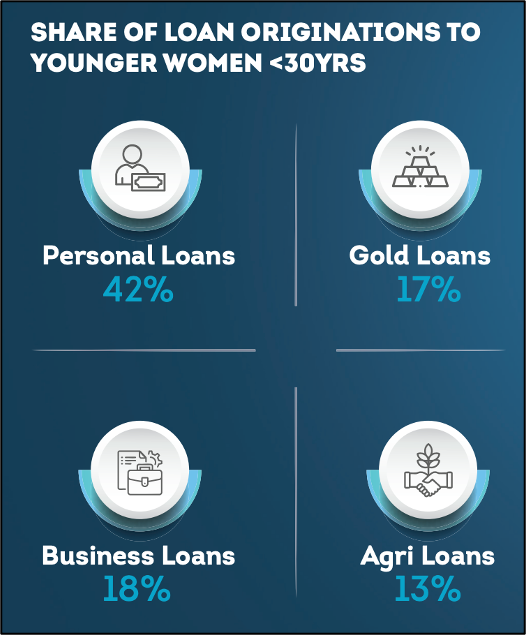

Young women (30 years or younger) mainly take personal loans, but their share in other types of credit, like business or agricultural loans, remains low. Possible reasons for the same include challenges in accessing collateral or credit history, social and cultural barriers, etc.

Meanwhile, women living in semi-urban and rural areas were more likely to take loans for business, agriculture, or gold purchases rather than personal finance needs (like personal loans or home loans).

Across states, there is significant difference in the credit participation of women

Credit participation among women borrowers varies significantly across states, highlighting regional differences in financial inclusion. Southern states have a higher percentage of women with at least one active loan. As of December 2024, Tamil Nadu leads with 44%, followed by Andhra Pradesh at 41%, Telangana at 35%, and Karnataka at 34%. In comparison, the national average for women with active loans is 31%.

On the other hand, northern and central states like Rajasthan, Uttar Pradesh, and Madhya Pradesh have seen a high compound annual growth rate (CAGR) in the number of women borrowers over the past five years. However, their overall share of women borrowers in the country remains relatively low.

More women are self-monitoring their credit

The report notes that women are increasingly demonstrating financial independence through self-monitoring and credit management, reflecting their growing financial acumen. By the end of 2024, nearly 27 million women were actively monitoring their credit, a 42% increase from 2023 when this figure was 19 million. In 2018, the number was just one million. This shift highlights a broader cultural and economic transformation, with women viewing credit health as a key tool for shaping their financial futures. The surge is led by younger generations, especially Gen Z women. The number of Gen Z women self-monitoring their credit grew by 56%, while millennial women saw a 38% increase, indicating a strong trend toward financial engagement.

It is also seen that in 2024, women accounted for 19.43% of the total self-monitoring base, up from 17.9% in 2023. Among them, Gen Z women saw a rise in their share of the self-monitoring population, reaching 27.1% in 2024, compared to 24.9% the previous year. Gen Z women contributed 2.16 million new individuals to the self-monitoring group, while millennial women added 3.80 million.

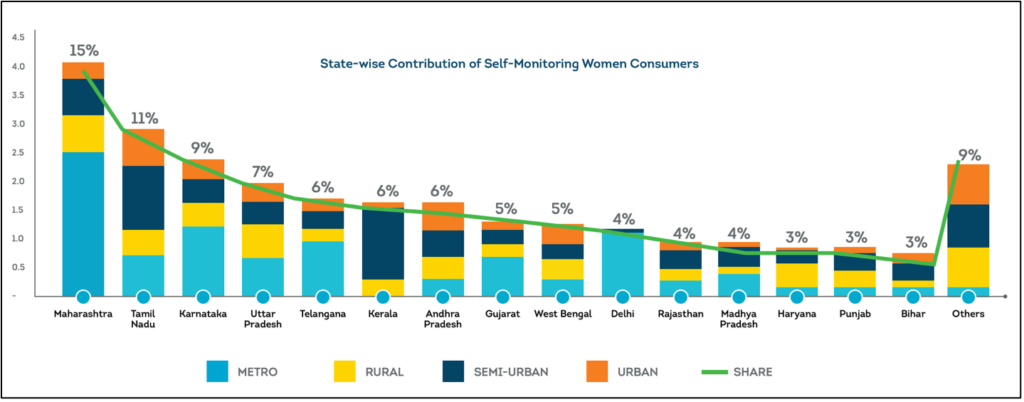

From December 2023 to December 2024, the number of self-monitoring women in metro areas grew by 30%, while in non-metro areas, the growth was even higher at 48%. Maharashtra, Tamil Nadu, Karnataka, Uttar Pradesh, and Telangana were the top five states for women self-monitoring in 2024, together accounting for 49% of all women self-monitoring across India. The southern region led with the highest number of women self-monitoring, totalling 10.16 million, and experienced a growth of 46% during the same period.

Women who monitor their credit are seeing positive results. 13.5% of them open a new loan within a month of checking their credit, and 44% improve their credit scores within six months.

Data from the report indicates clearly that more women are entering the formal credit system, with a notable rise in first-time borrowers. Credit awareness is also increasing, as women actively monitor and improve their financial health. While entrepreneurial aspirations are growing, access to business credit remains a challenge. Regional trends show differences in credit participation, with some states leading in financial inclusion. Younger women are engaging with credit in new ways, signalling a shift in financial decision-making.

Women borrowers continue to face challenges

Despite progress, women borrowers still face significant challenges. Many women entrepreneurs struggle to secure loans due to gender biases, lack of collateral, and limited financial literacy. Some avoid formal loans because of social norms, fear of default, and complex application processes. The banking system can be unwelcoming, and many banks don’t offer services tailored to women’s needs. Only 7% of MSME credit goes to women, and 79% of women-owned businesses are self-financed. Lenders often view women as higher-risk borrowers due to limited credit history. Many women also lack the necessary documentation, guarantors, and collateral for loans, and most women-led MSMEs rely on non-collateral loans, often capped at Rs. 1.5 lakhs. Financial products that meet women’s specific needs are still limited.

MSC and WEP recommend helping women become “credit-ready” by encouraging digital transactions, bookkeeping, and business formalization. Digital training at the grassroots level can build confidence to access credit. Collaboration between stakeholders is key to closing the gender gap, with initiatives like WEP’s Financing Women Collaborative (FWC) offering mentorship and access to creditors. Finally, increasing women’s roles in financial product design and decision-making will ensure services better meet their needs.