The SC Judgment on Electoral Bonds Highlights Several Important Issues Related to Electoral Financing in India

Access Comprehensive Data on Electoral Bonds (as of February 2024)

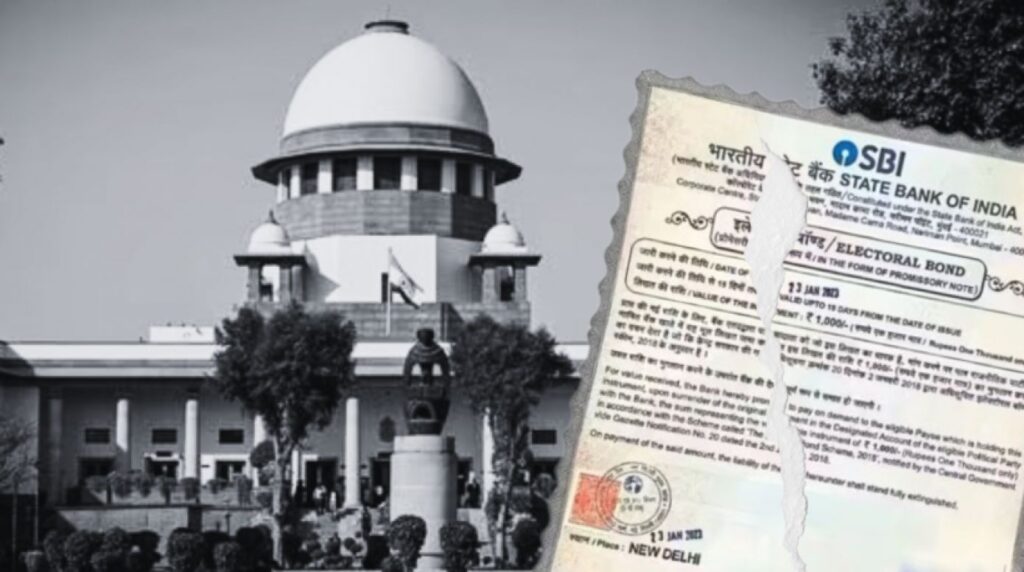

The SC in its landmark judgment on 15 February 2024 struck down the Scheme of Electoral Bonds (EBs) finding it ‘Unconstitutional.’ It also struck down amendments made to three principal legislations in this regard. The court highlighted several important issues related to electoral financing in India in this judgement.

The Supreme Court (SC) of India in its landmark judgment on 15 February 2024 struck down the Scheme of Electoral Bonds (EBs) finding it ‘Unconstitutional.’ In order to allow and give effect to the same scheme, the Parliament in 2017 made amendments to the three principal legislations that regulate the electoral process and finance in India; Sections 29 (C) of the Representation of People’s Act (RPA), 13 (A) of Companies Act (CA) and 182 (1) & (3) of Income Tax Act (ITA) were amended through the Finance Bill, 2017. The SC while holding the Scheme of EBs as unconstitutional has also declared the amendments made to these legislations as unconstitutional. Only the addition of section 31 (3) of the Reserve Bank of India Act (RBIA), which was also done through the Finance Bill, 2017, was allowed to operate by the SC.

The judgment was passed unanimously by a 5-member bench led by Chief Justice D. Y. Chandrachud. While 4 of the judges have written a single judgment, one judge wrote a separate judgment but concurred with the majority opinion albeit with different reasoning. Prashant Bhushan, one of the arguing lawyers on behalf of the petitioners, called the judgment universally welcomed and lauded the judgment.

Since the inception of the EBs Scheme, Factly has time to time published explainers and analysis stories on the EBs Scheme, its nuances, beneficiaries, and other details, along with details of volume and value of bonds sold/purchased (sold), redeemed/encashed (redeemed), etc.

Factly’s previous explainer stories on the issue of Electoral Bonds can be accessed here, here, here & here, and the analysis can be accessed here.

In this story, we look at the timeline of EBs from the beginning to their latest declaration as unconstitutional, the volume and value of EBs that have been issued since their inception till date, the parties that benefitted most and the issues of the electoral process and finance that persist in India yet, besides the landmark judgment of the SC on EBs.

Methodology

The story uses excerpts from the SC’s judgment on EBs, the issues and reasons which have been considered by the SC in declaring the EBs scheme and the amendments made to the pertinent laws as ‘Unconstitutional’.

The story also uses the comprehensive data of EBs sourced from Dataful, which has compiled the EBs data obtained through Right To Information (RTI) Applications and through Annual Audit Reports of Political Parties (PPs) submitted to the Election Commission of India (ECI), that consist details of contribution to political parties through EBs. The same data is used for analysis in the story.

EBs Scheme and Amendments made to Laws

An EB is a bond issued in the nature of a promissory note which shall be a bearer banking instrument. It neither carries the name of the buyer nor the payee. The one (eligible political party in this case) in possession of the electoral bond is entitled to redeem the same.

Until the introduction of the EBs Scheme, the financial donations made to the PPs were reasonably regulated in terms of donor transparency for high-value donations. As mentioned, the pertinent sections of RPA, ITA and CA have made it mandatory for PPs to disclose donor information and the total amount of money received from each donor if the donation exceeds Rs. 20,000 in a particular year. They have also fixed the financial ceiling on the total amount of donations made by the companies to the PPs. However, in the year 2017, these legislations were amended as follows to bring and operate EBs, to provide immunity from disclosure of donor’s information and to allow unlimited funding to PPs.

| Legislation Name | Amendment Made |

| Section 29C of RPA | All donations made to PPs by any person or company above Rs. 20,000 should be required to be reported. This requirement is done away with if the donations are made through EBs. |

| Section 13 (A) of ITA | All sources of income of PPs, including donations, over Rs. 10,000 are required to be disclosed with the name and address of the source from which income has been obtained. The income obtained by PPs through EBs is exempted from this requirement. |

| Section 182 (1) of CA | The companies that have been in existence for more than 3 years and which are not government companies were permitted to donate up to 7.5% of the average net profits during the preceding 3 years. This cap of a maximum of 7.5% of total funding to PPs is taken away by amendment |

| Section 182 (3) of CA | Any company making donations to PPs was required to disclose the amount it has donated to each PP in its annual profit and loss statement, along with details of the total sum donated and the names of PPs to whom donations have been made. This requirement has been done away with in the amendment. |

Source: Judgment of SC

In addition to these changes, section 31 (3) had been added to RBIA to give power to the central government to authorize any bank to issue EBs. Earlier, it was only the Reserve Bank of India (RBI) that had the authority to do so.

In other words, in contrast to the original requirement of law, any person, group of persons, companies, etc., who are making donations or contributions through EBs to any of the PPs are not required to disclose the details of their name and address, amount of money donated and party to which it has been donated. Along with this, companies are given free will to donate any amount of money to any PP without the disclosure of any of the basic details mentioned before.

Therefore, in a nutshell, the amendments made to these legislations have facilitated anonymity and unlimited political funding to be made through EBs to the PPs.

Timelines of EBs Scheme, Operation and Legal Proceedings in SC

Here is a timeline of EBs since their inception to the SC judgment on 15 February 2024.

| Date | Development |

| 02 January 2017 | The EBs Scheme was introduced by the Union Government |

| 28 January 2017 | The Finance Bill, 2017 with amendments to the RPA, RBIA, ITA and CA, among others were proposed, to allow and implement EBs Scheme |

| 30 January 2017 | The RBI objected to the proposed amendment to the RBI Act stating that it would be in violation of the principles and spirit of the Prevention of Money Laundering Act (PMLA), and allow secrecy of contributors to the Political Parties (PP) |

| 30 January 2017 | The Ministry of Finance (MoF) responded to the objections of RBI stating that RBI did not understand the core purpose of EBs and that its advice had come late since the bill had already been printed |

| March 2017 | Finance Bill 2017 with proposed amendments was passed by Parliament |

| 26 May 2017 | The ECI wrote a letter to the Ministry of Law and Justice (MLJ) stating that changes made to principal legislations would have serious impact on transparency in the political funding. Accordingly, the ECI appealed to MLJ to reconsider and re-incorporate previous changes made to RBIA, RPA, ITA, and CA. |

| 25 and 30 May 2017 | The Community Party of India (CPI) and All India Congress Committee (AICC) sent separate letters to Finance Minister stating that the scheme would allow quid pro quo with corporates and other vested interested parties and that the names of the donors and donees should be disclosed to the public as a matter of transparency |

| 12-13 April 2019 | The SC in a batch of petitions filed against EBs Scheme and amendments of four principal laws observed that they give rise to weighty issues which have a bearing on the sanctity of the electoral process. It has issued an interim order directing that the information of donations received and will be received must be submitted by political parties to the ECI in a sealed cover |

| 15 February 2024 | The SC declared the EBs Scheme and the pertinent amendments made to ITA, RPA and CA are unconstitutional and ordered for all the donations which have been made and received by PPs through EBs to be disclosed to ECI and then to the Public |

Sources: Press Release of GoI and Information obtained from RTI

The table above shows that since its inception, the EBs Scheme and amendments made to legislations have received opposition from several sections, including the opposition parties, independent regulatory bodies like RBI and the Election Commission of India (ECI).

SC overrules the question of its jurisdiction over economic matters involving constitutional validity and electoral process

A batch of petitions were filed in SC under Article 32 of the Constitution of India against the EBs and the amendments made to the legislations earlier mentioned. One of the primary defences that the Union of India (UoI) had taken before the SC was that the EB scheme and the amendments carried to the legislations were a matter of economic policy. Therefore, the judicial restraint to adjudicate the same matter applies in the case before it. In support of this claim, the UoI relied on several decisions as Rustom Cavasjee Cooper v. Union of India, (1970) 1 SCC 248, etc.

The SC rejected and overruled this claim of UoI by holding that their jurisdiction extends even to the matter of the economic policies when the questions of their constitutionality and electoral process are raised. Accordingly, the SC dismissed this claim of the UoI and adjudicated the matter.

This is one of the first cases where the SC has considered and adjudicated a matter which involves issues and questions of economic policies.

SC rules anonymity of funding to PPs through EBs is Unconstitutional

Factly’s previous stories such as the explainer story of 22 April 2019 and others have consistently pointed out several issues with the EBs, including the grievous issue of anonymity. It was also highlighted that the practice of anonymity in electoral funding is banned and not permitted in more than 80% of countries across the Americas, Europe & Asia. The disclosure of details of donations has been set as a norm in most of the matured democracies.

The SC in several parts of its verdict had held that maintaining the anonymity of funders to PPs was the chief feature of EBs. Such a practice was held as violative of Article 19 (1) (a) of the Constitution of India – the fundamental right to freedom of expression and speech.

As mentioned, the EBs Scheme permitted non-disclosure of details such as donor, donee and the amount donated to PPs, along with permission for unlimited funding by the companies.

The EBs data compiled by Dataful shows that the anonymity funding or the funding through EBs since the inception year 2017-18 has increased steeply over the years.

The data shows that while the total income of all recognized PPs in the year 2017-18 was Rs. 1226 crores, the income obtained through EBs was Rs. 215 crores, which is about 18% of the total income. However, in the subsequent years, the proportion of this income obtained through EBs increased steeply to 57%, 64% 62% and 62% in the years 2018-19, 2019-20, 2021-22 and 2022-23, respectively, to the total income obtained by recognized PPs. It is only in the COVID-19-affected year of 2020-21 that the proportion of income obtained through EBs was 21% of total income obtained by PPs.

In other words, ever since the EBs started to operate, the proportion of funding received from EBs has drastically increased.

Data shows 90% of EBs Donations were Affluent Donations; SC Rules it as a potential possibility of leading to Quid Pro Quo

As per the EBs scheme, the bonds worth Rs. 1000, Rs. Ten Thousand, Rs. One Lakh, Rs. Ten Lakhs, and Rs. One Crore can be purchased by a buyer and donated to a PP. Though the scheme envisaged the sale of bonds with different monetary values, the data, however, shows that 90% of the income obtained by PPs across all the years was through EBs sold and redeemed worth Rs. 1 crore, the highest value of EBs allowed for sale and redemption.

The data shows that in the first year 2017-18, EBs worth Rs. 222 crores and 221 crores were sold and redeemed, respectively. 86% of these sold and redeemed EBs were those worth Rs. 1 Crore, signifying that the anonymous funding with higher monetary value had started from the introduction year itself. In the subsequent years, the same trend has only increased and consistently stood over 90% each year, including the COVID-19-affected year of 2020-21. This was also noted by SC in its verdict – “ninety-four percent of the contributions through electoral bonds have been made in the denomination of one crore. Electoral bonds provide economically resourced contributors who already have a seat at the table selective anonymity vis-à-vis the public and not the political party.”

Such a trend implies that anonymous contributions could have been made by those who are from the economically affluent class. However, as mentioned, details such as the names of donors, the total amount of money donated each year and the party to whom money was donated, etc., remain unknown.

This phenomenon was held by SC in its verdict as a legitimate and higher possibility of having quid pro quo arrangements between donors and PPs.

Ruling Parties benefitted most from EBs with BJP getting 55% of all till 2022-23

Since the introduction of the EBs Scheme, not many PPs have spoken against it. The CPI (M) (Community Party of India (Marxist) is one of the parties which spoke against it and is believed to have not received any money through EBs. The same party is also one of the petitioners in the case against EBs in SC.

The party-wise analysis of donations received through EBs shows that the ruling party Bharatiya Janata Party (BJP) received the maximum amount of donations every year, except for the COVID-19 year of 2020-21.

The data shows that since the introduction of EBs, a total of 21 PPs have received money through EBs, including 4 national parties namely BJP, INC, Nationalist Congress Party (NCP) and All India Trinamool Congress (AITC). In the year 2017-18, only the two national parties BJP and INC have received donations through EBs. While the BJP received Rs. 210 crores, the INC received Rs. 5 crores, which is about 2.3% of the total donations received during the same year.

Though the number of parties receiving donations through EBs has increased in the subsequent years, the ruling party at the centre, the BJP has consistently stood on top in the total amount of donations received each year. For example, in the year 2018-19, the BJP received Rs. 1451 crores of donations, whereas all the other parties together received Rs. 1089 crores. Therefore, 58% of total donations received through EBs by all PPs were received by BJP. During the same year, the INC stood next with Rs. 383 crores in donations at 15% of total donations. Further, in the subsequent 2019-20, 2021-22 and 2022-23 years, BJP received 74%, 39% and 46% of total donations, respectively. During all these years, the BJP continued to be the top party with a higher amount of donations received each year. It is only in the COVID-19 hit year of 2020-21 that the total amount of contributions received through EBs by the BJP was lower than the other parties with Rs. 22 cores. In the same year, the ruling party of Andhra Pradesh Yuvajana Sramika Rythu Congress Party (YSRTP) stood on top with Rs. 96 crores.

Between 2017-18 and 2022-23, the total amount of money received through EBs is about Rs. 11,948 crores. Out of this, BJP received about Rs. 6,566 crores or 55% of the total which is way above the percentage share of donations received by other parties through EBs. The INC and AITC secure the next position with Rs. 1,123 crores and Rs. 1,093 crores respectively (9.4% and 9.1% in terms of share). All these 3 parties are the national parties. The state party and former ruling party of Telangana, Bharatiya Rastra Samiti (BRS) stands in the next position with Rs. 912 crores donations or 7.6% of the total EBs income.

Further, out of the total value of EBs sold across all the years, about Rs. 25 crores or 0.2% of the total unredeemed EBs went to the Prime Minister’s National Relief Fund (PMNRF)

SC Judgment is a leap forward in electoral finance transparency, but India grapples with several other issues

Soon after the EBs Scheme was proposed, independent bodies like the ECI and RBI have said that it is a retrograde step in electoral finance in India, since it leads to various forms of corruption such as black money, quid pro quo, creation of shell companies, etc., thereby affecting the transparency in the elections. The perusal of the SC’s historic judgment reveals it had also weighed heavily on these issues and held that the blanket allowing of unlimited and anonymous donations through EBs is a violation of the fundamental right to equality and information of the voter, as envisaged by Articles 14 and 19 (1) (a) of the Constitution.

While the verdict of SC is a leap forward in the broader context of electoral finance transparency, India however grapples with several other critical issues in the same respect. The SC itself has noted some of these issues in its judgment. For example, the SC noted that “However, the law does not prescribe any limits for the expenditure by a political party…. Thus, there is an underlying dicohotomy in the legal regime. The law does not regulate contributions to candidates. It only regulates contributions to political parties. However, expenditure by the candidates and not the political party is regulated.”

Similarly, Justice Sanjeev Khanna in his separate concurrent judgment had also noted that “suggestions were made that corporate funds should be accumulated and the corpus equitably distributed amongst national and regional parties. I have not in-depth examined these aspects to make a pronouncement. However, the issues raised do require examination and study”

Both these observations of the SC highlight several issues relating to the electoral process and finance prevailing in India.

Similarly, the Central Information Commission in its historic 2013 order held that PPs who have received funding from the Central Government are Public Authorities under section 2 (h) of the Right To Information Act (RTIA). Accordingly, a direction was issued to the PPs to suo-motu disclose information as envisaged under section 4 (1) (b) of RTIA. However, the CIC order is still pending for implementation. An appeal was filed against it in SC, and the matter is still sub-judiced before it.

The importance of information is also noted by the SC itself in several parts of its verdict on EBs.

Along with these, the increasing number of contesting candidates with pending criminal cases against them, the increasing number of ultra-rich among the elected candidates in the elections, etc. are well-known in India. Cumulatively, these issues highlight the lack of adequate legislative framework, as noted by the SC itself, comprehensive and effective policies, etc. that create an atmosphere and system of accountability and transparency in the regulation of Elections and Political Parties of India, the world’s largest democracy.