[orc]The Reserve Bank of India (RBI) is inviting comments on a draft circular issued to rationalize the MDR on debit card transactions. The circular seeks to restructure the MDR based on merchant turnover rather than the value of the transaction.

The Reserve Bank of India (RBI) in 2012 capped the Merchant Discount Rate (MDR) for debit card transactions based on the value of transaction. After demonetization, it issued one more circular further reducing the MDR on debit card transactions below Rs 2000. It has now issued a draft circular to rationalize the MDR on debit card transactions based on merchant’s turnover rather than the value of the transaction. RBI is now seeking comments on this draft circular on or before February 28th, 2017.

Capping MDR on Debit Card Transactions – The History

To encourage the use of debit cards, especially at smaller merchants/service providers, the RBI in 2012 had capped the MDR for debit card transactions like the following.

- MDR not exceeding 0.75% of the transaction amount for value upto Rs 2000

- MDR not exceeding 1% for transaction amount for value above Rs 2000

After demonetization a few months ago, RBI further reduced MDR on debit card transactions to facilitate more card payments. As a special measure, it introduced the following cap on MDR till 31st March, 2017.

- MDR capped at 0.25% of the transaction value for transactions up to Rs 1000

- MDR shall be capped at 0.5% of the transaction value for transactions above Rs 1000 and up to Rs 2000

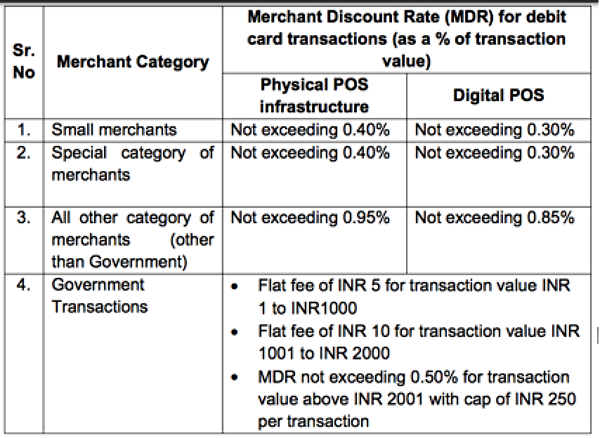

These were supposed to be a temporary measure. Now the RBI has issued a draft circular that seeks to rationalize MDR on debit card transactions by taking the merchant’s turnover rather than the value of the transaction following consultations with various stakeholders. The circular also proposes a differential MDR for Government transactions and for certain special categories. The circular also talks about need to encourage asset-light digital infrastructure such as QR-code. Hence it proposes to differentiate MDR between acquiring infrastructure involving physical terminals, including mPOS and digital acceptance infrastructure models such as QR Code.

The Proposed Model

Under the proposed model, merchants will be categorized as,

- Small merchants with turnover outside the ambit of GST (turnover less than Rs 20 lakhs per annum)

- Government transactions

- Special category of merchants

- All other category of merchants with turnover within the ambit of GST (turnover above Rs 20 lakhs per annum)

The GST limits have been considered for the above classification for transparency and uniformity. As and when the GST limits undergo a change, RBI proposes to modify the categorization accordingly.

The circular also mentions that the MDR for debit cards for petrol/fuel shall be decided after the industry consultation process with Oil Ministry is completed.

The circular has also listed an indicative list of merchants for both the special category and government transactions.

The following are part of the indicative list in the special category of merchants

- Utilities incl. Private Sector (Electricity, Water, Municipal Taxes). Excludes Telecom.

- Education Sector (Govt. & Private sector). Coaching Classes excluded.

- Hospitals (Only Government) and primary health care centers, Jan Aushadhi outlets

- Agriculture and allied activities including fertilizers and seeds, nursery, farming equipment, APMCs and mandis, fisheries, milk cooperatives, vegetable mandis etc.

- Cooperatives including KVIC

- Army Canteens

- State Transport & State Waterways; Toll collections

- Insurance

- Mutual Fund

- PDS / Fair price shops

- Places of Tourist Interest run by Govt. (ASI Monuments, Forest Dept./National Parks, Museums, Zoos & Aquariums, Govt. Libraries, Govt. Expositions etc.)

The following are part of the Government Merchant Category as listed in the draft circular

- GST, Income Tax, Customs Duty, other Government Taxes & Levies & Fines

- MEA Passport Fees

- Visa Fees (Indian Consulates & Foreign Consulates operating in India)

- Railways – Ticketing and Passenger services

- Duties and registration charges such as Property registration, Vehicle Registration, Stamp Duty, Road Tax etc. and any other Municipal taxes.

The draft circular also puts the responsibility on the banks to ensure that all merchants display the signage “No convenience or service charge is payable by customers”. It has to be noted that the banks are free to set the MDR on debit card transactions below the above mentioned regulatory caps in each category.

The comments to the draft circular may be sent by post to the Chief General Manager, Department of Payment and Settlement Systems, Reserve Bank of India, Central Office Building, 14th Floor, Shahid Bhagat Singh Road, Mumbai – 400 001, or by email to mdrfeedback@rbi.org.in on or before February 28, 2017.

Featured image is repurposed for editorial from : indianexpress.com