What are Special Category States? – The History & other Details

Special Category State (SCS) is again in the headlines. Political parties have been demanding that Andhra Pradesh be granted the SCS status post the bifurcation of the state. Chhattisgarh, Jharkhand, Odisha and Rajasthan have been demanding this status for quite some time now. Both the present and former Chief Ministers of Bihar have gone a step ahead by doing a protest in Delhi over extending SCS status to their state.

[orc]As the competition among states for getting the SCS gets fierce, we decided to examine & understand what does being a SCS mean.

What are Special Category States (SCS)?

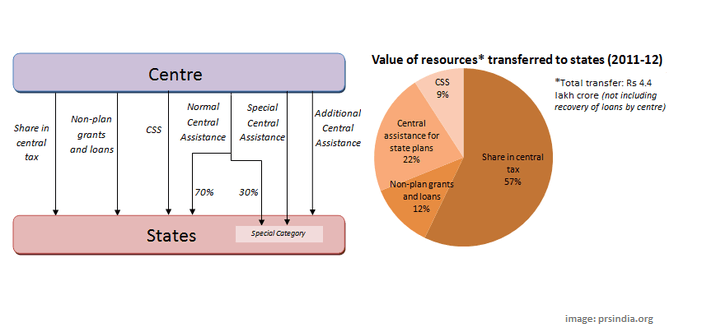

The Central Government assistance to states (apart from sharing the central tax revenue) has many components. Some of them are

- Normal Central Assistance (NCA) allocated to States as per Gadgil formula.

- Additional Central Assistance (ACA) – provided for implementation of externally aided projects. Unlike NCA, this is Scheme based.

- Special Central Assistance (SCA) – provided for special projects/programmes e.g., Western Ghats Development Programme, Border Areas Development Programme etc.

- Centrally Sponsored Schemes (CSS) – are special purpose grants extended by the Central Government to States to attain certain national goals. Schemes such as the Sarva Shiksha Abhiyan(SSA), Mahatma Gandhi National Rural Employment Guarantee Scheme(MNREGS), Jawaharlal Nehru National Urban Renewal Mission(JNNURM) are some of the examples.

The issue of Special Category Status came up at the time of approval of the Gadgil Formula at the meeting of the National Development Council (NDC) held in April, 1969. Out of the 17 States at that time, 14 States were brought under the Gadgil Formula. The remaining 3 States namely Assam, Jammu & Kashmir and Nagaland were given special consideration. Subsequently, eight (8) other States were granted Special Category Status when they attained statehood. Himachal Pradesh (1970-71), Manipur, Meghalaya and Tripura (1971-72), Sikkim (1975-76), Arunachal Pradesh and Mizoram (1986-87) and Uttarakhand (2001-02) were added to the list. States other than these eleven are referred as General Category States (GCS).

(Gadgil Formula is now revised and is known as the Gadgil Mukherjee formula that is used for allocation of NCA among General category states. This formula gives weight to population (60%), per capita income (25%), fiscal performance (7.5%) and special problems (7.5%))

The decision to grant special category status lies with the National Development Council, composed of the Prime Minster, Union Ministers, Chief Ministers and members of the Planning Commission (replaced by NITI Aayog).

The special category status is given based on the following parameters

- Hilly and difficult terrain

- Low population density and / or sizeable share of tribal population

- Strategic locations along the borders with neighbouring countries

- Economic and infrastructural backwardness

- Non-viable nature for state finances.

States under this category have a low resource base and are not in a position to mobilize resources for their developmental needs even though the per capita income of some of these states is relatively high. Moreover, a number of these states were constituted out of the former small Union Territories or districts of some other states, necessarily involving creation of overheads and administrative infrastructure that was out of proportion to their resource base.

During the past four years, requests for special category status have been received from the State Governments of Bihar, Jharkhand, Odisha, Goa, Rajasthan, Andhra Pradesh, Chhattisgarh and Telangana.

Benefits to Special Category States (SCS)

The nature of benefits to Special Category states will help us understand why many states crave for this status. The major benefits of SCS are

- A major portion of the Normal Central Assistance (56.25%) is distributed to eleven Special Category States and the remaining (43.75%) among eighteen General Category States.

- Only Special Category States receive Special Plan Assistance and Special Central Assistance grants.

- The assistance for Externally Aided Projects (EAPs) flows to Special category States as 90 per cent grant whereas for General Category States, it flows as loans.

- The state share in Centrally Sponsored Schemes is usually lower for Special Category States, especially the States of North East region as compared to General Category States.

- Special-category states get a significant excise duty concession & other such tax breaks that attract industries to relocate/locate manufacturing units within their territory.

Apart from the central assistance, the states receive a significant amount of revenue from the transfer of central taxes. The current share of states in the net collection of central tax revenue is 32% (to be increased to 42% as per the recommendations of the 14th Finance Commission). There is no preferential treatment to SCS when it comes to sharing of the central tax revenue.

To get an idea of what these amounts look like, let us look at the actual numbers for the financial year 2011-12. All the figures in actuals for financial year 2011-12.

| Type | Amount (In Rs Crores) |

| Total Central Government Expenditure | 1304365 |

| State’s share in Central Taxes | 255414 |

| Total Central Assistance to States | 104016 |

| Total Central Assistance to SCS | 58103 |

| Total Central Assistance to GCS | 45913 |

| Percentage of Total Central Assistance to SCS | 55.86% |

| Percentage of Total Central Assistance to GCS | 44.14% |

Sources: RTI reply from Planning Commission, Finance Commission of India , PRS Legislative Research, India Budget Portal , Reply to starred question No 70, Lok Sabha answered on 11th July, 2014.