Fact Check: How true is Congress party’s claim regarding shortfall in Government earnings

[orc]Recently, Congress Party has claimed that there is a shortfall in government earnings in 2018-19 and that 2019-20 would see further shortfall due to reduction in corporate tax. Here is a fact check of these claims.

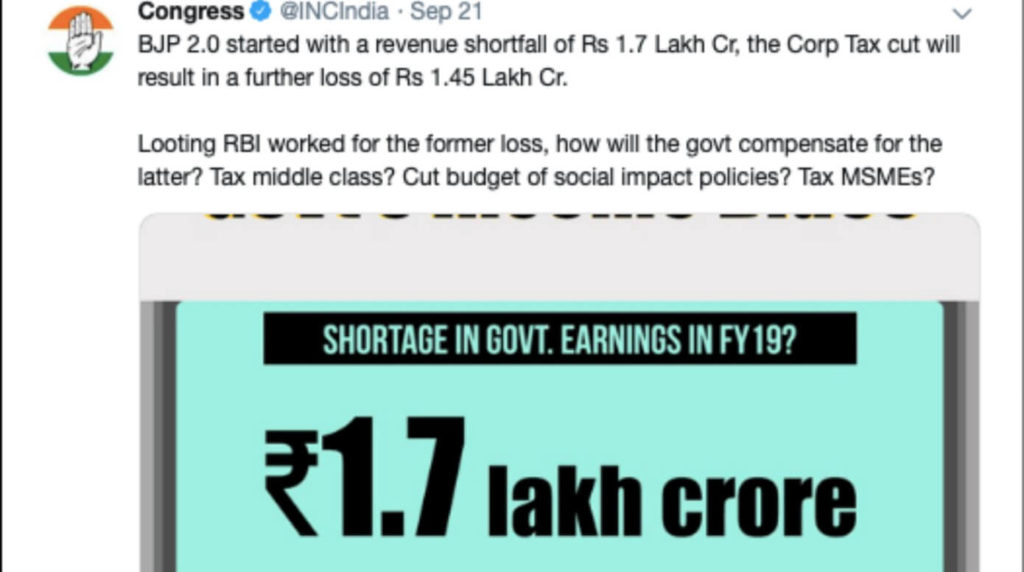

The official Twitter handle of Indian National Congress (INC) on 21 September 2019, tweeted about the shortfall in government earnings for 2018-19 and the additional burden it needs to bear in 2019-20 due to the latest corporate tax cuts. It further claimed in the tweet that the shortage in government earnings was compensated by ‘looting’ RBI. Here is a fact check of these claims.

What is the difference in Central government’s estimates & actuals of revenue receipts for 2018-19?

Claim: There was a shortfall in government earnings in 2018-19 to the tune of Rs.1.7 lakh crores and the shortfall was compensated by taking money from RBI.

Fact: There is a difference which amounted to Rs. 1.7 lakh crores between the ‘Provisional Actuals’ of revenue receipts provided in the Economic Survey of India and the ‘Revised Estimates’ of revenue receipts as reported by the government for 2018-19. Since provisional actuals (PA) may be a better estimate of the actual figures, there could well be a shortfall in government earnings for 2018-19. Hence the claim is TRUE. Further, RBI has transferred Rs. 1.76 lakh cores to the government, the purpose and utility of which the government has not been clarified. This transfer is based on recommendations of an expert committee, hence the claim of terming the transfer as a ‘loot’ is MISLEADING.

Prior to the budget presentation for 2019-20, the Ministry of Finance has released Economic Survey 2018-19 report. In this report, the Provisional Actuals of revenue receipts for 2018-19 stand at Rs. 15.6 lakh crores. Meanwhile, the budget for 2019-20 provides the Revised Estimate of government Revenue receipts at Rs. 17.3 lakh crores.

Revised estimates provided in budget is a projection of how much the government is expected to earn, whereas the Provisional actuals are a more accurate estimate of the government earnings during that specified period since it comes from the ‘Controller General of Accounts (CGA)’. The difference between these provisional actuals and the revised estimates for revenue receipts of the government amounts to Rs. 1.7 lakh crores which is considered to be a deficit in the government earnings, compared to the estimates. While the actual earnings for 2018-19 will only be known when the budget for 2020-21 is presented, the Provisional actuals do point to a shortfall in the government’s earnings. The Economic Survey 2018-19 cites lower Gross Tax Revenue (GTR) as the reason for the fall in revenue receipts. So the claim that there is a shortfall in government revenue receipts is TRUE.

RBI’s transfer to government based on recommendations of Expert committee

An expert committee to review the Economic Capital Framework of RBI was constituted and headed by former RBI Governor Bimal Jalan. The extent to which RBI can maintain its reserves for future contingencies, and the surplus it transfers to the government has always been an issue of contention. The committee was supposed to give its recommendations regarding both these issues.

In addition to the other revenue receipts, Government of India also depends on the surplus transfers from RBI to meet its public spending. Hence the government expects a higher surplus to be transferred. RBI, on the other hand has a more conservative approach and maintains higher reserves. In this context, an expert committee was setup to evaluate the provision for reserves that RBI should maintain and the surplus of profits that RBI needs to transfer to government. The committee submitted a report to the RBI Governor with its recommendations.

In line with the recommendations, RBI has decided the transfer of Rs. 1.76 lakh crores to Government of India. This includes Rs. 1.23 lakh crores as surplus for the year 2018-19 and Rs. 0.52 lakh crores as excess provisions identified after the revised Economic Capital Framework. The surplus transferred to Government of India by RBI over the last 10 years is in the following chart. While it is true that the transfer in 2018-19 is almost twice the previous highest, it is misleading to say that the government looted it from RBI. It was based on the recommendations of a committee. However, it remains to be seen how this surplus is going to be used by the government.

It is also true that the amount transferred to Government of India by RBI matches the difference between the Provisional Actuals and Revised estimates of revenue receipts. However, it may not be proper to say that the surplus transfer is due to the deficit. Further, with the revised Economic Capital Framework for RBI, Governments might receive a higher surplus than this in future.

The additional burden due to Corporate tax cuts cannot be ascertained as yet

Claim: The additional burden due to Corporate tax cuts to the tune of Rs. 1.45 lakh crores for 2019-20.

Fact: The estimated loss due to Corporate tax cuts amounting to Rs.1.45 lakh crores is the government’s estimate based on previous data. Whether this shortfall can be met with increased collections is yet to be ascertained. Hence the claim remains UNVERIFIED.

The Gross Tax Revenue (GTR) for 2018-19 was estimated at Rs. 22.7 Lakh crores with 51% coming from Direct taxes and 49% from Indirect taxes. The Economic Survey Report states that, as per the Provisional Actual figures, the growth rate of GTR was lower than envisioned. It further states that the rate of growth is higher for Direct Taxes ( thanks to increase Corporate tax revenue) than Indirect taxes which have seen a dip due to lower than expected GST revenue.

The estimated Corporate tax revenue for 2018-19 was Rs. 6.21 lakh crores, while as per Provisional Actual figures it is Rs. 6.65 lakh crores (32% of GTR).

Finance Minister, Nirmala Seetharaman has announced reduction in Corporate Tax rates as part of the stimulus to economy. As per the Taxation Laws (Amendment) Ordinance 2019, the Corporate tax for domestic companies is reduced to 22% and for new domestic manufacturing companies it is reduced to 15%.

Government has claimed that this would result in an overall tax relief of Rs. 1.45 lakh crores. This is based on the total revenue foregone calculations of previous years for the reduction in corporate tax rate and other relief measures. The information stated on INC’s twitter handle is true to the extent of the data released by government.

However as for the question ‘who will pay the price’, NITI Aayog is of the opinion that this shortfall would be met through the higher growth rate, the tax rate cut is expected to achieve. Hence as it stands today, both positions are conjectures and one has to wait for the actual tax collection figures to understand the impact.

Factly has earlier published stories regarding unrealised Tax revenue and revenue earned by government for 2017-18 to understand the difference between estimates & actual realization in the revenue of government of India.