India has committed to reaching 500 GW of non-fossil fuel capacity by 2030, which would comprise over half of the total installed power base. India also targets a 45 per cent reduction in emissions intensity of GDP by 2030 (compared to 2005) and achieving net-zero emissions by 2070. Official data underscores the scale of the challenge ahead.

Electricity lies at the heart of India’s development journey. From an installed capacity of just 1,362 megawatts (MW) in 1947, India today has an installed capacity of 4.4 lakh MW in 2023-24, making it third third-largest global producer and consumer of electricity. Access to electricity has seen a significant rise, mirroring India’s expanding economy and consumerism. Over the last 5 years, the power requirement has grown at an average of 5% each year.

However, this growth has largely been powered by fossil fuels. Around 74% of India’s electricity still comes from Coal. India also plans to meet its rising demands by substantially increasing coal production by 42% in the next 5 years and thermal power production by another 87,910 MW by 2031-32. Incidentally, India is the only country which continues to increase power production through Coal among the six major countries that account for 63% of GHGs and which have gradually reduced their power production through Coal.

India is already the third-largest emitter of Greenhouse Gases (GHGs). As part of its climate commitments, India vowed to reach 500 GW of non-fossil fuel capacity by 2030, which would comprise over half of the total installed power base. India also targets a 45 per cent reduction in emissions intensity of GDP by 2030 (compared to 2005) and achieving net-zero emissions by 2070.

In the evolving landscape, while electricity stands as the foundation for growth, clean energy is no longer an option, but is central to ensuring economic resilience, environmental balance, and energy equity for a developing India. However, meeting clean energy commitments remains a critical concern for India in the midst of rising demand.

Against this backdrop, we look at the trends in the installed capacity, generation, and consumption of electricity in India, together with a rising trend in renewable energy production.

The data for this story is sourced from Dataful’s collection of datasets on infrastructure data, curated from the Reserve Bank of India Report on Indian States. The RBI sourced this data from the Central Electricity Authority (CEA), the nodal agency responsible for the electricity sector in the country, and other electricity authorities.

Between 2005-06 & 2023-24, Installed capacity of Electricity increased at an average 7% each year

India’s total installed electricity (power) capacity stood at 1.2 lakh MW in 2004–05. This rose to 1.7 lakh MW by 2010–11, reached 3 lakh MW by 2015–16, climbed to 3.8 lakh MW by 2020–21, and further expanded to 4.4 lakh MW by 2023–24. The average Year-on-Year (y-o-y) growth in installed capacity during this period was approximately 7%, with the highest recorded growth of 15% in 2011–12, and the lowest growth rate of 3% occurring in both 2005–06 and 2006–07.

Between 2013-14 & 2023-24, peak demand has increased at an average 6% each year

As per official data, the country’s peak electricity demand was approximately 1.3 lakh MW in 2013–14, which increased to 1.5 lakh MW in 2015–16, 1.9 lakh MW in 2020–21, and further to 2.4 lakh MW in 2023–24. Correspondingly, the per capita availability of electricity rose from 532 kilowatt-hours (kWh) in 2004–05 to 901 kWh in 2015–16, and reached 1,340 kWh by 2023–24. Per capita consumption also increased steadily, from 1,010 kWh in 2014–15 to 1,255 kWh in 2021–22.

Despite installed capacity exceeding peak demand by one to two lakh MW during the period 2013–14 to 2023–24, the country continues to experience power shortages, particularly during peak demand periods. This paradox is attributed to a range of factors, including transmission and distribution losses, the financial distress of DISCOMs, variability in demand, and lower Plant Load Factor (PLF) in generation.

In 2013–14, the peak power demand shortfall was about 6,143 MW. This gap narrowed to 3,314 MW in 2017-18 but subsequently widened again to 8,657 MW in 2022–23. However, it reduced significantly to 3,340 MW in 2023–24.

Grid Interactive Installed Capacity of Renewable Power reached 1.25 lakh MW in 2022-23

As per data from the Ministry of New and Renewable Energy (MNRE), the total installed capacity of renewable energy (RE) in India as of 31 May 2025 stands at 1.78 lakh MW, sourced from wind, small hydro, biomass power/bagasse cogeneration, biomass (excluding bagasse), waste-to-energy, off-grid waste energy, biopower, and solar power. When the installed capacity from large hydro power projects is included, the total renewable energy capacity reaches 2.26 lakh MW. This marks a remarkable increase from just 35,849 MW (excluding large hydro) in 2013–14.

According to MNRE, the share of renewable energy in India’s total installed electricity capacity reached 46% by October 2024, underscoring the rapid transition towards cleaner energy sources.

Alongside the expansion in total installed capacity, grid-interactive renewable energy has also experienced a strong growth trajectory. Grid-interactive capacity refers to installations connected to the electricity grid, though it does not imply that the same amount of power is generated continuously. The grid-interactive RE capacity stood at 10,256 MW in 2006–07, rose to 31,692 MW by 2013–14, increased substantially to 95,803 MW in 2019–20, and reached 1,25,160 MW by 2022–23.

What about India’s commitment to meet 500 GW non-fossil fuel power by 2030?

Despite the impressive progress in the installed capacity and grid-interactive installed capacity of RE, the CEA data shows that as of 2023-24, the total electricity generated from RE is only 19 Billion Units (BU) out of 129 BU of total electricity generated, showing a share of only 15%.

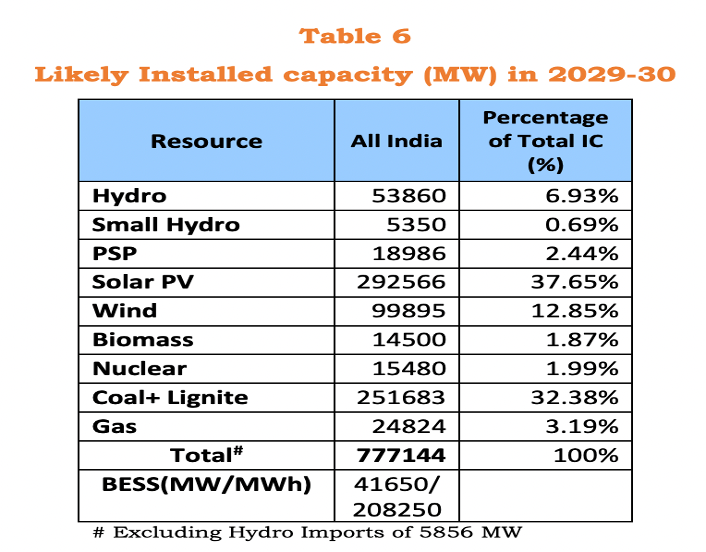

Interestingly, as per a CEA report from April 2023, the installed capacity of electricity in 2029-30 is likely to be 7.77 lakh MW, marking a significant 75% increase from 4.4 lakh MW in 2023-24. Out of this, the report estimated that the share of thermal energy (coal+lignite+gas) in total installed capacity is likely to come down to 57% in March 2023, to 35.5% by 2029-30. Conversely, during the same period, the share of RE installed capacity is likely to be up from 41.4% to 62.4%.

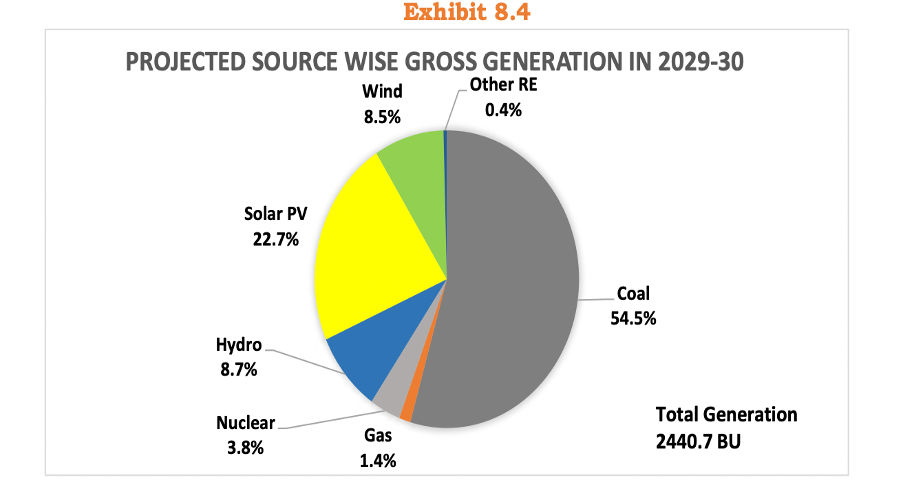

Further, the report also specified share of thermal power generation in the total generation is likely to reduce to 55.9% in 2029-30, compared to around 75% in 2022-23. About 42% of electricity generation will be met by renewable energy, and another 2% by nuclear energy, by 2029-30.

Excluding the projected share of about 4% of nuclear power by 2029-30, for India to meet its commitment of 500 GW (or 5 lakh MW) of non-fossil fuel energy by 2030, it will need to double the installed capacity from current May 2025 figures of 2.26 lakh RE within the next five years. Further, the share of electricity generation from renewables also has to significantly increase from a mere 15% in 2023-24 to 50% in 2029-30.

These significant gaps in the installed capacity and real generation, combined with the steep targets set for the next five years, underscore the scale of the challenge for India to meet its renewable energy commitments by 2030.