Fake Circular Claims ITR Deadline Extended to 30 September 2025

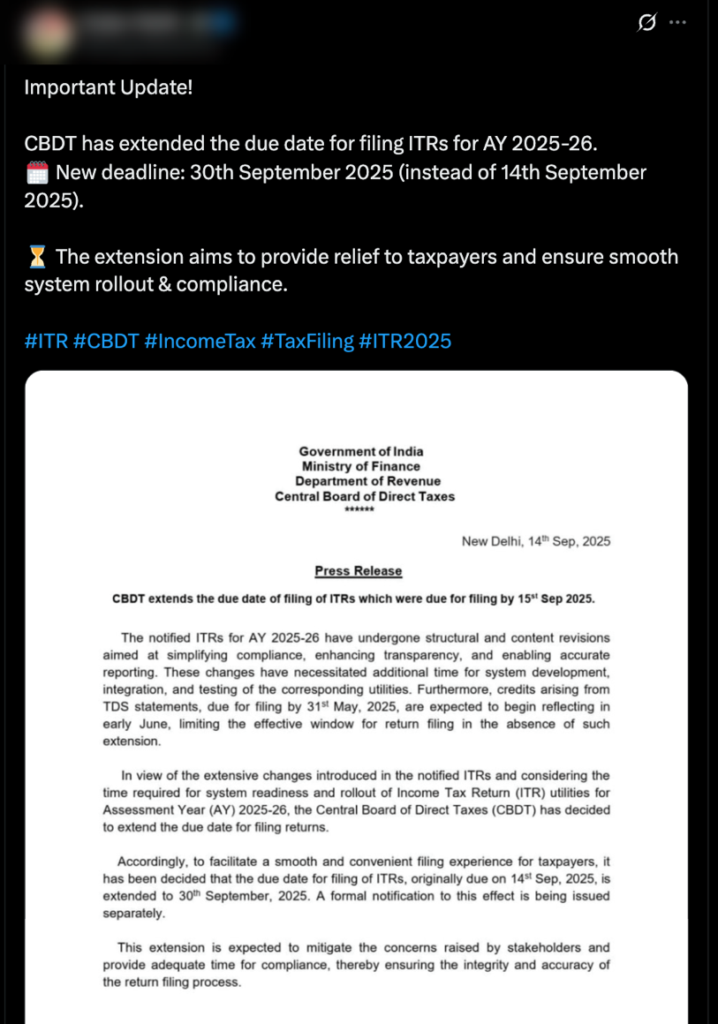

A circular (here, & here) is being widely shared on social media claiming that the Central Board of Direct Taxes (CBDT) has extended the deadline to file Income Tax Returns (ITR) to 30 September 2025 for the assessment year 2025–26. Let’s verify this claim.

Claim: Income Tax Department has extended the deadline to file Income Tax Returns (ITR) for the assessment year 2025–26 to 30 September 2025.

Fact: The Income Tax Department has clarified that the circular is fake. The actual extension was only from 15 September 2025 to 16 September 2025, and no further extension has been announced. Hence, the claim made in the post is FALSE.

First, we looked at the official website and social media handles of the Income Tax (IT) Department, and found that, on 14 September 2025, the department stated that the viral circular was fabricated and that no such decision had been made.

We also found a press release (here & here) issued by the IT department on 15 September 2025 extending the due date for filing ITRs for AY 2025–26 from 15 September 2025 to 16 September 2025.

At the time of publishing this article, the IT department has not announced any further extension of the ITR filing deadline beyond 16 September 2025. Taxpayers who missed the deadline can still file a belated return until 31 December 2025 with a late fee. However, this can lead to consequences such as penalties, interest, disallowance of losses to be carried forward, and unavailability of certain deductions and exemptions.

To sum it up, a fake circular is being circulated on social media claiming that the ITR filing deadline has been extended to 30 September 2025.