The RBI recently announced the withdrawal of Rs. 2000 notes. There are also reports of increased cash transactions in businesses like petrol pumps, jewellery shops, etc. But did this announcement affect the UPI & Debit Card transactions?

On 19 May 2023, the Reserve Bank of India (RBI) announced the withdrawal of Rs. 2000 denomination banknotes from circulation. The Rs. 2000 denomination note was introduced in November 2016, post-demonetization of the old Rs. 500 and Rs. 1000 notes. The stated objective of introducing this high-value currency was to meet the currency requirement of the economy in an expeditious way after the withdrawal of Rs. 500 and Rs. 1000 currency notes in circulation. The RBI stated that the purpose of issuing notes of Rs. 2000 was met once currency notes of other denominations became available in adequate quantities.

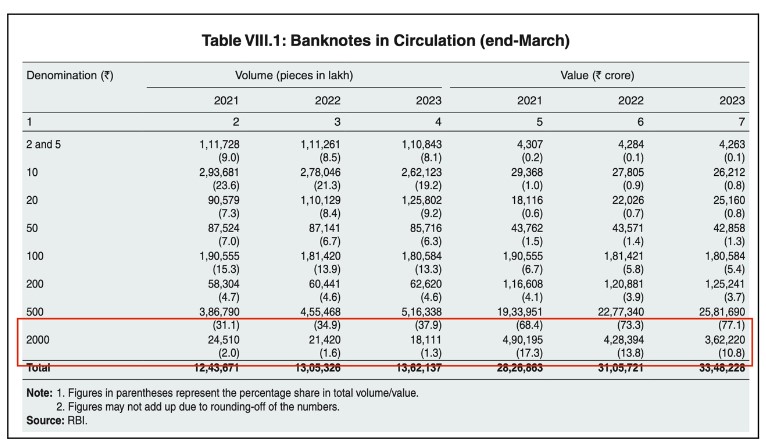

Data from RBI’s Annual report 2022-23 also indicates a declining trend in the circulation of Rs. 2000 notes.

RBI in its circular mentioned that the public can deposit Rs. 2000 notes into their accounts or exchange them into any denominations at any of the branches until 30 September 2023, subject to certain rules. It further stated that the bank notes would continue to be a legal tender and they can be used for carrying out commercial transactions.

Media has reported an increase in cash transactions involving Rs. 2000 currency notes at various establishments including petrol pumps, restaurants, etc. There are also reports of a few business establishments encouraging customers to transact in Rs. 2000 currency notes and avail offers, aimed at increasing their business.

But what does the data say about the impact of withdrawing Rs. 2000 from circulation on digital payment transactions? Here is an analysis.

Methodology: For this analysis, RBI’s data on payments done through different payment systems is considered. Detailed & processed datasets of this information can be found on Dataful. A daily seven-day moving average for the volume and value of the transactions is considered to offset the variances in daily transactions caused due to various reasons such as weekends, starting days of a month, etc. Three payment types are considered – UPI, Credit Card POS transactions and Debit Card POS transactions, as all these are the most likely payment options substituted to transact using cash, in this case, Rs. 2000 currency note.

For a better comparative analysis of the trends post the announcement by RBI on 19 May 2023, the 7-day daily moving average for the period 19 May to 30 May 2023 is compared with the information during the same period in the months of January-April, 2023.

Fall in UPI transactions during last week of May 2023

One of the most discernible changes in the economy post-demonetisation is the shift to UPI Payments. As per the statements of the government, a cashless economy was one of the intended objectives of demonetisation. Data over the years does indicate a substantial increase in the volume and the value of UPI transactions. Factly’s story on digital transactions can be read here.

As indicated above, we have considered the trends in transactions for the period 19th to the end of the month for the period January-May’2023. 7-day moving average during this period of a month indicates a general increase in both the volume and value of UPI transactions compared to the same period the previous month. This trend can be observed from Febraury-April’2023. Although the trends within the period are not consistent, the general trend during these months has been that the overall numbers were higher than the preceding month.

However, this is not the case for May 2023. The trends indicate that while the numbers were higher during the first few days of this period, it tapered off in the subsequent days. In January 2023, the daily value of transactions was around Rs. 37-39 thousand crores, in February it was around Rs. 39-41 thousand crores, in March it is Rs.41-43 thousand crores which increased to around Rs. 43-46 thousand crores in April. However, in May 2023, it fell from Rs. 46 thousand crores to around Rs. 43 thousand crores.

Higher decline in Debit Card POS transactions compared to earlier months

Among the various payment options that were impacted by UPI transactions, debit card POS are the most impacted. Data does indicate a consistent fall in the value and volume of debit card transactions over the past few years. For the period analysed for the story, the decline in the numbers for Debit card POS transactions is very much visible. However, compared to the decline in the earlier months, the decline was steeper during May 2023.

The correlation between UPI and Debit Card POS transactions in the earlier months was that the decline in Debit card transactions corresponded with an increase in UPI transactions. However, as highlighted above, there is a decline in UPI transactions as well in the days following RBI’s announcement indicating that this fall in UPI & Debit Card POS transactions are substituted with other means of payment like cash.

Growth of Credit Card POS transactions remained stagnant

Another payment option that is an alternative to cash transactions is Credit card POS payments. However, compared to the other two payment options i.e., UPI and Debit Card POS, there is no discernible fall. While there is no discernible fall in the value and volume of the Credit Card POS transactions during the period after RBI announcements, there is also no growth. This contrasts with the trends in the earlier months where there is a growth in the credit card POS transaction.

The trends especially in the case of UPI transactions and Debit Card POS indicate a decline post-RBI’s announcement regarding the withdrawal of Rs. 2000 from circulation. Though we cannot directly correlate this fall with an increase in cash transactions, various news reports and considering the fact there isn’t any other development which would have impacted the trends, people resorting to the use of Rs. 2000 notes cannot be ruled out.

Featured Image: Withdrawal of Rs. 2000 notes