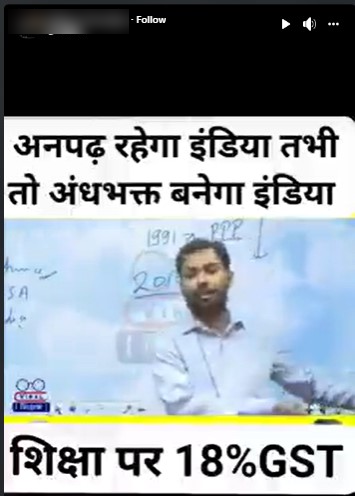

A video is being widely shared on social media platforms claiming that the 18% GST is applicable on education in India. Let’s verify the claim made in the post.

Claim: 18% GST is applicable on education in India.

Fact: According to the GST rates available on the Central Board of Indirect Taxes and Customs website, 18% GST is applicable only for private coaching institutes. However, services provided by both regular and vocational educational institutions are exempted from GST. Hence the claim made in the post is MISLEADING.

Definition of an Education Institution:

According to the report “GST on educational services” available on the Central Board of Indirect Taxes & Customs website, Educational Institution means an institution providing services by way of:

- Pre-school education and education up to higher secondary school or equivalent

- Education as a part of a curriculum for obtaining a qualification recognised by any law for the time being in force

- Education as a part of an approved vocational education course.

What is the meaning of ‘‘education as a part of curriculum for obtaining a qualification recognized by law’?

In other words, educational services that are related to delivery of education as ‘a part’ of the curriculum prescribed for obtaining a qualification prescribed by law are in the negative list, and do not attract any tax under GST. It is important to understand that to be in the negative list , the service should be delivered as part of curriculum for obtaining a qualification. Conduct of degree courses by colleges, universities or institutions which lead to grant of qualifications recognized by law would be covered in this list. Training given by private coaching institutes would not be covered as such training does not lead to grant of a recognized qualification

An “approved vocational education course” means,

- A course run by an industrial training institute or an industrial training centre affiliated to the National Council for Vocational Training or State Council for Vocational Training offering courses in designated trades notified under the Apprentices Act, 1961 or

- A Modular Employable Skill Course, approved by the National Council of Vocational Training, run by a person registered with the Directorate General of Training, Ministry of Skill Development and Entrepreneurship.

All this means that private coaching centres or other unrecognized institutions, though self-styled as educational institutions, would not be treated as educational institutions under GST and thus cannot avail exemptions available to an educational institution

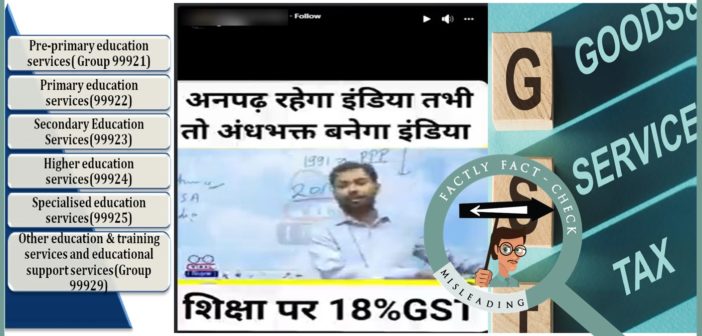

Now, lets see the GST rates on each of the educational services based on CBIC-GST website (Heading 9992)

The following educational services are exempted from GST:

1.Services provided –

(a) by an educational institution to its students, faculty and staff;

(aa) by an educational institution by way of conduct of entrance examination against consideration in the form of entrance fee;

(b) to an educational institution, by way of,-

(i) transportation of students, faculty and staff;

(ii) catering, including any mid-day meals scheme sponsored by the Central Government, State Government or Union territory;

(iii) security or cleaning or house- keeping services performed in such educational institution;

(iv) services relating to admission to, or conduct of examination by, such institution;

(v) supply of online educational journals or periodicals; Provided that nothing contained in [sub-items (i), (ii) and (iii) of item (b) shall apply to an educational institution other than an institution providing services by way of pre-school education and education up to higher secondary school or equivalent. Provided further that nothing contained in sub-item (v) of item (b) shall apply to an institution providing services by way of,-

(i) pre-school education and education up to higher secondary school or equivalent; or (ii) education as a part of an approved vocational education course.

2. Any services provided by

(a) the National Skill Development Corporation set up by the Government of India.

(b) a Sector Skill Council approved by the National Skill Development Corporation.

(c) an assessment agency approved by the Sector Skill Council or the National Skill Development Corporation.

(d) a training partner approved by the National Skill Development Corporation or the Sector Skill Council, in relation to-

(i) the National Skill Development Programme implemented by the National Skill Development Corporation; or (ii) a vocational skill development course under the National Skill Certification and Monetary Reward Scheme; or

(iii) any other Scheme implemented by the National Skill Development Corporation.

3.Services provide by-

Indian Institutes of Management, as per the guidelines of the Central Government, to their students, by way of the following educational programmes, except Executive Development Programme: –

(a) two year full time Post Graduate Programmes in Management for the Post Graduate Diploma in Management, to which admissions are made on the basis of Common Admission Test (CAT) conducted by the Indian Institute of Management;

(b) fellow programme in Management;

(c) five year integrated programme in Management

The following educational services are charged under GST:

- Private educational institutions are taxable at GST rate of 18%

- Distance Education is taken up generally for higher education and hence taxable at the GST rate of 18%

- Instruments, apparatus and models, designed for demonstrational purposes (for example, in education or exhibitions), unsuitable for other uses attracts 28% GST

- Any other service that is not exempted would attract 18% GST

To sum it up, there is no GST on services provided by both regular and vocational educational institutions, an 18% GST is applicable only for private coaching institutes