[orc]Has currency made a comeback into the economy? What is the currency in circulation & how does it compare to pre-demonetization levels?

During his first tenure as the Prime Minister, Narendra Modi made an announcement regarding demonetization on 08 November 2016. With this announcement, ₹ 500 and ₹ 1000 currency notes ceased to be legal tender effective from midnight of 08 November 2016.

In his speech, the Prime Minister has listed out various reasons for taking this step. During the ensuing period, the government, through the ministers kept announcing multiple objectives of demonetization.

One of the more prominent objectives highlighted by the government and around which initiatives driven are around building a ‘Cashless Economy’. The then Finance Minister Arun Jaitley had also tweeted that cancellation of the ₹ 500 and ₹ 1000 currency notes will advance India into a cashless economy. Arun Jaitley later went onto clarify that ‘cashless economy is actually a less-cash economy as no economy can be fully cashless’.

In this story, we review the current circulation of cash in the economy after nearly 3 years of demonetization and see if we have had progress towards less-cash economy.

Reducing the circulation of cash in the economy and encouraging digital transactions

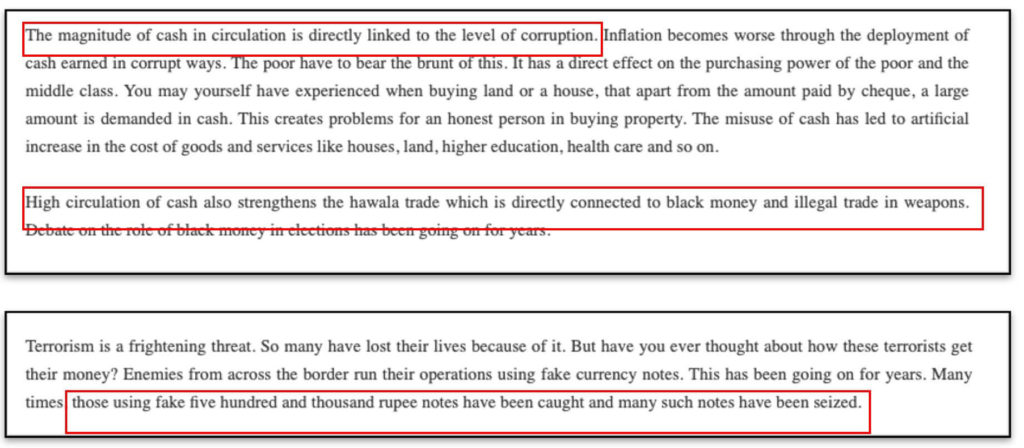

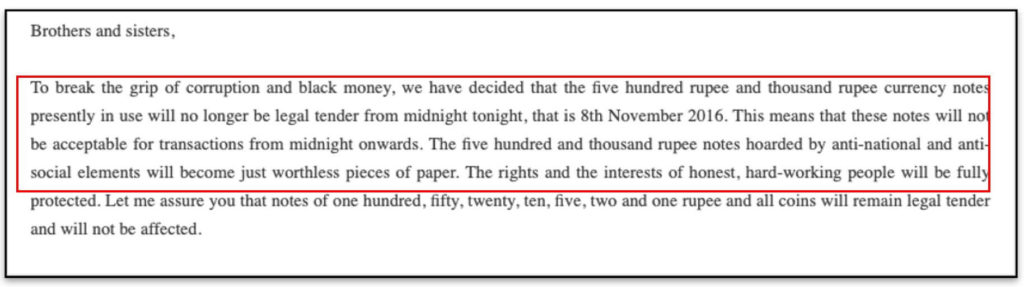

During his address to the nation on 08 November 2016, the Prime Minister highlighted the following points as being the broad reasons for taking such a step.

- The magnitude of cash in circulation is directly linked to the level of corruption.

- High circulation of cash also strengthens the hawala trade which is directly connected to black money and illegal trade in weapons.

- Cross-border terrorism is being funded by fake currency

The government has on its end took initiatives to incentivize people to opt for digital transactions. The reasons stated in the prime ministerial address and the further actions from the government indicate the intent of the government to move the economy towards a less-cash society.

More cash currently in circulation than prior demonetization

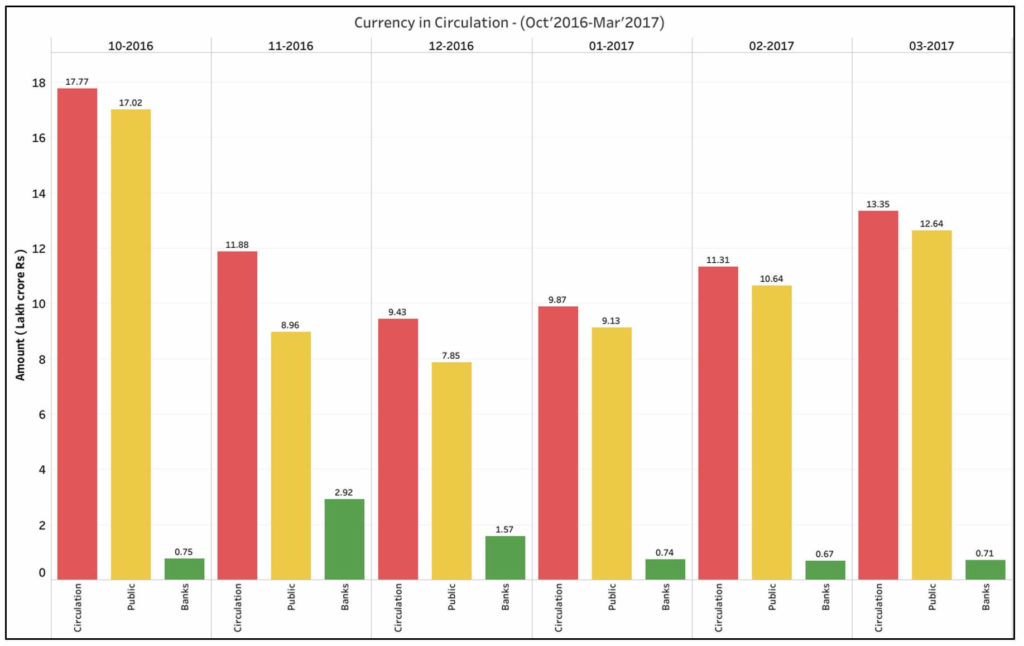

At the end of October 2016, i.e. prior to demonetization, the total currency in circulation was ₹ 17.77 lakh crores, out of which only ₹ 0.75 lakh crores were with the banks and the rest of ₹ 17.02 lakh crores were with the public.

After demonetization, the currency in circulation fell to ₹ 11.88 lakh crores in Nov’16 and further to 9.43 lakhs in Dec’16. Since then the amount of currency in circulation has shown a gradual growth in the following months.

The below graph illustrates the currency in circulation a month prior to demonization and for a period of 6 months after demonization.

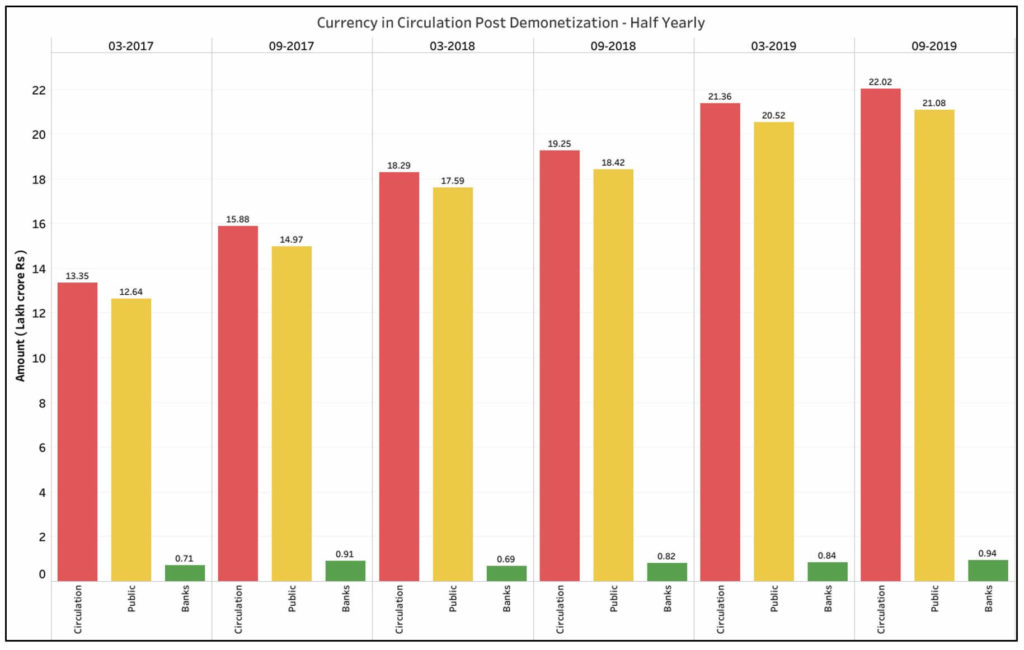

By the end of 2016-17, the Currency in circulation was ₹13.35 lakh crores and by the end of next year by March 2018, the total currency in circulation had gone up to ₹ 18.29 lakh crores which is slightly more than the currency in calculation prior to demonetization.

By the end of 2018-19, the value of currency in circulation has increased to ₹ 21.36 lakh crores.

As per the latest numbers (as on 13 September 2019) the total value of currency in circulation stands at 22.02 lakh crores.

Though the increase in the absolute value of cash in circulation is linked to the increase in the size of the economy, the currency to GDP ratio has also increased in the last few years as is explained further in this story.

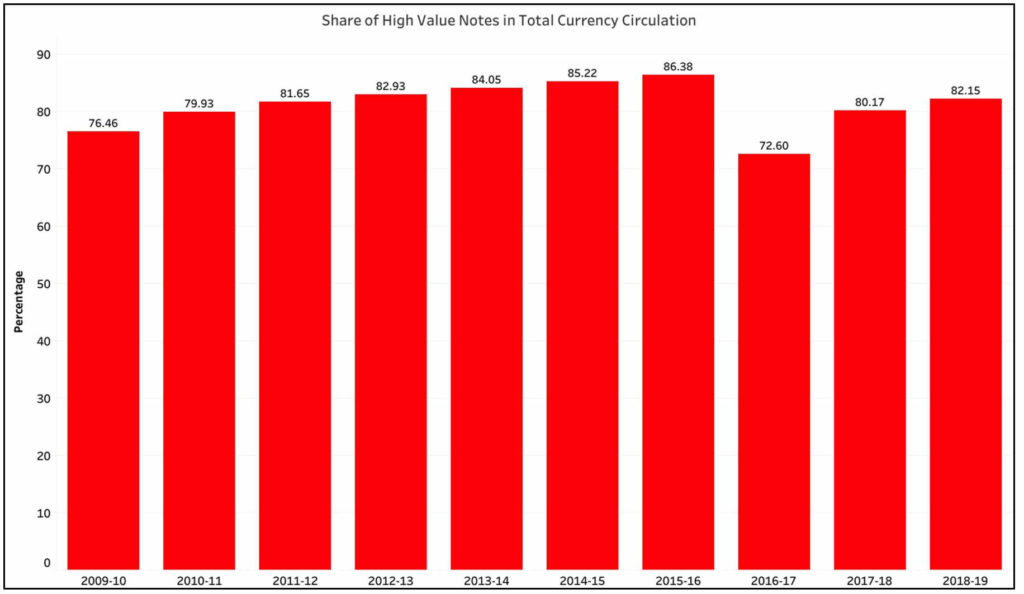

Increase in amount of High-value currency

The currency of higher value prior to demonetization was the old ₹ 500 and ₹ 1,000 which were rendered to be no more legal through demonetization. The rationale behind this being that higher value notes are an easier means of facilitating corruption and for hoarding of black money.

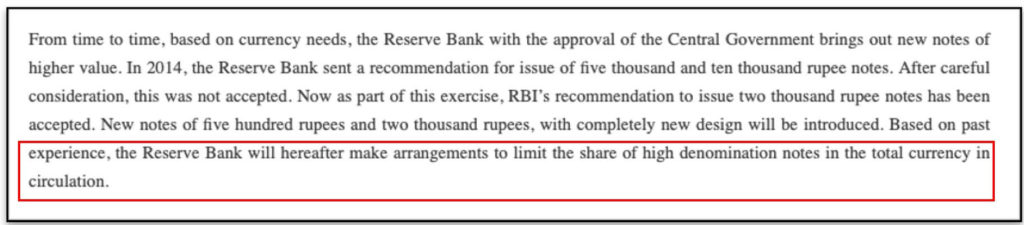

In the same speech, it is specified that in view the necessity for currency notes of higher value, new ₹ 500 and ₹ 2000 notes were introduced. It was also mentioned by the Prime Minister that RBI would be making necessary arrangements to limit the share of these notes of high denomination in the total currency in circulation.

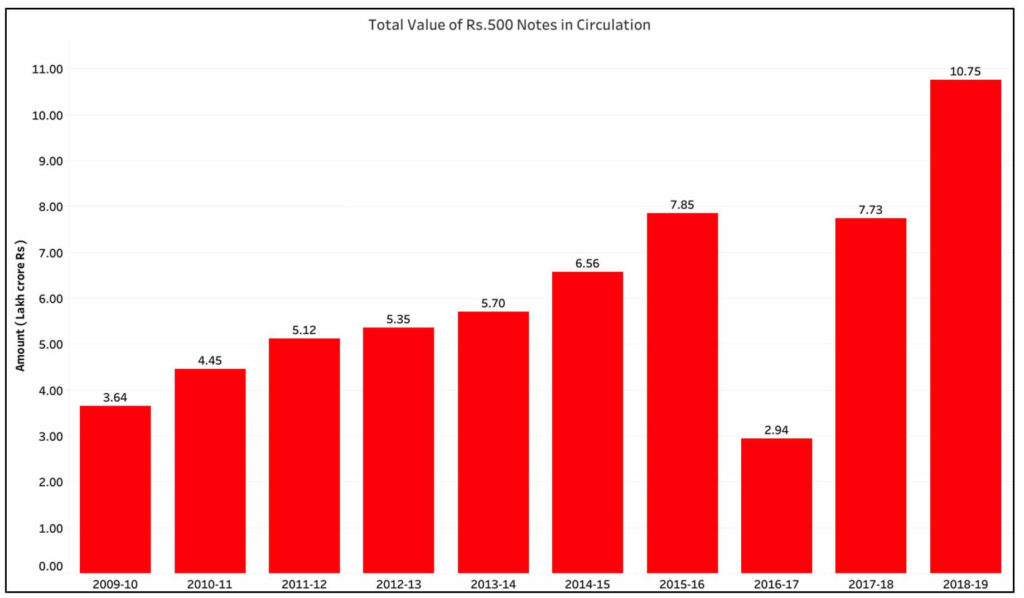

The limitation in the share of high-value currency notes is to avert a similar situation that existed prior to demonetization.

In RBI’s Annual Handbook of Statistics on Indian Economy, the report on Notes and Coins in Circulation provides details of the coins and notes of different monetary values in circulation. As per the report, the value of ₹ 500 currency notes by the end of 2015-16 was ₹ 7.85 lakh crores. The immediate effect of demonetization was reflected in 2016-17 where the value of these notes went down to ₹ 2.94 lakh crores.

However, the value of ₹ 500 currency notes in circulation has increased in the subsequent years with ₹ 7.73 lakh crores by the end of 2017-18 and ₹ 10.75 lakh cores by the end of FY 2018-19.

As for ₹1000 currency note, the value was ₹ 6.32 lakh crores by the end of 2015-16. Post demonetization, ₹ 2000 currency note was released. By the end of 2016-17, the total value of ₹ 2000 currency note in circulation was ₹ 6.57 lakh crores higher than the total value that ₹1000 note in circulation by the end of previous year 2015-16. By the end of 2018-19, the total value of ₹ 2000 notes in circulation is ₹ 6.58 lakh crores. This is because the government has literally stopped the printing of the ₹ 2000 note.

The total amount of high-value currency (₹ 500 & ₹ 1000 currency notes) by the end of 2015-16, prior to demonetization was ₹ 14.17 lakh crores or about 86.4% of the total currency in circulation. Post demonetization the total amount of high-value currency fell to ₹ 9.6 lakh crores only to increase in the subsequent years. The total amount of high-value currency (₹ 500 and ₹ 2000 currency notes) in circulation by the end of 2018-19 was ₹ 17.34 lakh crores or 82.2% of the total currency in circulation.

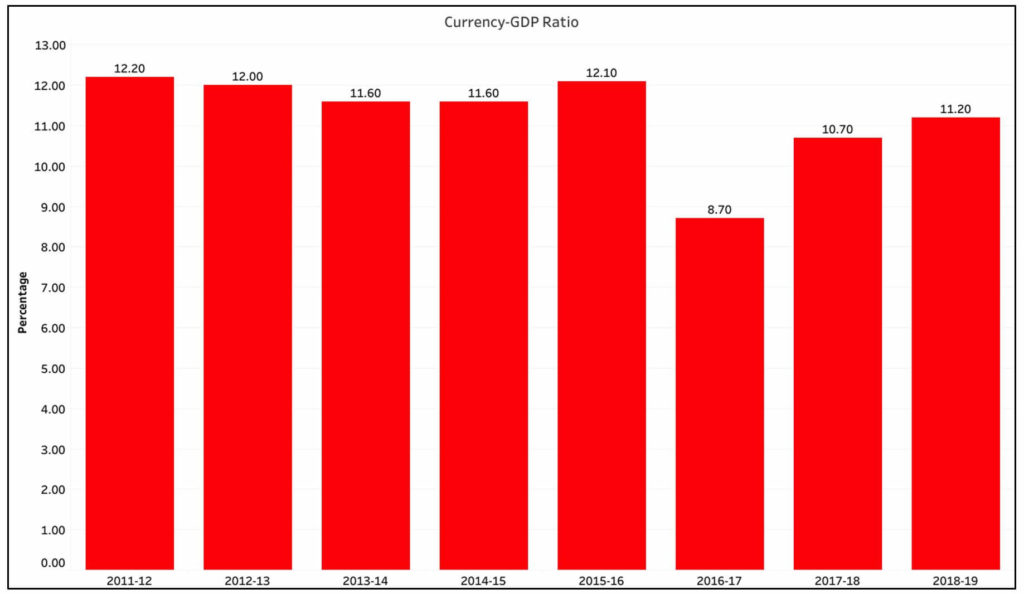

Currency-GDP ratio has increased in the last two years

In one of the statements issued post demonetization, the then Finance Minister Arun Jaitley stated that the Currency-GDP Ratio of India is 12% at the time of demonetization, while in developed countries it is around 4%. Lower currency-GDP ratio is cited as one of the objectives to be achieved out of demonetization.

As per RBI data, the currency to GDP ratio was 12.1% for 2015-16. Post demonetization, this ratio decreased to 8.7% for 2016-17. However, in the ensuing two years, the Currency-GDP ratio has increased to 10.7% and 11.2% for 2017-18 and 2018-19 respectively. Though is still less than 12.1% pre-demonetization, the continuous increase of this ratio is a concern. However, the RBI’s annual report for 2018-19 paints a positive picture of this scenario and noted that, ‘in spite of currency in circulation growth of 16.8% for the year as a whole, the currency-GDP ratio remained lower than 11.6-12.2 per cent observed during 2011-2016, perhaps indicating decline in cash intensity of the’.

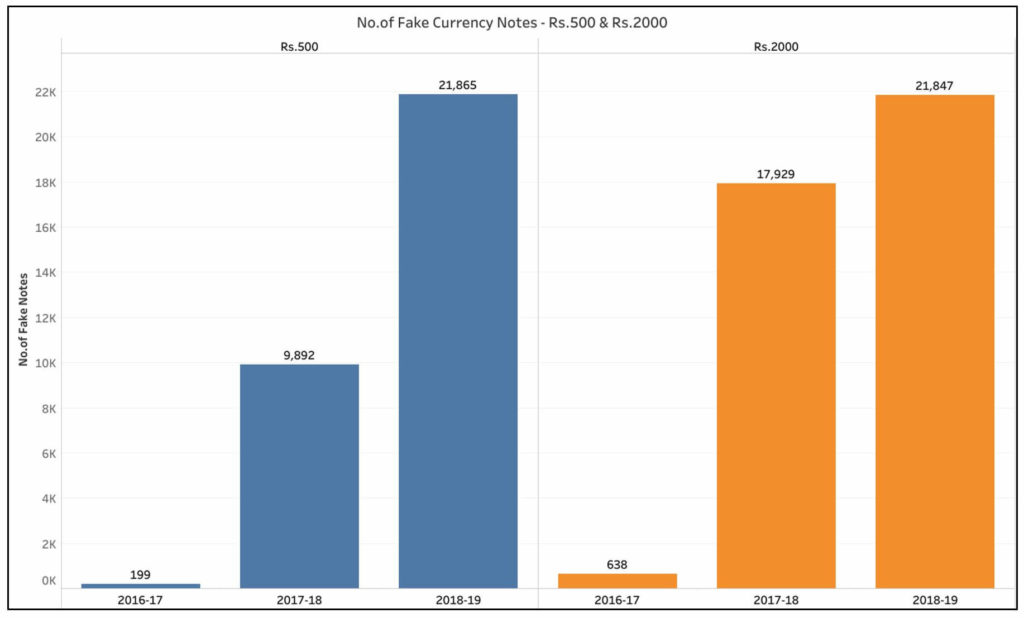

Increase in Fake notes of new currency

To counter the use of fake notes which sponsor terrorism was one of the reasons provided for demonetization in Prime Minister’s address to the nation on the eve of demonetization.

In this context, ₹ 500 note with a new design and a new ₹ 2000 note was released by RBI.

The data as per RBI annual report, shows an increase in the fake currency of these two currency notes.

In 2016-17, 199 new design ₹ 500 notes were identified as fake as per RBI data. This number has increased to 9,892 and 21,865 in 2017-18 and 2018-19 respectively in the case of ₹ 500 notes.

Similarly, in the first year (2016-17) of introduction of ₹ 2000 note, 638 pieces were identified as fake. The number has further increased to 17,929 and 21,847 fake notes in the subsequent two years.

While the total value is still less & negligible, it needs to be noted that these are the notes which have been identified by banks as fake. It does not indicate the quantum of fake notes of new currency in the economy.

Objectives of demonetization from a cash perspective not yet achieved

Reduction in the utilization of cash and driving the country towards a cash-less or less-cash economy was one of the key stated objectives of demonetization. However, the increased amount of the currency in circulation, as well as the higher Cash-GDP ratio, indicate the reality being different from the objective.

Furthermore, high-value currency was cited to be an encouraging factor for corruption and hence the withdrawal of ₹ 500 and ₹ 1000 notes which formed nearly 86% of the currency in circulation at the time of demonetization. However, the amount of new high-value notes has also increased over the three years and now form nearly 82% of the total currency in circulation.

Furthermore, the past two years have also seen an increase in the number of fake currency notes detected of the two new currency notes of ₹500 and ₹ 2000.

Though all these numbers are still less than the pre-demonetization levels, if this level of growth continues, we might reach the pre-demonetization levels in the next few years.

Hence, the objectives of demonetization at least to the extent of the less cash economy is yet to be achieved.

1 Comment

Pingback: Has Demonetization achieved its goal of less cash society? - Fact Checking Tools | Factbase.us