Part-1: What is the Pradhan Mantri Fasal Bima Yojana (PMFBY)?

[orc]In a three-part series, we look at the Pradhan Mantri Fasal Bima Yojana (PMFBY) in detail. In the first part, we look at the scheme, its similarities & differences with the earlier insurance schemes.

With the objective to provide comprehensive insurance coverage and financial support to the farmers at the time of crop failure due to natural calamity or pest attack, the Government of India launched the Pradhan Mantri Fasal Bima Yojana (PMFBY) in February 2016. But what are the salient features of the scheme? How does it differ from its predecessors and what is the current status of implementation? Here is a three-part series that looks into the various aspects of the PMFBY.

PMFBY was launched in Kharif 2016 in place of NAIS and MNAIS

Currently, the Government of India is implementing four crop insurance schemes. These are Pradhan Mantri Fasal Bima Yojana (PMFBY), Restructured- Weather Based Crop Insurance Scheme (RWBCIS), Unified Package Insurance Scheme (UPIS) and Coconut Palm Insurance Scheme (CPIS). PMFBY was launched by the NDA Government in Kharif season of 2016 after reviewing the erstwhile agricultural insurance schemes of National Agriculture Insurance Scheme (NAIS), Weather-based Crop Insurance scheme (WBCIS) and Modified National Agricultural Insurance Scheme (MNAIS). PMFBY replaced National Agriculture Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS). While PMFBY is based on yields, the weather index based Restructured Weather Based Crop Insurance Scheme (RWBCIS) was also launched in 2016. The RWBCIS is a restructured version of the erstwhile WBCIS.

What is the objective of PMFBY?

The PMFBY has been launched with the aim to provide risk cover for crops of farmers against all the natural risks which cannot be prevented, from pre-sowing to post-harvest period. Some of the non-preventable natural risks include natural fire, lightning, storm, floods, cyclone, drought and landslides. Further, the scheme also aims to provide farmers with adequate claim amount and timely settlement of the same. The objectives of the scheme also include stabilisation of farmers’ income in order to ensure that they continue farming and also ensure flow of credit to the sector. Through this scheme, the government also aims to encourage farmers to adopt new and innovative agricultural techniques.

It has to be noted that most of the features of PMFBY are taken from those of the erstwhile schemes like the NAIS and MNAIS. While the insurance unit for former MNAIS scheme was reduced to village or village panchayat level for all crops, under PMFBY the unit area of insurance for major crops is at the village or village panchayat level and that for other crops was higher such as block and taluka. Another major difference lies in the premium rate. Under PMFBY, the premium rates have been brought down considerably.

Farmers have to pay a premium between 1.5% to 5% depending on the type of crop

The farmers across the country will have to pay a premium at 2% of sum insured for all Kharif food and oilseed crops and 1.5% of sum insured for Rabi food and oilseed crops. For annual commercial crops and horticulture, premium borne by farmers will be 5% of the sum insured. The remaining amount of premium will be equally split and paid by the Central and State governments. The role of state governments is to determine the crops and areas where scheme has to be implemented. They are also responsible for selecting insurance companies through bidding, determining the cluster of districts and furnishing the past set of yield data and other data for insurance companies, premium rates, release their share of premium subsidy and monitoring the scheme along with other responsibilities.

PMFBY has features similar to its predecessor schemes under UPA

Unlike in the case of NAIS, empanelled private insurance companies were also considered eligible to be appointed as ‘Implementing Agencies’ at district level on the lowest premium quoted under the MNAIS of the UPA. The same is being continued under PMFBY.

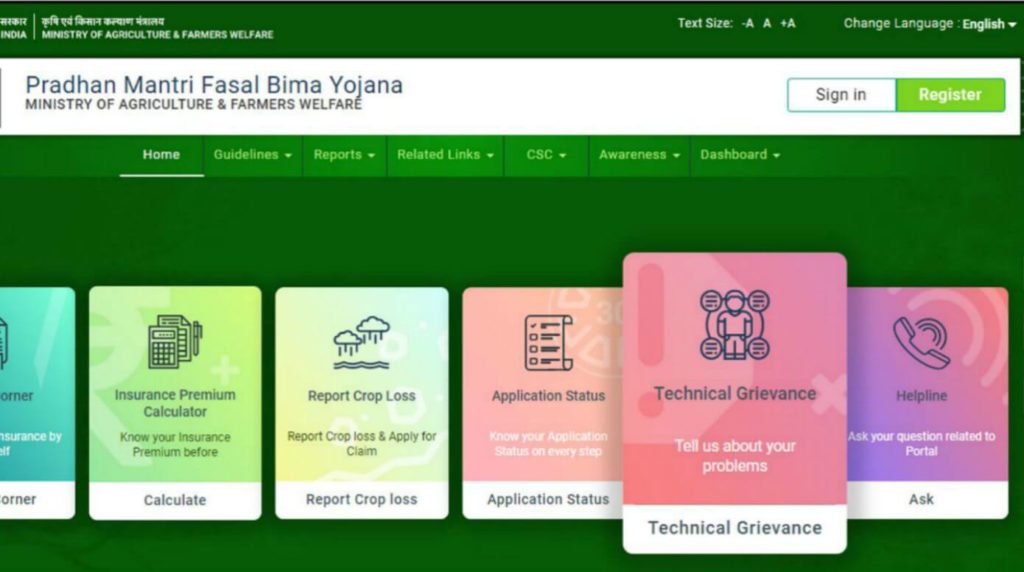

In the case of PMFBY, digital innovation such as smartphone applications have also been added for yield estimation. Thus PMFBY can be considered a modified version of the erstwhile crop insurance schemes. Also, under PMFBY, it is mandatory for farmers who have availed crop loans from financial institutions to get enrolled under PMFBY.

RWBCIS was also launched in Kharif 2016

RWBCIS is the improvised version of WBCIS scheme that was already being implemented in India since 2007. Under this scheme, farmers are provided with insurance protection against adverse weather incidents such as deficit or excess rainfall, temperature difference, moisture and others which have a significant impact on crop production. RWBCIS is a revised version of the earlier WBCIS scheme, under which, the premium rates have been made on par with that under PMFBY. Under this scheme, plans have been devised to set up more ‘Automatic Weather Stations (AWS)’ in the country.

About 20 States have opted for PMFBY

Kharif crops are usually grown from June to September in India (during the Monsoons) and Rabi crops are grown from October of one year to March of the following year. Very little sowing happens in the Zaid season between April and June and hence is not covered under the insurance schemes.

Insurance coverage is provided for Kharif and Rabi separately. In the following chart, the number of applications of loanee and non-loanee farmers for Kharif 2019 and Rabi 2018-19 is given. The number of states which had opted for PMFBY in Kharif (2019) is 20 states while that for RWBCIS is 11. For Rabi (2018-19), 18 states had opted for RWBCIS and 21 states had opted for PMFBY.

The scheme has been criticised that it benefits the private insurance companies and not the farmers. Further, delay in payment of premiums by state and central governments is another reason for the criticism. There have also been complaints that farmers do not receive claim payments on time. In Parts 2 & 3 of this series, we analyse the numbers related to PMFBY to understand if there is any merit in the criticism.